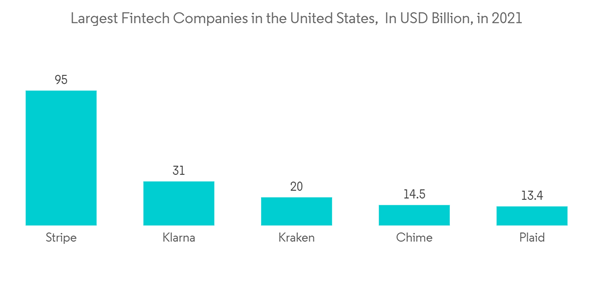

North American Fintech Market The largest Fintech companies in the United States in billions of USD in 2021

Dublin, Jan. 23, 2024 (GLOBE NEWSWIRE) — The “North America Fintech Market Size and Share Analysis – Growth Trends and Forecast (2023-2028)” the report has been added to ResearchAndMarkets.com’s offer.

The North American Fintech market size in terms of transaction value is expected to grow from USD 4.93 trillion in 2023 to USD 9.52 trillion in 2028, at a CAGR of 14.07% during the forecast period (2023-2028).

The COVID-19 pandemic has had a significant impact on the North American fintech market, both in terms of challenges and opportunities. On the one hand, the pandemic has caused disruptions in the global economy, leading to a decline in consumer spending and investment. This has hurt the fintech sector, as it has made it harder for new and small businesses to secure funding and investment. In addition, some fintech companies that relied on face-to-face interactions, such as those that help people plan their finances, have seen demand decline due to social distancing policies. On the other hand, the pandemic has made it easier to use digital payments and financial services, as many people have turned to online shopping and contactless payments to avoid having to touch other people. This has opened up new opportunities for fintech companies that offer digital payment solutions, mobile banking, and online financial services. As a result, the number of people looking for digital financial solutions such as e-commerce platforms, digital wallets and mobile banking apps has increased significantly.

The largest investments in fintech were made in North and South America, followed by Asia Pacific and EMEA. Many startups and emerging companies that provide AI services to the financial services industry dominate the North American fintech market. Virtual assistants, business analytics and reporting, and customer behavior analytics are among the most important applications.

The United States has led the market in changing the way people lend, invest, choose loans, support startups and even buy new businesses. One in three digital consumers uses two or more fintech services. The Canadian ecosystem, however, is poised to grow. While Canadian cities benefit from the fundamentals of disruptive leadership at scale, major hubs can still enhance their reputation as world-class fintech ecosystems. There are approximately 700 fintech companies operating in the country, 18 of which launched in 2020. The payments, lending, back-office and digital currency verticals continue to rank among the largest for many Canadian fintech companies.

Fintech Market Trends in North America

TUS Dominates North American Fintech Market

The United States dominates the North American fintech market. The United States is the largest market in North America, accounting for over 80% of total fintech investments in the region. The US fintech market is also one of the largest in the world, with significant investments in various fintech subsectors, such as payments, lending, wealth management, and blockchain. The US fintech industry is supported by a strong ecosystem of investors, accelerators, and incubators that provide funding and resources to fintech startups. In addition, the US has a highly developed financial infrastructure and regulatory environment that supports innovation and growth in the fintech sector.

The US fintech market is dominated by a small number of large players, such as Stripe, Klarna, Kraken and Chime, which are very large and have significant market share in their own sub-sectors. But many smaller fintech startups are also launching and changing the way traditional financial services operate. Overall, the US’ dominance in the North American fintech market is likely to continue, as the country has a strong foundation for fintech innovation and growth, as well as access to large pools of capital and talent.

Blockchain Technology Drives Fintech Market in North America

Cross-border payments around the world are strictly regulated and distributed ledger technology, which is expensive, has reduced some costs and made tracking easier. Most fintech companies are rapidly creating new platforms for online financial services and coming up with new ideas. Global fintech companies are partnering with local mobile phone companies, money transfer companies and banks in the US, Mexico and Canada. However, the recent COVID-19 outbreak has highlighted the demand for digital transformation in the banking sector as people have been forced to use online services and limit their visits to the bank. For this reason, most banking companies have collaborated with fintech providers to offer differentiated and competitive services as in the future, digital customer experience will be the main area of competitive advantage and is expected to drive the market.

North America Fintech Sector Overview

The North American fintech market is largely consolidated, with a few dominant players in each subsector of the industry. This consolidation has been driven by several factors, including high barriers to entry due to regulatory compliance requirements, the need for significant capital investments to develop and scale fintech solutions, and network effects that arise as fintech companies grow and expand their customer base. Some of the major players in the market include Stripe, Chime, Avant, Wealthsimple, and SoFi.

Main topics covered:

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

4.1 Market Overview

4.2 Market Driving Factors

4.3 Market Restrictions

4.4 Information on key sectoral regulations and policies impacting the financial technology market in the region

4.5 An overview of internet and smartphone penetration in the region

4.6 Revenue and Financing Statistics

4.7 Porter’s Five Forces Analysis

4.8 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

5.1 By service proposal

5.1.1 Money transfer and payments

5.1.2 Savings and investments

5.1.3 Digital loans and lending markets

5.1.4 Online insurance and insurance markets

5.1.5 Other service proposals

5.2 By country

6 COMPETITIVE LANDSCAPE

-

Before

-

Financial Chime

-

Wealthsimple Inc.

-

Stripe, Inc.

-

SoFi Technologies

-

Square

-

Kraken

-

Oscar Health

-

Mogo

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

For more information about this report, visit https://www.researchandmarkets.com/r/jus260

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for market research reports and international market data. We provide you with the latest data on international and regional markets, key industries, top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900