Niro Fintech Startup Shuts Down After 4.5 Years

The fintech landscape has lost another player as Niro, a Bengaluru-based startup, officially announced its closure after four and a half years of operation. Co-founder Aditya Kumar made the announcement via his LinkedIn profile, marking the end of a venture that aimed to revolutionize the lending process through technology.

Challenges Faced by Niro

Despite successfully raising $20 million and facilitating $200 million in loans with an extensive network of 30 partnerships, Niro faced a myriad of challenges that ultimately led to its decision to cease operations. Kumar cited regulatory hurdles, deteriorating credit conditions, and limited access to capital as primary factors influencing this outcome.

A Brief Overview of Niro’s Journey

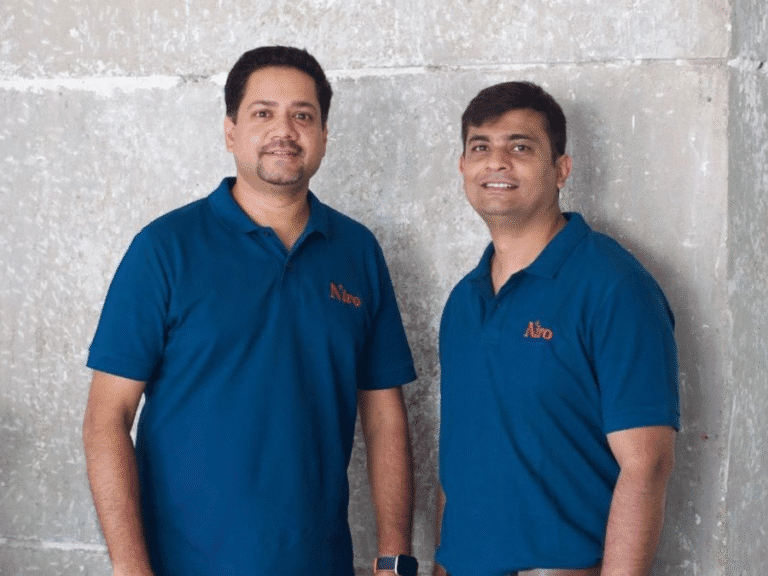

Founded in 2021 by Aditya Kumar and Sankalp Mathur, Niro positioned itself as a B2B2C lending platform, enabling consumer internet companies to offer in-app credit solutions. The startup partnered with significant players in the internet space to provide personal loans ranging from Rs 50,000 to Rs 7 lakh, with flexible tenures from 6 to 72 months and competitive interest rates between 12% and 28%.

Impressive Metrics but Insufficient Momentum

During its operational years, Niro generated an impressive $100 million in assets under management (AUM) within just two years post-launch. At its peak, the platform reportedly experienced over 170 million user flows, underscoring its initial success in capturing the market. Notable investors included Elevar Equity, GMO Venture Partners, and Mitsui Sumitomo Insurance VC.

Kumar’s Reflections on Niro’s Closure

In his statement, Kumar reflected on the unexpected nature of Niro’s closure, expressing disbelief despite the startup’s rapid initial growth. He noted, “We had done the impossible… Despite scouring the world for capital, I couldn’t bring this one home.” He attributed the challenges to a “perfect storm” of tightening regulations and lackluster innovation from financial institutions.

The Future of India’s Fintech Ecosystem

While acknowledging the current setbacks, Kumar maintained an optimistic outlook on the future of India’s fintech ecosystem. He expressed hope for regulatory improvements that may facilitate better access to consumer data for underwriting purposes, highlighting the need for innovation in the sector.

A Grateful Goodbye

Before concluding, Kumar took a moment to extend his gratitude to investors and employees who stood by Niro during its challenging phases. He specifically mentioned the critical support from individuals like Jyotsna and Sandeep Farias, which played a pivotal role in the startup’s journey.

Next Steps for Kumar

As Niro bids farewell to the market, Kumar plans to take some time to decompress and gain perspective. He plans to attend the upcoming Global Fintech Fest as an attendee, looking forward to what lies ahead for the fintech sector in India.