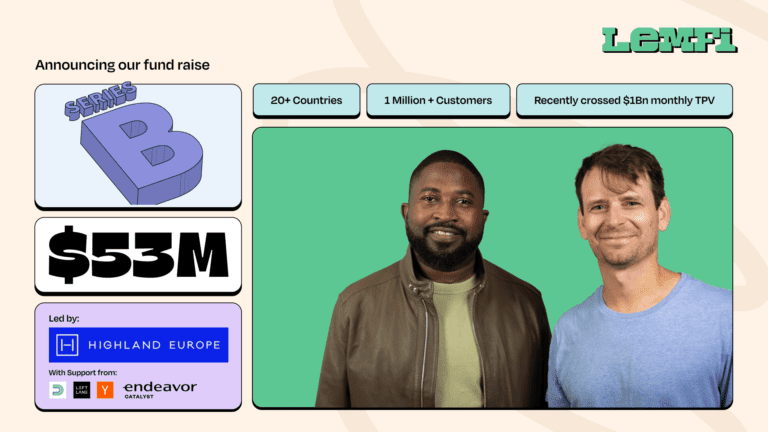

Nigerian fintech startup LemFi has raised $53 million in Series B funding to help it expand its product offerings and become a comprehensive financial services hub for immigrants around the world.

Founded by Ridwan Olalere and Rian Cochran in 2021 under the name Lemonade Finance, before a Name change in 2023, LemFi is an international remittance and payments platform that enables diaspora communities in Europe and North America to reliably and affordably transfer money to emerging markets including China, India, Kenya, Nigeria and Pakistan.

Since its launch, LemFi has grown to over 1 million customers and recently surpassed $1 billion in monthly transaction volume. It is now poised for further growth after raising $53 million in Series B funding led by Highland Europe with participation from previous investors. Lane Capital, Palm Drive Capital, Endeavor Catalyst and Y Combinator.

This new round brings LemFi’s total capital raised to date to US$85 million and will be used to help LemFi provide additional services and features to create a comprehensive financial services hub for immigrants around the world.

LemFi will also use the funds to expand its payment network licenses and partnerships to provide hyper-localized service and hire talent globally to support its next stage of growth.

“When we started building LemFi, we were told that remittances had already been resolved. But for too many people, it remains too slow, tedious and expensive, with customers telling us that in some cases it was cheaper to send money from the US via Canada than directly to their family remained in the country. By targeting communities that need it most, we have made LemFi the go-to remittance service for a million people, helping them build wealth across 20 countries,” Olalere said.

“We’re not stopping there: this new funding will support us in our mission to build the financial services hub for immigrants around the world, from adding new features to expanding into new countries. We are excited to partner with Highland to help us build LemFi into a fintech giant.

Sam Brooks, Partner at Highland Europe, said LemFi’s mission to provide trusted and trusted access to financial services to immigrant communities had inspired an incredibly loyal customer base and generated impressive growth over the past few years.

“In addition to the success in the initial geographies, we are excited about LemFi’s continued international expansion given the scale of the global problem they are solving.” Ridwan and Rian are fantastic leaders, and we are excited to partner with them and the LemFi team to help them scale and continue their growth into new markets,” he said.