Published on January 26, 2024

This content first appeared in the January 2024 Fintech Newsletter. If you would like more commentary and analysis on news and trends from the a16z Fintech team, you can subscribe here.

New year, new trends

Marc Andrusko

We closed out 2023 by sharing some of the big ideas what we’re looking for in fintech this year, including the rise of developer as buyer in financial services, how professional financial services will be supercharged by software, and why AI will push Latin American SMEs to go digital.

Since then, things have evolved rapidly. As 2024 gets off to a strong start, we’re keeping an eye out for some interesting stats and observations that could lead to bigger developments in the future. Here are 4 things that stood out to us this month:

AI in personal finance

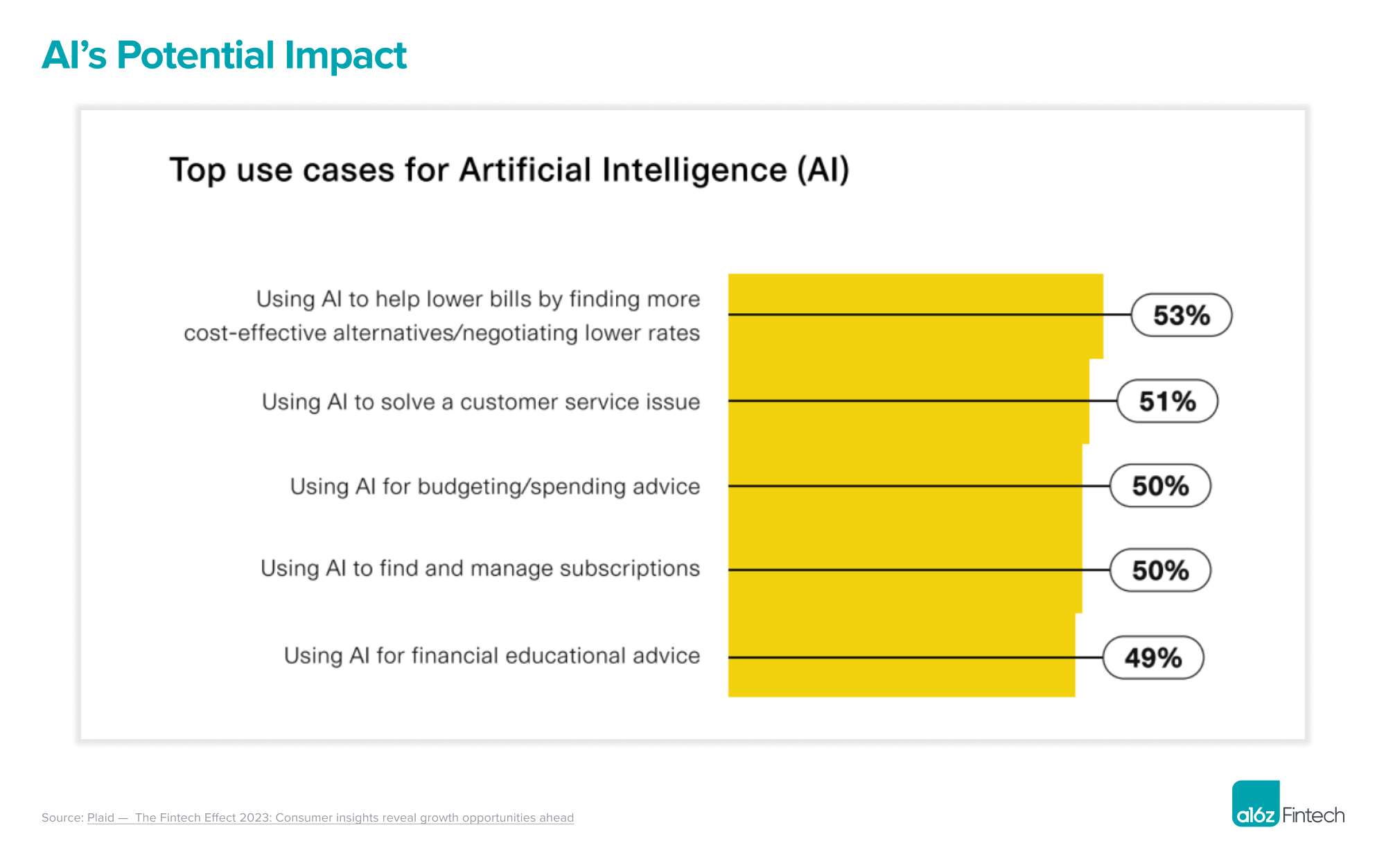

As part of the most recent Plaid project Fintech Effect Reportreleased late last year, the fintech platform released some interesting data on where consumers are most likely to adopt AI solutions in their financial lives.

The report found that:

- Most consumers (53% of respondents) hoped AI could help them solve their financial problems, saying “reducing bill expenses and negotiating lower rates” were among the top things they wanted it to do. AI helps them.

- About half of respondents wanted AI’s help with “customer service issues (51%), budgeting advice (50%), and subscription management (50%).”

- Younger generations were more open to AI solutions, with around 60-65% of Millennials and Gen Z believing the technology had potential.

Although finding and managing new investment opportunities was notably absent from the response data, the results above are starting to look awfully close to a world in which personal financial management runs on autopilot. The only downside to this is that more than 75% of certain populations surveyed by Plaid (notably Generation X) say they want to be able to review all decisions generated by AI regarding their finances. This suggests that at least in the short term, we will likely continue to see more co-pilots than fully autonomous agents responding to consumer needs.

Macroeconomic Improvements

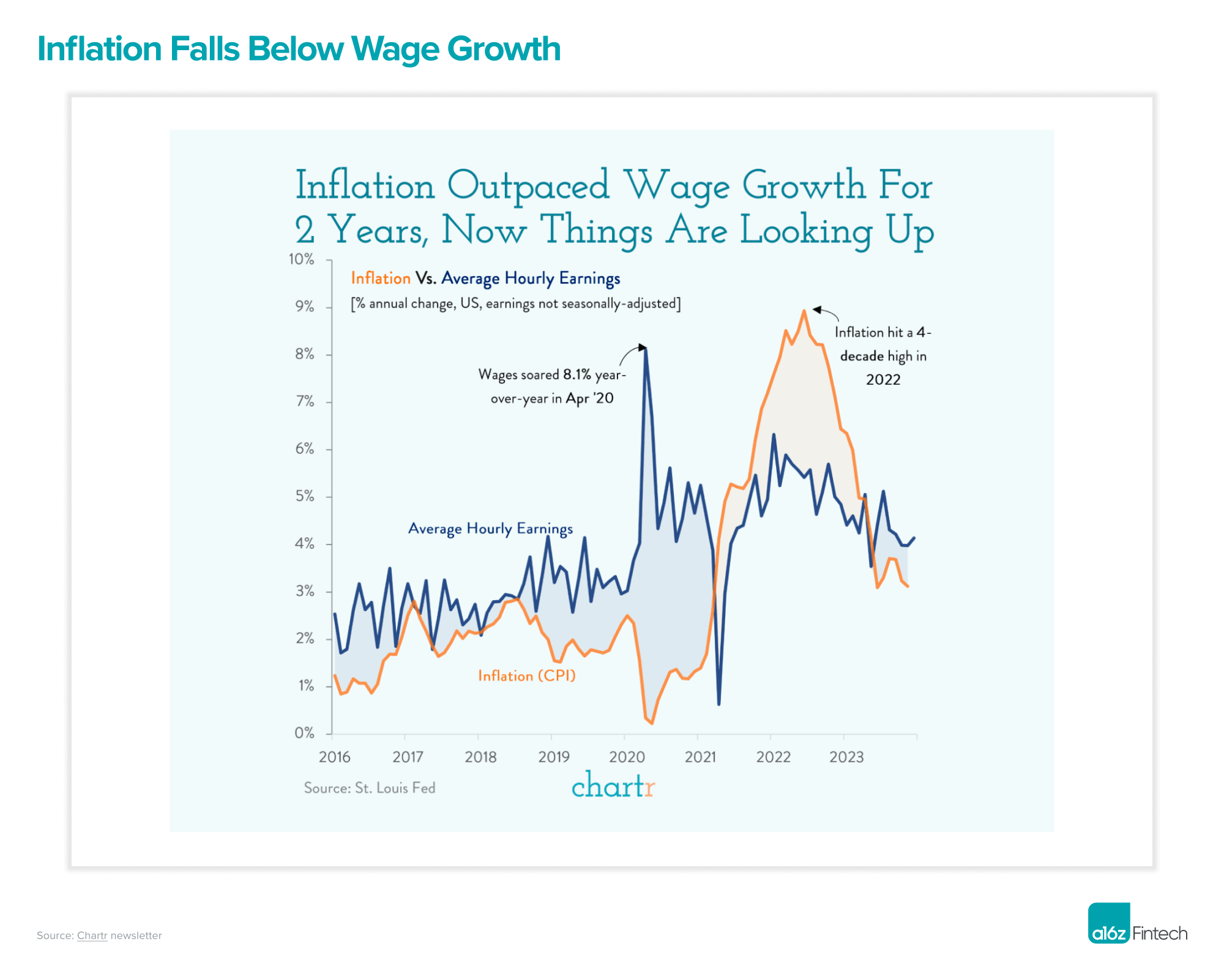

THE January Jobs Report revealed a healthier job market than many expected, with the U.S. economy adding 216,000 jobs (compared to an estimated 170,000 jobs). Unemployment remained at 3.7% (compared to 3.8% consensus). Perhaps most notably, wage growth continued to outpace inflation, resulting in sustained increases in “real” wages for 6 consecutive months, a trend that reversed more than 2 years of loss of wage power. purchase of the average consumer.

The strength of the report indicated to some that the economy may not need stimulus in the form of rate cuts. In fact, the market is now pricing the likelihood of cuts in March at just – as of this writing – 70% (which is down from 100% before the new jobs data).

Regulatory proposals

The Consumer Financial Protection Bureau (CFPB) proposed a new rule this month, it would limit the amount banks and credit unions can charge in overdraft fees and require much more transparent disclosures about what they cost and under what circumstances they are incurred.

According to the CFPBthe rule “would close an outdated loophole that exempts overdraft loan services from long-standing provisions of the Truth in Lending Act and other consumer financial protection laws.” For decades, very large financial institutions were able to issue highly profitable overdraft loans, which brought them billions of dollars in revenue each year. Under the proposal, big banks would be free to make overdraft loans if they followed existing lending laws, including disclosing any applicable interest rates. Alternatively, banks could charge a fee to recover their costs at an established benchmark – as low as $3, or at a cost they calculate, if they show their cost data.

The proposal, which the CFPB hopes to enact by October 2025, would directly jeopardize the ~$9 billion in annual overdraft revenue earned by financial institutions each year. Thus, lobbyists and professional organizations in the financial services sector are already jostling to prevent its passage.

Current activity

Banking results for the 4th quarter of 2023 were quite weak in all areas. Several of Wall Street’s largest banks owed substantial special assessment fees to the FDIC to finance losses of the regional banking crisis last yearwhich complicated their income situation. Meanwhile, regional banks have been forced to pay higher interest rates for deposits, with many of their customers abandoning them in favor of GSIBs (globally systemically important banks) for fear of further bank runs. (This is just one of the many reasons we are so happy to continue to support ModernFi in their journey to create a radically better end-to-end deposit management platform for banks and credit unions!)

Looking ahead, banks have warned of the potential for net interest margin contraction (i.e., lower lending revenue) if the Fed moves forward with lowering interest rates. rate at the start of 2024.

Apple’s payments pressure

Seema Amble

As Apple continues to leverage its retail ownership strength and act as a gatekeeper to payments – iPhone, Apple Wallet, App Store – it understandably faces regulatory tensions around its position within the technological ecosystem. Some important news this month shows that even as pressure increases, Apple is not eager to relax its influence over the payments landscape.

Earlier this month, the U.S. Supreme Court refused to hear the appeal of the Apple v. Epic decision. The decision of the time, which we have discussedwas largely in favor of Apple, but argued that Apple should allow app developers to “steer” their customers outside of the App Store to alternative payment options to pay for in-app purchases (e.g. pay on a website rather than on the website). App Store). Such payment methods could be cheaper and potentially avoid the 30% fee Apple charges all developers.

After this announcement from the Supreme Court, which allows control in the application, Apple has revised its policy on the US App Storespecifying that applications would still have to pay 27% to Apple, even if users paid outside the platform. Apple responded similarly by imposing such fees in other countries like the Netherlands and South Korea. From Apple’s perspective, the company should be compensated for distribution through the App Store, and its policies protect consumers from unfamiliar payment methods. For developers, however, this hefty “Apple tax” can seem overwhelming to their own economy.

Epic, Spotify and other app developers are clearly expressed their objectionscalling the movement “scandalous.” Epic CEO Tim Sweeney highlighted the 27% fee, but also Apple’s actions to discourage third-party payments. For example, to offer an alternative payment option on their websites, developers must seek permission from Apple and also offer in-app purchases through Apple’s billing system. Developers must then certify to Apple that they have processes for handling billing complaints and that their payment options meet Apple’s standards. Apple must also approve wording for linking outside the App Store, and users face a full-screen warning that Apple’s protections do not apply.

Also this month, Apple proposed opening Apple Pay to mobile wallets and third-party payment services in Europein the face of antitrust pressure from the EU and the EU Digital Markets Acta new law requiring online gatekeepers to open their systems to more competition. Third parties (e.g. banks, payment companies) can access the NFC functionality of an Apple phone to make contactless payments and freely use Apple’s operating systems without necessarily directing the buyer to the Apple Wallet or Apple Pay.

What does all this mean for startups? The game of cat and mouse will continue. Large platforms are under regulatory and industry pressure to open up their platforms and not make it prohibitive for developers to distribute through them, but change will take time to happen. While the intention is to make it easier for developers to succeed, even if platforms open up and allow the development of third-party payments (e.g. Tap to Pay, mobile point of sale), this likely won’t happen without more restrictions subtle, like Apple does now. And after all, Apple has consumer trust that’s hard to break.

More from the Fintech team