After witnessing a significant decline in recent times, the Indian public market has benefited from the market dynamics. last week of 2024 in the first week of 2025. With this in mind, new age technology companies have largely witnessed bullish sentiment.

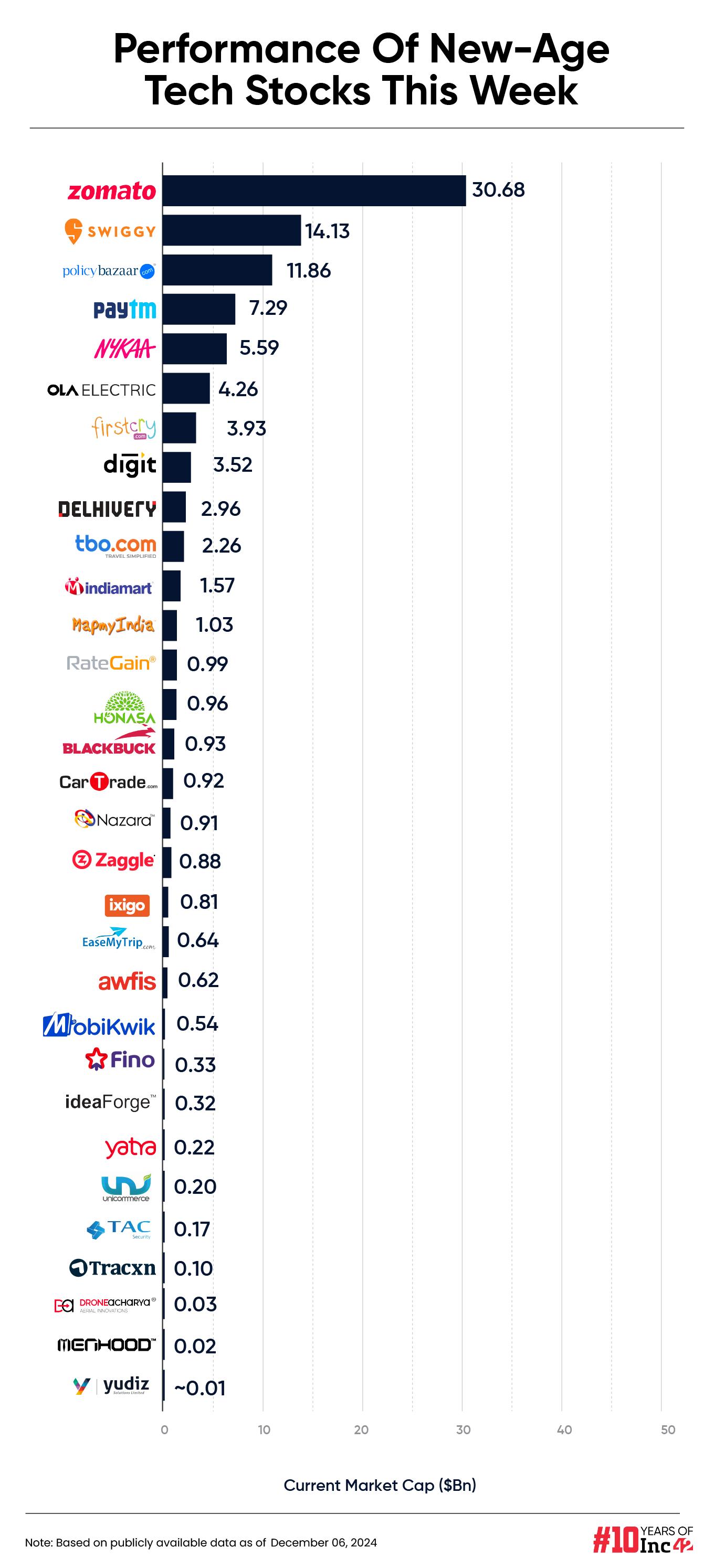

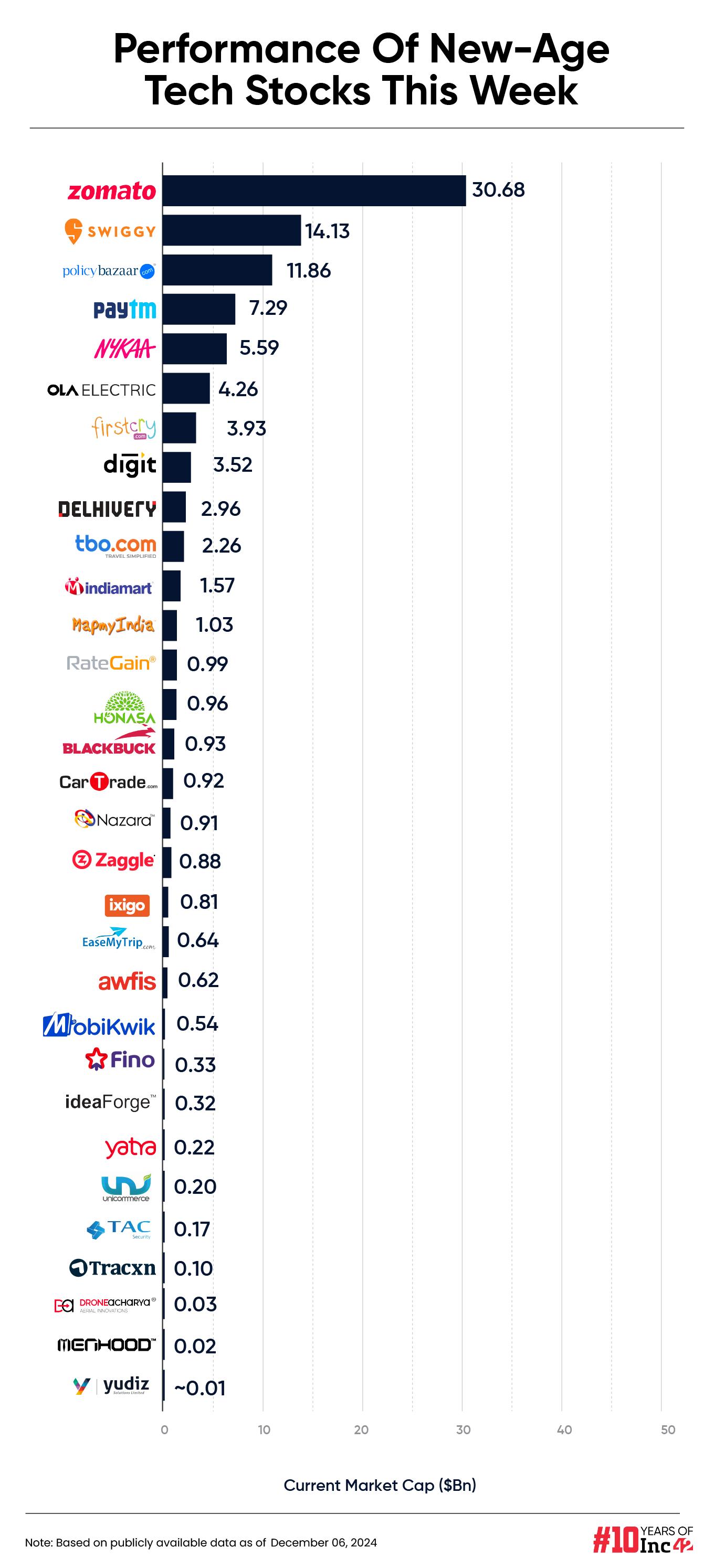

Twenty of the 31 new age tech stocks covered by Inc42 rose in a range of 0.12% to more than 10% this week.

Just like the last few weeks, shares of NSE listed SME cybersecurity company TAC Infosec ended the week at an all-time high of INR 1,410.55. This is a gain of 10.40% from the stock’s closing price on the previous Friday (December 27).

ideaForge emerged as the second biggest gainer this week, with its shares rising 9.86% to close Friday’s session at INR 647.25. The stock is steadily recovering from the crash it witnessed after a disappointing financial performance in Q2FY25. After reporting a loss of INR 13.7 Cr during the quarter ending September 2024 in October, the shares fell to 52-week low from INR 535.45 on October 29

Other winners this week include PB Fintech, Zaggle, Nykaa, FirstCry, Zomato, among others.

Meanwhile, 11 new-age tech stocks ended the week in the red. Shares of companies like IndiaMART, Swiggy, Delhivery, Yudiz, among others, fell in a range of 0.19% to a little over 15%.

Logistics company BlackBuck saw the biggest decline this week, with its shares falling 15.02% to INR 453.35. The fall occurred after a Morgan Stanley’s dark projection. The brokerage initiated its coverage on the stock with an ‘underperform’ tag, giving a target price (PT) of INR 450 per share on December 30. As a result, BlackBuck shares fell as much as 5% to their lower price range of INR 506.85 on Monday.

Another loser this week was online travel aggregator (OTA) EaseMyTrip, whose shares fell 5.94% to end the week at INR 15.52. This was slightly above its 52-week low price of INR 14.23, which the shares touched in October. The reason for this week’s decline was sale of participation by its co-founder and CEO Nishant Pitti, who sold 1.4% of the capital, or 5 Cr of shares, for INR 78.3 Cr, Tuesday, December 31.

Following this, he also resigned from the post of CEO and his brother Rikant took charge January 1st. Facing the negative market reaction to the move, Nishant addressed his departure on Friday through a post on social media platform I will no longer sell participation in EaseMyTrip.

Shares of Paytm fell 3.15% to end the week at INR 982.30.

The bearish investor sentiment towards Paytm mainly stems from the National Payments Corporation of India’s (NPCI) decision to extend the deadline for the implementation of a 30% cap on the market share of third-party application providers (TPAP) within two additional years.

It is pertinent to mention that Paytm has lost its market share in the UPI ecosystem in 2024. Its market share amounts to 7.03% in 2024 compared to 14.1% the previous year.

Shares of another fintech company, MobiKwik, were also down 4.59% this week at INR 599.70. The company is expected to release its financial results for the second quarter of FY25 next week on January 7.

Meanwhile, the market as a whole rebounded for the second consecutive week between December 30 and January 3. While the Sensex gained 0.66% to end the week at 79,223.11, the Nifty 50 gained 0.80% to end at 23,813.40.

The main reason for this is optimism about the upcoming earnings season. The rally was broad-based this week, with most sector indexes posting gains.

Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Intermediates, said a buy-on-the-dip strategy is recommended as long as Nifty remains above 23,900.

According to Vinod Nair, Head of Research at Geojit Financial Services, global developments, along with third quarter results, will determine market performance in the coming weeks.

“…investors are likely to align their portfolios based on pre-budget expectations. Key data such as FOMC minutes, US non-farm payrolls and the unemployment rate will influence market sentiment,” he said.

Now let’s take a look at the performance of 31 new age tech stocks this week.

The total market capitalization of the 31 new-age technology companies covered by Inc42 stood at $98.68 billion at the end of the week, up from $98.42 billion at the end of the previous week.

Ola Electric faces intense competition

Shares of electric vehicle giant Ola Electric fell 8.14% to end the week at INR 82.76. The company’s market capitalization also fell to $4.25 billion. However, it was still higher than its IPO valuation of $4 billion.

This drop came after the company informed the stock exchanges on Friday, December 27 last week, after market hours, that its Chief Marketing Officer (CMO) Anshul Khandelwal and Chief Technology and Product Officer (CTPO) Suvonil Chatterjee submitted his resignation with immediate effect.

Although the stock fell about 5% earlier this week, it took further hits after the release of electric vehicle sales figures for December. In what has been a slow month, old auto industry players Bajaj Auto and TVS Motor Ola Electric has taken a leap forward in December in terms of sales of electric two-wheelers (E2W). As a result, Ola Electric’s market share fell to 19% in December from over 24% in November.

It is pertinent to mention that the company led by Bhavish Aggarwal retained its first place in the E2W electric vehicle market in 2024. Its total electric vehicle registrations jumped 52% to around 4.1 Lakh units in 2024 from 2.7 Lakh units in the previous year.

PB Fintech reaches new heights

Fintech major PB Fintech was on a bullish run this week with its shares gaining over 7.93% to end at INR 2,214.85. The stock hit an all-time high of INR 2,246.95 on Friday, before shedding some gains.

The rally came after the company hinted to stock markets on January 2 that it had sand create a new 100% subsidiary under the name PB Healthcare Services Private Limited. The move was given the green light by the insurance major’s board last month.

At the same time, the company also received tax relief. In a January 3 exchange filing, PB Fintech said it received an order from the Deputy Registrar of the Income Tax Appellate Tribunal (ITAT) in New Delhi, upholding all grounds of appeal filed by the company against a previous decision taken by the commissioner. Income Tax Appeal (CIT-A). The tax amount in question was INR 166.12 Cr.