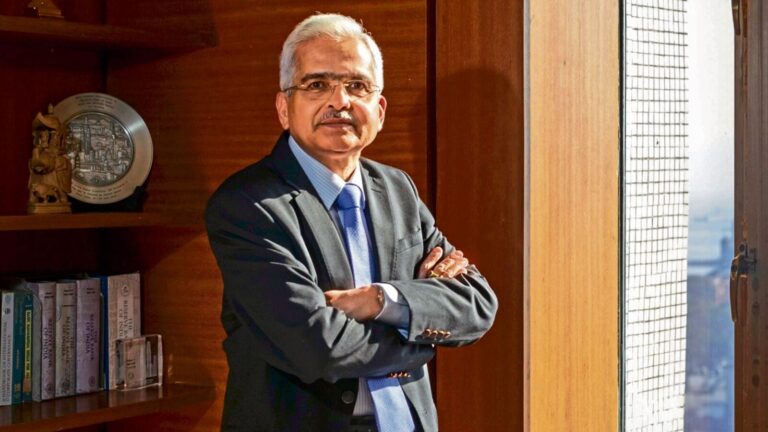

Mumbai: As frenetic digitalization reshapes the financial landscape, India must learn to balance innovation and prudence, Reserve Bank of India (RBI) Governor Shaktikanta Das said, urging financial institutions and fintechs to capitalize on new opportunities while mitigating risks.

More Indians are turning to digital financial services, and their expectations for “personalized, efficient and seamless” experiences have also increased, Das said. At the same time, new risks related to data privacy and security breaches have emerged, adding to existing risks such as mis-selling and fraud.

“Leveraging technology for real-time monitoring and ensuring regulatory compliance will be key to addressing these challenges effectively,” Das said at the third edition of the Global Fintech Fest in Mumbai.

The central bank has often criticized fintechs, even though it laid the foundation for the sector to flourish. Earlier this month, it tightened rules for the peer-to-peer lending industry and imposed sanctions on two industry platforms. In January, the RBI imposed severe trading restrictions on Paytm Payments Bank Ltd, while in February it ordered a leading card network to stop business-to-business card payments routed through third-party fintechs.

On Wednesday, Das said the central bank was also focused on making local fast payment network UPI and card network RuPay “truly global”. “The deployment of UPI-like infrastructure in foreign jurisdictions, facilitating the acceptance of QR code-based payments through UPI applications among international merchants and the interconnection of UPI with Fast Payment Systems (FPS ) other countries for cross-border remittances are at the top of our priorities. program,” Das said.

Helped by cheap data and ubiquitous smartphones, digital payments have exploded since the rollout of the Unified Payments Interface (UPI) eight years ago. Mobile apps such as BHIM, Google Pay and PhonePe took UPI transactions to 131 billion in FY24 from 83.7 billion in FY23. July recorded 14.44 billion of UPI transactions, up 45% from the previous year.

Fintech Monitoring

In FY24, there were 968 million transactions via RuPay cards, which was less than 1.26 billion in FY23. The transaction amount remained unchanged at ₹2.4 billion over the two years.

Das said publicly available information puts the number of fintechs founded in India at around 11,000, with the sector receiving investments of around $6 billion in the last two years alone. India’s fintech sector’s revenue grew 50% in 2023 and is expected to reach $190 billion by 2030, according to a Boston Consulting Group (BCG) report released on Wednesday.

RBI on Wednesday also recognized the Fintech Association for Consumer Empowerment (FACE) as the industry’s first self-regulator. The central bank, which has received three applications to become a fintech sector self-regulatory organization (SRO-FT), is considering the rest, Das said. The recognition of the first self-regulator comes a year after the initial announcement of an SRO structure at last year’s Global Fintech Fest.

“This is a momentous opportunity for the fintech community as recognition by the regulator brings unity of purpose and gives us a chance to amplify our collective contribution and impact,” said Sugandh Saxena, CEO of FACE. “Within regulatory guidelines, self-regulation gives us latitude to shape the sector that creates value for customers and all market participants. We have a long list of things to do and we look forward to the opportunity and responsibility to respect the charter,” Saxena said. said.

OAR Fintech: RBI sets limits

While releasing the draft norms for SROs in January, RBI had said that given the diverse nature of fintechs, limiting itself to a single SRO-FT could dilute some of the industry’s concerns, while having several OAR-FTs could undermine the representative nature of the OARs. regulation.

“We have three applications and we are considering several SROs, but there must be a limit; you can’t have an infinite number of SROs. I think two or three SROs should be enough at this stage,” Das said on the sidelines of the event. When asked if the regulator had any specific preference or criteria for selecting SROs, Das said there was no such sequencing and approvals were only based on the order of applications received.

Two other organizations vying to become SROs include the Fintech Convergence Council (FCC) and the Digital Lenders’ Association of India (DLAI). “SRO – FT represents an important industrial development and we are happy to see things moving in this direction. DLAI’s request has not been returned, we look forward to further communications from the regulator in this regard,” DLAI said.

Yashraj Erande, global head of fintech and India head of financial institutions at BCG, said it is encouraging to see that Indian fintechs are demonstrating a path to profitability, sooner than was anticipated two to three years ago. years. “Moreover, profitable and compliant growth is the new mantra for fintech founders, rather than unbridled growth,” he said.

Das warns against dark patterns

Das also warned against “dark patterns” such as deceptive buttons, hidden fees and forced continuity, saying they have become big concerns in the digital market. “The Guidelines for Prevention and Regulation of Dark Patterns, 2023, issued by the Government of India, is an important step to protect consumers from unfair application of technology in businesses. » These guidelines, Das said, aim to identify, prohibit and penalize restrictive and deceptive practices, so that consumers can make informed choices.

India has seen more progress in digital transformation in the last decade than in previous decades. Currently, there are 53 crore account holders under the Pradhan Mantri Jan Dhan Yojana (PMJDY), of which 55 per cent are women account holders and 66 per cent of the accounts are in rural and semi-urban areas, Das said on the sidelines, adding that there are several other steps to be taken.

Catch all Industry News, Banking news and updates on Live Mint. Download the Mint News app get daily Market Updates.

MoreLess