News UpdateAugust 13, 2025 at 1:36 p.m. UTC

Nedbank’s Strategic Acquisition of Ikhokha

Nedbank has officially entered into a binding agreement to acquire the South African fintech company, Ikhokha, for a total of 1.65 billion rands, equivalent to approximately $93.3 million. This acquisition is a significant development in the evolving fintech landscape of South Africa, aimed at enhancing digital payment solutions.

Details of the Acquisition

The acquisition of Ikhokha is pending regulatory approval and is expected to be finalized in the coming months. Ndabeni’s strategic move signifies the bank’s commitment to staying competitive amidst the rapid growth of fintech innovations. Ciko Thomas, the Group Management Executive for Personal and Private Banking at Nedbank, described this as a “pivotal moment” for empowering small and medium-sized enterprises (SMEs).

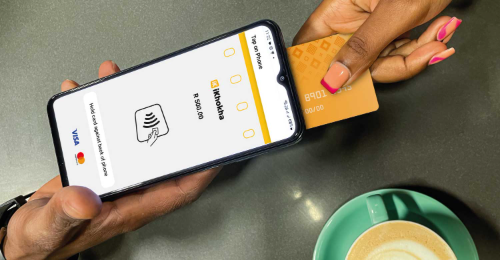

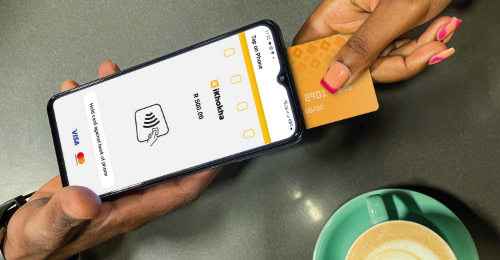

Ikhokha’s Role in the Fintech Landscape

Founded in 2012, Ikhokha has established itself as a leader in providing point-of-sale mobile devices and comprehensive payment solutions for businesses. The company processes over 20 billion rands (about $1.1 billion) in annual digital payments and has facilitated more than 3 billion rands ($169.7 million) in working capital for SMEs.

Ikhokha will maintain its brand identity and leadership teams, ensuring continuity and growth while integrating into Nedbank’s broader operational framework.

Benefits of the Acquisition

For Nedbank, acquiring Ikhokha aligns with its strategy to digitally empower entrepreneurs and enhance financial accessibility for SMEs. This move is also beneficial for Ikhokha, as the backing of a large institution will provide access to capital, regulatory resources, and an expansive network for more rapid growth in the competitive payments market.

Supporting Stakeholders

The transaction also facilitates an exit for key stakeholders such as API Partners, CrossFin Holdings investors, and the International Finance Corporation, which have significantly contributed to Ikhokha’s development over the years. This acquisition marks an important shift in the investment landscape for these partners.

Implications for the Banking Sector

This acquisition underscores a wider trend where traditional banks are turning to fintech companies to enhance their services and remain competitive in the digital banking space. By integrating Ikhokha’s agile solutions with Nedbank’s robust financial infrastructure, the partnership is designed to foster greater financial inclusion and strengthen support for SMEs in South Africa’s dynamic digital payments ecosystem.

Conclusion

The acquisition of Ikhokha marks a significant milestone for Nedbank as it seeks to harness technology to better serve its clients in a fast-evolving marketplace. With the potential for accelerated innovation and increased financial access, both Nedbank and Ikhokha are poised to make a lasting impact on the South African fintech landscape.

Subscribe to The Daba Newsletter for insights into the African investment landscape.