The reprieve will provide “substantial relief” to home buyers whose home loans were sanctioned before the RBI’s crackdown on the company.

Earlier this month, the RBI barred Navi FInserv from issuing new loans after the close of business on October 21, citing “significant supervisory issues”.

Navi Finserv reported operating revenue of INR 1,906.2 Cr in FY 2023-24 (FY24), down from INR 2,040.6 Cr in FY23.

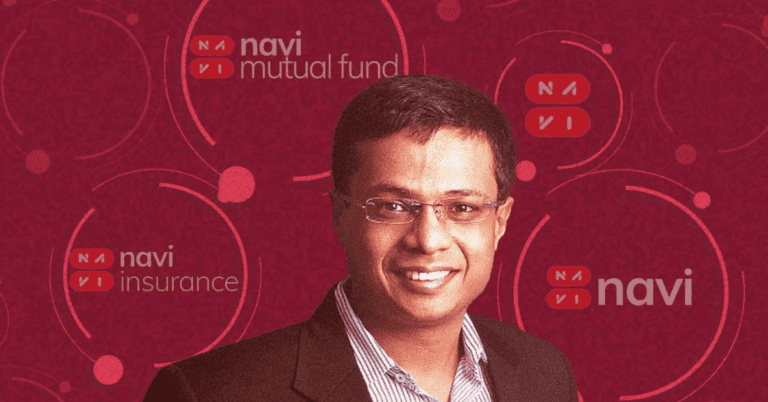

Barred from granting new loans, Sachin Bansal-led Navi Finserv said on Tuesday (October 29) that the Reserve Bank of India (RBI) had allowed it to make disbursements of home loans scheduled before October 20.

“The Reserve Bank of India (RBI) has authorized Navi Finserv to commence scheduled disbursements of home loans, sanctioned before October 20, 2024. The authorization has been granted up to December 31, 2024,” Navi Finserv said according to news agency PTI.

The company added that the reprieve will provide “substantial relief” to homebuyers whose home loans were sanctioned before the RBI’s crackdown on the company.

Notably, the central bank, earlier this month, banned the fintech startup from granting new loans after close of business on Oct. 21, citing “significant oversight issues,” including alleged predatory pricing.

Similar directions were also issued against DMI Finance, Arohan Financial Services and Asirvad Micro Finance.

The RBI also reportedly hit the four companies for excessive interest rates, non-compliance with its regulations, discrepancies in assessing household income, irregularities in loan classification, outsourcing of financial services and inadequate disclosure of interest rates and fees.

The consequences saw Navi Finserv cancels plan to sell INR 100 Cr bondswhich was initially scheduled to open for auction on October 21. At the time, the company said it maintained a healthy liquidity position, adding that there was “no immediate need for external financing at this stage.”

The crackdown is likely to have a direct impact on the IPO plans of Navi Finserv’s parent company Navi Technologies, which had even filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI ) in 2022. He then shelved the plan. .

Navi Finserv reported operating revenue of INR 1,906.2 Cr in FY 2023-24 (FY24), down from INR 2,040.6 Cr in FY23. Meanwhile, the fintech’s consolidated profit after tax (PAT) fell 56% YoY (y-o-y) to INR 115.6 Cr during the financial year under review.