Nigerian government has started deducting electronic N50 levy from transactions of N10,000 and above made by users of financial technology (Fintech) companies including Opay, Moniepoint, Kuda and others.

The levy on electronic money transfers (EMTL), established within the framework of the Finance Law 2020imposes a one-time fee of N50 on persons receiving any electronic payment or transfer of N10,000 or more and was previously scheduled to begin on September 9.

However, the EMTL rollout has been met with backlash from Nigerians, with many groups including the National Association of Nigerian Students (NANS) urging the Nigerian government to reconsider its decision regarding the rollout. work of the tax.

“Please note that from September 9, 2024, a one-off fee of N50 will be applied to electronic transfers of N10,000 and above remitted into your personal or business account, in accordance with Federal Inland Revenue Service (FIRS) regulations.

“It is important to note that Opay does not benefit in any way from these fees as they are entirely directed by the federal government,” Opay explained in its previous notice.

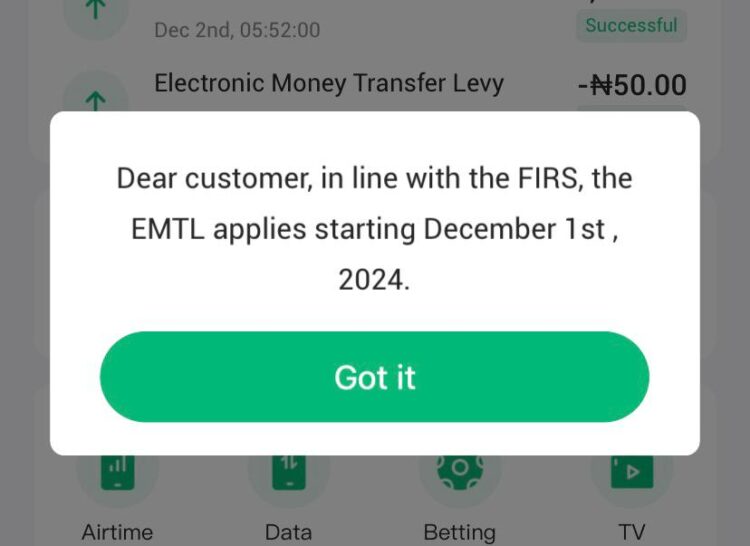

Fintech companies have informed their customers that the application of the N50 EMTL deduction began on December 1, 2024.

Opay, in a notification sent to its users on Saturday (which was also shared through its app), clarified that electronic direct debit deduction begins on December 1.

“Dear Customer, as per FIRS, EMTL applies from December 1, 2024,” the message said.

Moniepoint, in a message sent to its customers on Saturday, said it had started implementing EMTL rates. He also clarified that the fees will be handed over to the FIRS.

“Dear Customer, You will be charged a stamp duty of N50 on entries of N10,000 and above. Moniepoint collects and delivers this information on behalf of and to FIRS,” explains Moniepoint.