The CEO of an AI robotics company she ran from an apartment in Miami was better at hiding truths about the company’s progress, herself and how investors’ money was being spent than to guide the company to produce the service robot it had promised investors.

At least that’s what a Securities and Exchange Commission complaint against Destiny Robotics and its CEO Megi Kavtaradze claims. Kavtaradze, legally, neither admits nor denies the accusations. And she declined to comment when reached by phone Sunday.

However, money talks. The settlement of the case approved Thursday by Miami Federal Court Judge K. Michael Moore says Kavtaradze agreed to pay the SEC a total of $64,384: $12,990 in disgorgement, which is how much she has profited from “false statements” in the SEC complaint; interest of $1,394; and a civil penalty of $50,000.

Although it is also listed as a defendant in the civil suit, Destiny Robotics is a defunct company and therefore was not subject to any penalties or restitution.

The SEC complaint states that in raising $141,000 from investors via crowdfunding, Kavtaradze and Destiny “made material misrepresentations” about:

▪ what Destiny Robotics products could do;

▪ when they would be released;

▪ touted “the completion of the hologram prototype while omitting that it had been abandoned”;

▪ “the personal and business relationship of a major investor with Kavtaradze while using his support and role as a shareholder;

▪ Kavtaradze being “an experienced executive in a technology company”;

▪ Kavtaradze diverts some of the investors’ money for his personal use,” including “meals, travel, and MBA program fees.”

Kavtaradze’s LinkedIn page says she is currently in an MBA program at the University of California’s Berkeley campus. Although she is proudly featured as the founder and CEO of Destiny in the company’s social media posts in 2021 and 2022, she does not. Destiny Robotics list among experiments on his LinkedIn page from Sunday. But she plans time with a “Stealth Startup” from July 2021 to August 2023.

This is his duration at Destiny Robotics.

The address on Destiny Robotics website still active is located at 201 SE Second Ave., Monarc in Met, a downtown building where Kavtaradze lived.

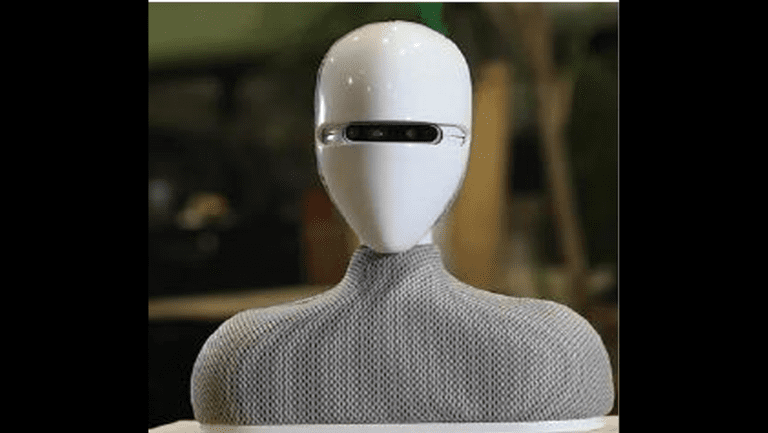

“I started Destiny Robotics to solve the problem of people feeling alone,” says Kavtaradze’s quote on the Wefunder page. “My mission is to give everyone a humanoid domestic helper.”

The SEC complaint states that Kavtaradze, beginning July 21, used various media outlets to tell potential investors that Destiny was “developing next-generation technology that would allow it to produce the world’s first humanoid robot capable of serving as an assistant and companion at home. »