2025 Latin America Fintech Market Report Overview

Market Statistics

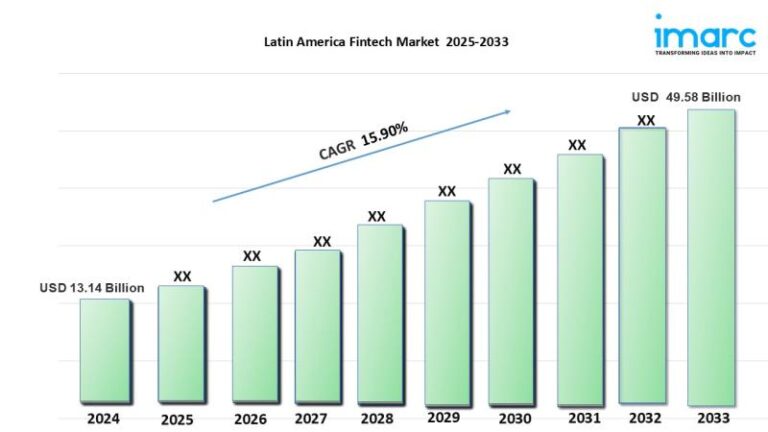

The Latin American fintech market has showcased substantial growth, with a market size reaching USD 13.14 billion in 2024. According to the latest report from the IMARC Group, the market is predicted to expand further, reaching USD 49.58 billion by 2033, signifying a robust compound annual growth rate (CAGR) of 15.90% from 2025 to 2033.

Key Trends Driving Growth

The fintech landscape in Latin America is evolving, driven by several major trends. One notable aspect is the emergence of neobanks like Nubank in Brazil and Albo in Mexico, which are reshaping financial services through mobile-first solutions that enhance accessibility and reduce costs. Additionally, digital payment systems are steadily gaining traction, with alternative payment methods making up a significant share of e-commerce transactions.

Revolutionizing Payment Systems

Innovations such as Brazil’s Pix system are transforming payment processes, enabling instant and low-cost transactions that promote financial inclusion across the region. The integration of financial services into non-financial platforms, led by companies like Mercado Pago, further underlines the shift towards seamless, all-encompassing financial solutions.

The Impact of Open Banking

Open Banking has emerged as a crucial turning point, particularly in Brazil and Mexico. Regulations now allow consumers to share financial data easily, providing access to a wider array of services. This shift not only enhances the service offerings but also promotes healthy competition among fintech players in the market.

Embracing Cryptocurrencies and Blockchain

The rising adoption of cryptocurrencies and blockchain technology, especially in countries like Brazil and Argentina, illustrates the migration towards decentralized financial solutions. Factors such as high inflation and economic instability markedly influence this trend, offering further opportunities for innovation and expansion within the fintech sector.

Comprehensive Market Segmentation

The market report provides an in-depth analysis of key segments within the Latin American fintech industry, highlighting those with the largest market shares. Segmentation includes deployment methods, technological advancements, application types, end-user demographics, and regional insights, covering nations like Brazil, Mexico, Argentina, Colombia, Chile, and Peru.

Insights and Recommendations

The report not only outlines market performance from 2019 to 2024 but also analyzes projections for the upcoming years. It offers strategic recommendations, a comprehensive SWOT analysis, and a detailed mapping of the competitive landscape, ensuring stakeholders can navigate the evolving fintech environment effectively.

Get More Information

For those interested in a more detailed overview of the market, a PDF sample can be requested here.

Contact Details

For further inquiries, please reach out to IMARC Group at:

134 n 4th St. Brooklyn, NY 11249, United States

Email: sales@imarcgroup.com

Phone: +1-631-791-1145

About IMARC Group

IMARC Group is a global management consulting firm dedicated to helping ambitious businesses create lasting impacts. They offer comprehensive services, including market assessments, feasibility studies, business incorporation support, and strategic recommendations designed to ensure success in various industries.