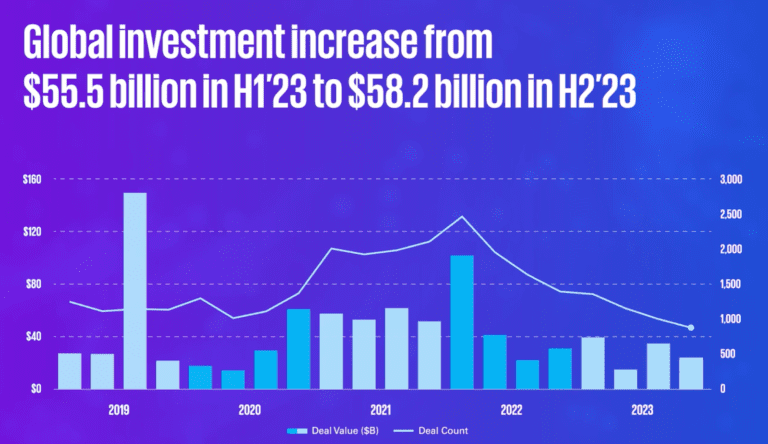

Fintech has been driving change in financial services for over a decade, attracting billions of dollars worth of investment. Recent quarters have seen a slowdown in the pace of deals being closed, but fintech innovation remains a very powerful economic driver in the global economy.

Finding the right focus

Source: Pulse of Fintech, biannual analysis of global fintech financing by KPMG

Despite some slowing in the pace at which investments in fintech are being made, there is no shortage of investor optimism in this area and there is every reason to expect that fintech will continue to help define the how the broader financial services industry is evolving over the current decade and beyond.

Notably, there is now enormous interest in the potential integration of AI, and particularly generative AI technologies, into financial service offerings at all levels. At the same time, the transition to “open banking” and data sharing with the aim of significantly improving the consumer experience continues to support technological developments in payment systems, savings apps and alternative lending solutions.

Ongoing impacts

The pace and manner in which fintech solutions are integrated into financial services differs across regions and regulatory environments, with consumer demands, security concerns and data protection considerations impacting how whose specific markets are taking shape. But with fintech’s ability to improve everything from payment processing speed to fraud detection standards to reducing costs while improving the customer experience, the opportunities for impactful innovation in the domain remains larger than ever.

Challenges to overcome

While fintech innovators typically look for ways to come up with solutions to problems, the industry as a whole has been facing inevitable headwinds of late. Indeed, KPMG, in itslook at the fintech landscape to 2024, describes the industry as facing “a storm of global challenges”. These problems have generally been caused by macroeconomic factors such as stubbornly high inflation rates in many parts of the world, as well as unnecessary increases in borrowing costs.

All eyes on AI

Source: AI in the banking sector: AI will gradually change the game according to S&P Global

Looking ahead, as inflation generally continues to decline throughout 2024, the environment for investors is expected to improve, with AI-based technology clearly a bright stopping point in the landscape. In fact, AI seems poised to make a significant contribution tothe next wave of fintech developments. From an investment perspective, the financial services sector is largely supportive of AI, withJuniper Research predicting that bank investments in generative AI will reach $85 billion globally by 2030, up from the $6 billion expected to be allocated to these areas in 2024.

For now, AI investments in financial services are often aimed at achieving easy wins through efficiency gains, but with technology evolving so quickly, more impactful innovations and changes in business models complete sets are also eagerly awaited. As IDC Group Vice President for Global Research Rick Villars explains: “In 2024, the shift to AI everywhere will enter a critical development phase as businesses make major new investments with the goal of significantly reducing the time and costs associated with customer productivity use cases and employees. From there, the focus will be on investments that drive revenue and business results.

Promote inclusion

More broadly, the emergence of fintech at the very heart of the global financial services landscape has been one of the most significant economic, social and technological developments of recent decades. Today, fintech-based solutions are taken for granted and are an integral part of how a myriad of banking activities are conducted daily across the world.

Coupled with the onset of the Covid-19 pandemic and the dramatic increase in global mobile phone usage over the past decade, fintech innovation is driving financial inclusion worldwide, particularly in developing countries where millions of people are still unbanked. According to the World Bank, these same forces and technological advancements have helped open access to banking services to all demographic segments of societies around the world.

Focus on value creation

The explosion of fintech startups during the early stages of the industry’s evolution helped transform the landscape of the financial services industry and gave rise to what experts at McKinsey & Company describe as“hypergrowth”. More recently, the sector reportedly saw the value of the collective market capitalization of publicly traded fintech companies double to $550 billion between 2019 and July 2023, according to the F-Prime fintech index. During the same period, the number of fintech unicorns worth more than $1 billion exploded, from 39 to 272, McKinsey’s analysis suggests.

Going forward, the market expects innovation among fintech companies to shift more toward creating sustainable value rather than experimentation or risk-taking. However, there is no doubt among analysts that fintech companies and investors will continue to play a major role in shaping the financial services landscape, with the adoption of digital banking expected to continue to grow rapidly, e-commerce services expanding and AI driving all kinds of advancements.

Notably, even as technology-driven companies focus more on sustainable value creation rather than instant-impact innovation, McKinsey experts estimate that fintech sector revenues will grow almost three times as fast as those of the traditional banking sector between 2023 and 2028.

Source: Fintechs: A new growth paradigm by McKinsey & Company

Competition vs collaboration

The story of fintech has often been one of startups responding to consumer demands that more traditional banks were unable to meet themselves. This dynamic has fueled cycles of innovation and led to dramatic changes across the financial services landscape, with traditional banks ultimately forced to respond to protect their market share and satisfy customers where they can.

By 2024, fintech companies will be a fundamental part of the competitive parameters in which all financial services activities take place, with big banks often working alongside startups to improve their offerings, particularly with regard topayment processingand other times competing against them and seeking to maximize their own advantages.

But whether their efforts are geared toward working with established players in the banking industry or against them, fintech companies still have enormous room and potential to continue making waves across the industry and fundamentally influence how people bank across the world.