(Bloomberg) — Klarna Bank AB’s planned IPO fuels hopes that a long listing drought in the fintech sector is coming to an end, heralding a wave of debuts for the sector over the next two years .

The Swedish buy now, pay later giant plans to go public in New York in the first half of next year, Bloomberg reported. A successful listing – coupled with rising stock prices and the prospect of lighter regulation during a second Donald Trump presidency – could ultimately prompt some of Klarna’s peers to do the same, bankers, investors say in venture capital and analysts.

Other fintech companies are poised to move forward with their IPO plans. Zilch Technology Ltd. and Chime Financial Inc. plan to sell shares for the first time in 2025, and executives at Plaid Inc. and challenger banks Revolut Ltd. and Zopa Bank Ltd. Owner Trustly Group AB is exploring options for the fintech, including a sale or IPO, Bloomberg News reported. Brex Inc. and Ramp Business Corp. are also considering possible IPOs.

How quickly these companies come to market and where they choose to list could be influenced by Klarna’s behavior.

“Klarna’s highly anticipated filing may portend an uptick in fintech public offerings after a relatively slow period,” said Mark Palmer, senior research analyst for fintech and digital assets at The Benchmark Company. “The recent rise in fintech stock prices and valuations bodes well for further public offerings in this sector, as do investor expectations for a more fintech-friendly regulatory regime under the new Trump administration.”

Klarna, Zilch, majority owner Trustly, Nordic Capital, Revolut, Plaid, Brex and Chime declined to comment or did not respond to requests for comment for this story. A Zopa Bank spokesperson said that “an IPO is not an immediate priority” but that it continues to work on it, preferably in the UK, when the time is right. A Ramp spokesperson said: “We have ambitions to become a public company, but we are not actively planning this at the moment. »

Klarna has confidentially filed for an IPO with the U.S. Securities and Exchange Commission, it said in a statement last week. Although the company provided no financial details, analysts last month estimated Klarna’s implied valuation at around $14.6 billion after shareholder Chrysalis Investments Ltd. increased the value of his stake. This would mark an improvement over the $6.7 billion valuation it achieved in its last fundraising in 2022, but is still well below the $45.6 billion valuation Klarna boasted in 2021.

Fine or Tech?

Fintech valuations have collapsed during a broader tech rout in 2022 triggered by rising interest rates and geopolitical instability. Klarna’s share price will offer clues to other IPO candidates about what they can expect: will they be given rich valuations of tech stocks, or more down-to-earth prices of financial companies?

“The industry needs liquidity and valuations need to come back to Earth,” said Sydney Thomas, founding general partner of Symphonic Capital. She called Klarna’s decline in private valuation “reasonable” and its current estimated valuation “still exceptional”, given what the sector has been through.

“I hope that Klarna’s IPO will give other founders the courage to pursue their exit, even if it means doing so at a lower valuation,” Thomas said.

Venture capitalists backing fintechs are optimistic that there is once again a place on the stock market for fast-growing companies, especially those that are profitable or on track to be profitable.

“Fintechs – public and private – that solve real problems and have strong economic fundamentals will continue to perform well,” said Nigel Morris, managing partner at QED Investors.

Two of QED’s profitable portfolio companies are San Francisco-based SoFi Technologies Inc. and Brazilian challenger bank Nu Holdings Ltd., or NuBank. SoFi’s shares are up about 47% so far this year, while NuBank’s shares are up 62%.

But the reality of investing in IPOs has changed since these companies went public in 2021, part of a class of growth-oriented listings that emerged from the Covid-19 pandemic. Many of these stocks took a beating when the era of cheap borrowing came to an abrupt end, leaving investors reeling. The difficulties have also spilled over into private markets, where companies like Klarna have struggled to maintain their high valuations while seeking liquidity.

With the exception of artificial intelligence companies, IPO investors have recently favored more predictable and profitable companies over promises of future growth. They also demanded significant valuation reductions to account for the risk of betting on untested stocks.

There are signs that the tide may be starting to turn. For example, shares of US insurtech Lemonade Inc. are up nearly 189% this year and are once again above their IPO price – although they remain massively down from their peak from the start of 2021.

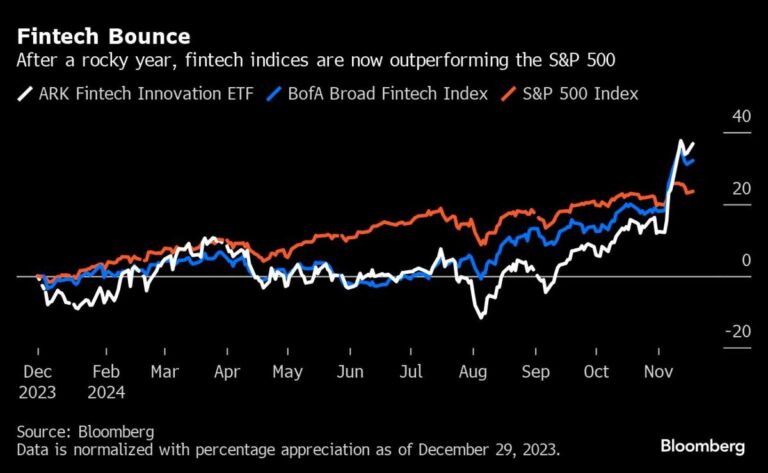

Other fintech stocks are also on the rise. Bank of America Corp.’s BofA Broad Fintech Index is up about 36% this year, while the Ark Fintech Innovation ETF is up about 38%. Both outperform the S&P 500.

Valuation divergence

Investors are also less likely to label the entire fintech sector with a broad label, preferring certain subsectors over others. Digital lending models have fallen out of favor, while payment companies are gaining popularity, according to some venture capital firms.

Many of the lending companies, including LendingClub Corp., were among the first generation of fintechs to go public about a decade ago. But some have struggled to compete with the rising cost of capital, while banks have managed to keep funding costs lower, notably through deposits.

Lending company valuations “have fallen to the ground” because of these competitive dynamics, said Tom Glocer, an angel investor and executive chairman of startup Capitolis Inc. On the other hand, “everyone loves payment companies because they want to get the multiple of Adyen NV. »

Shares of this Dutch fintech have soared 406% since its IPO on Euronext Amsterdam in 2018, even after plunging last year due to weak profits. The stock trades at 34 times its expected 2025 earnings and about 12 times its expected revenue, including debt, according to data compiled by Bloomberg.

Klarna, which provides short-term credit to shoppers around the world, will need to convince investors that it is not a traditional lending business to achieve its ambitious valuation. The company has expanded into areas beyond its core BNPL product, including offering more retail banking offerings and leveraging artificial intelligence to improve its services.

Domestic markets

Even with Adyen’s strong performance, many European fintechs are tempted by the promise of higher valuations and greater liquidity in the United States. This increases pressure on their home countries to maintain these lists.

Revolut, Britain’s biggest fintech, will be closely watched as it decides when, where and if it will list. Staying in London would be a big win for Britain’s tech industry and its stock market, which has suffered a dearth of IPOs since 2021. However, the benefits of the U.S. market, as well as potential regulatory benefits under Trump, could s prove difficult to resist.

Some companies may simply remain private while seeking additional fundraising and stake sales. This would give them time to improve valuations, while providing liquidity to early investors and employees.

“For some companies, there is a lot of dialogue going on and a desire to reconfigure their current capital structure to be more public company ready,” Brennin Kroog, chief executive of Lazard Inc., said in an interview.

Revolut completed a $500 million share sale for shareholders in August, valuing the company at $45 billion. Shortly after, its British counterpart Monzo Bank Ltd. also announced a stock sale to its employees, giving it a valuation of $5.9 billion.

Klarna’s filing doesn’t necessarily mean everyone will follow, said Rob Moffat, associate at Revolut partner Balderton Capital.

“This is great news, but not counting the chickens until the IPO is successfully completed,” he said. “Klarna has always been one of the first to go, it was founded in 2005.”

–With help from Aisha S Gani, Emily Nicolle and Emily Mason.

Most read from Bloomberg Businessweek

©2024 Bloomberg LP