JMJ Fintech Hits 52-Week Low Amidst Market Challenges

Overview of Current Stock Performance

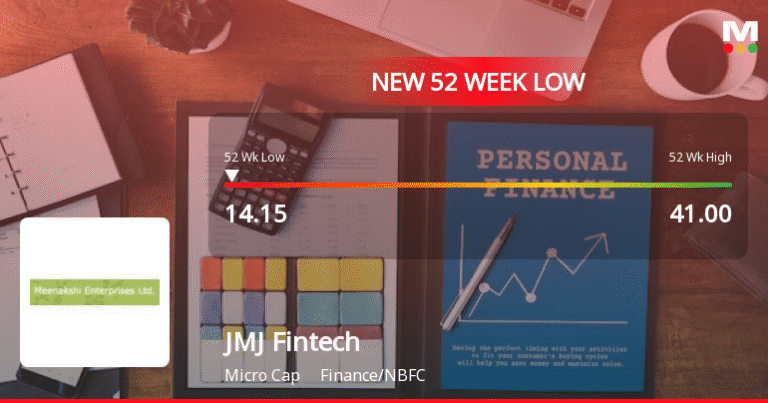

JMJ Fintech, a microcap entity within the Non-Banking Financial Companies (NBFC) sector, is currently facing significant volatility. Today, the stock hit a new 52-week low at ₹14.15, marking a troubling downward trend. This decline is underscored by a 16.34% drop over the past five days and a performance lag of 3.05% compared to its sector peers.

Recent Financial Growth

Despite these challenges, the company has reported robust financial metrics in recent quarters. JMJ Fintech has achieved a substantial increase in net sales, reaching ₹9.71 crore, which translates to an impressive 86.37% growth. Furthermore, the profit after tax (PAT) for the last nine months stands at ₹3.35 crore, up 71.79%, showcasing operational efficiency with the highest quarterly PBDIT hitting ₹3.91 crore.

Long-Term Performance Concerns

While recent figures are promising, concerns linger regarding the long-term performance of JMJ Fintech. The stock has faced a one-year decline of -37.45%, falling considerably behind the Sensex index, which recorded a modest increase of 0.27%. This stark contrast raises questions about the company’s sustainability and growth potential in the longer term.

Return on Equity Metrics

Moreover, JMJ Fintech’s average return on equity (ROE) is currently at 8.47%. This relatively low figure may indicate weak fundamental strength and could deter long-term investors. Understanding the implications of ROE is crucial for stakeholders as they assess the company’s performance in conjunction with market conditions.

Valuation and Investment Outlook

Despite the ongoing volatility, JMJ Fintech’s valuation remains appealing, presenting a price-to-book ratio of 2.4. This suggests that the stock is trading at a fair value when compared to its industry peers. For investors considering entry points, this valuation may serve as a compelling reason to investigate further.

Market Sentiment and Future Prospects

The current market sentiment surrounding JMJ Fintech appears mixed, with positive short-term financial growth overshadowed by long-term performance issues. Investors must weigh these factors carefully to make informed decisions regarding possible investments in JMJ Fintech and the broader NBFC sector.