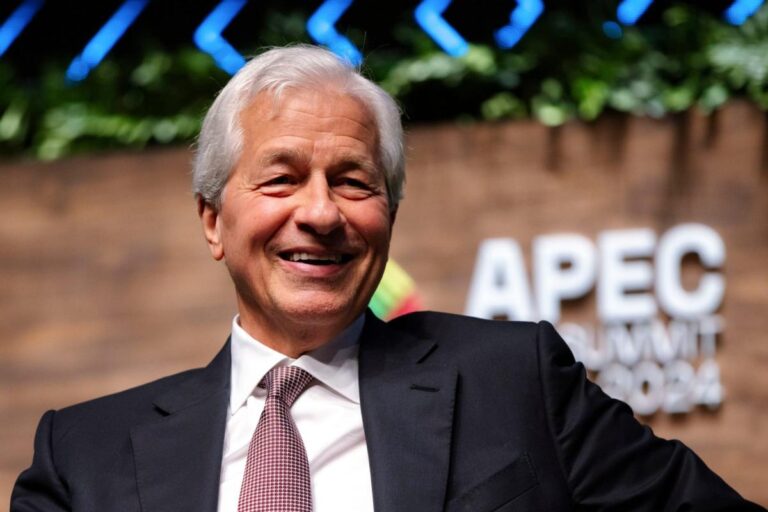

JPMorgan CEO Jamie Dimon rejects doomsday predictions about what AI means for humanity, instead explaining how he sees the technology dramatically improving businesses and their employees’ work-life balance.

Even Dimon—a staunch defender of long-established career standards, such as work hardbe prepared for everything, and work in the office— claims that future generations of employees could work a day and a half less each week, thanks to AI.

In addition to reducing the work week from five to three and a half days per week, Dimon also predicts that the workforce of the future could live to be 100 years old.

Thousands of people at the largest U.S. bank are already using the technology, Dimon said. Bloomberg Televisionadding that artificial intelligence is a “living thing” that will evolve throughout history.

The technology may be used by JPMorgan in a wide range of areas (errors, trading, research and hedging, to name a few), arguably illustrating fears that AI could take the jobs of its human counterparts .

Goldman Sachs predicted that around 300 million jobs will be lost to technology, with around a quarter of the American working population fearing that in the future they will lose their role to artificial intelligence.

But technological progress is also a problem that societies have already faced, Dimon pointed out, adding that AI and large language models also offer enormous opportunities to improve living standards.

“People need to take deep breaths,” Dimon said. “Technology has always replaced jobs. Your kids will live to be 100 and be cancer-free thanks to technology, and they’ll probably work three and a half days a week.

Employees could reduce their working hours, thanks to technology used to automate some of their activities, McKinsey found in a report published last year.

THE report also found that generative AI and other emerging technologies have the potential to automate tasks that currently take up 60% to 70% of employees’ time, an addition of $2.6 trillion to $4.4 trillion to the global economy each year.

And while companies are still wondering how quickly AI will transform their industry, arguments are already being made to reduce the number of days in the current work week.

A British study A survey of 61 organizations by the University of Cambridge found a 65% reduction in sick days during a four-day working week, while 71% of employees reported reducing their level of sickness. professional burnout. Result: 92% of companies participating in the program said they would maintain a three-day weekend.