The Italian Trade Agency (ITA) celebrated the next wave of Italian fintech innovators at the Global Startup Program Demo Day, hosted at the Marina Bay Cruise Centre. As part of ‘Villaggio Italia’, an exhibition accompanying the iconic Italian Navy ship Amerigo Vespucci on its global tour, the event demonstrated Italy and Singapore’s shared vision to establish a premier fintech hub. plan in Southeast Asia.

Against the symbolic backdrop of the Amerigo Vespucci, a historic vessel representing rich Italian heritage and modern ingenuity, the Demo Day highlighted the strategic cooperation between Italy and Singapore to strengthen fintech innovation. The Demo Day was a key part of the Global Startup Program, a collaborative initiative between the Italian Ministry of Foreign Affairs and International Cooperation and the ITA, aimed at accelerating the entry of Italian startups into international markets. The program, now in its fifth year, has chosen Singapore as a regular partner, organizing the Demo Day here for the third time and thus strengthening Singapore’s role as a gateway for Italian companies to Asia.

Italy’s commitment to fostering startup innovation

Opening the event, the Italian Deputy Minister of Business and Made in Italy, Mr. Valentino Valentini, highlighted Italy’s commitment to supporting its startup ecosystem. “Our ministry recognizes startups as a unique sector,” he said. “We focus on creating dynamic environments that enable ideas to become products. »

Mr Valentini highlighted Italy’s dedicated innovation hubs, designed to support emerging startups. These hubs serve as spaces where startups can showcase their businesses and access resources vital to their growth. He further announced that the Italian government is proposing new legislation to support start-up businesses, addressing challenges in a way that encourages entrepreneurship and actively supports it through structural reforms. “Having innovative ideas is not enough; Startups need support from institutions and investors to turn their ideas into reality,” he noted.

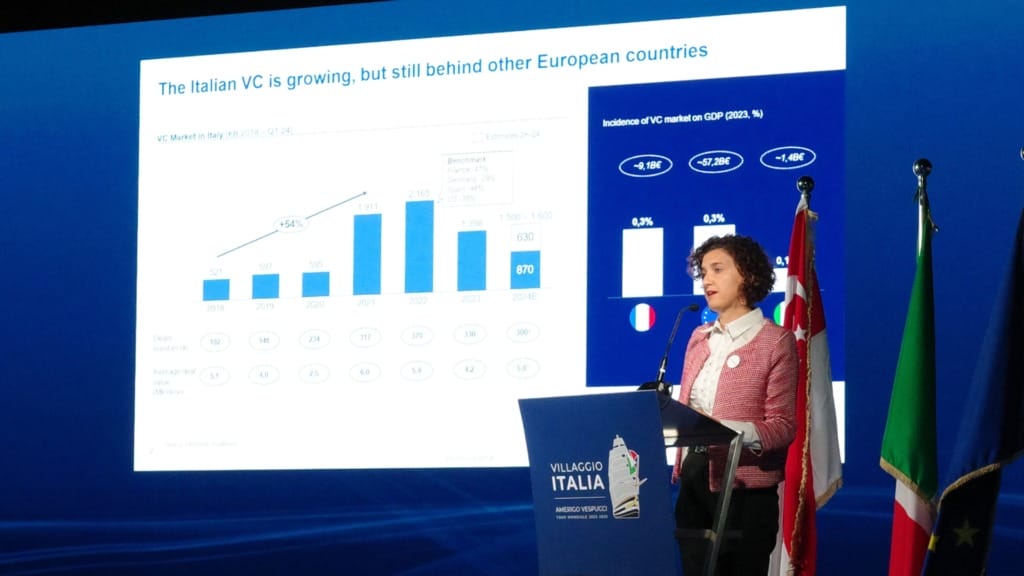

Addressing Italy’s traditional reliance on family businesses rather than venture capital, Mr. Valentini acknowledged that Italy has sometimes struggled to cultivate high-risk businesses. “People often point out that Italy doesn’t spend as much on venture capital as other countries,” he noted. “But those who are here today are breaking those barriers,” applauding the startups for their ambitious ambition to reach global markets.

Italian fintech startups present pioneering solutions

The Demo Day, organized in collaboration with Singapore-based pre-seed investor Tenity, brought together various stakeholders including venture capitalists, banking industry professionals and fintech industry leaders. ITA Singapore Director Giorgio Calveri highlighted the importance of this collaboration. “A strong partnership between Italy and Singapore is key to putting our fintech startups on the global map,” he said. “We are extremely proud of the talent and innovation coming from Italy, and today’s event offers a glimpse into how these startups are not only future players but also leaders in the world of financial technology. »

This year, six Italian fintech startups representing industries ranging from digital assets to SaaS and financial management participated in Demo Day, each showcasing unique solutions that push the boundaries of payments, data-driven management and customer experience. Among the companies presented was Appetizingfounded by Ernesto, an app designed to streamline meals for tourists and locals facing language barriers. “Appeaty allows restaurants to go digital, adapting to language preferences, allergens and dietary restrictions in just three clicks,” explained Ernesto, highlighting the app’s ability to reduce food waste and improve food efficiency. efficiency of the service.

Another notable fact was Financea financial “super app” co-founded by Matteo Spreafico, which simplifies personal finances through a fun and educational platform. “Personal finances can be intimidating, and many people don’t have the resources to manage their finances effectively. Finanz offers tailored education and investment options, all in one attractive app,” shared Matteo. Finanz has grown organically with over 15,000 downloads and is currently raising $1.5 million to scale and meet the needs of the next generation.

Hercle Srlanother innovative participant, offers a platform that enables seamless access to digital asset liquidity, designed to simplify and secure transactions for customers dealing in digital currencies. In the same way, Twiper Srl introduced a generative AI tool allowing businesses to customize chatbots and digital assistants tailored to user needs, from customer support to task management. According to Giulia, founder of Twiper, “our conversational AI goes beyond traditional bots, making decisions and taking actions based on user interactions, creating highly functional and efficient support for businesses. »

Complete the double-up was Startup programa platform that automates investment cycles, cap tables and incentive plans for startups, and Volvero, a blockchain-based vehicle sharing application. These startups benefit from tailor-made support as part of the program, including access to networking events, industry masterclasses and one-on-one sessions with investors, facilitated by Tenity’s extensive network within Singapore’s fintech ecosystem.

Finnley Lee, Head of Operations at Tenity, explained that the Global Startup Program helps startups connect directly to the local ecosystem, enabling valuable introductions to businesses, investors and stakeholders. Tenity has been instrumental in supporting Italian startups since 2019, offering advice to help them succeed in Asia. Finnley highlighted the program’s immersive approach, noting: “Face-to-face interactions are essential in Asia, and through our network, startups gain critical insights for successful expansion. »

Deepening fintech cooperation between Italy and Singapore

Italian Ambassador to Singapore, Dante Brandi, spoke of the strategic importance of the partnership, commenting: “Singapore, as a leading innovation hub, provides an ideal gateway for Italian startups to grow and thrive in a competitive global market. » In 2023, Italian exports to ASEAN reached €9.6 billion, and the collaboration provides Italian companies with direct access to one of the most dynamic fintech markets in the world. Ambassador Brandi also mentioned a memorandum of understanding signed last year between the Singapore Fintech Association and Italian company AssoFintech, reinforcing the two countries’ commitment to fostering fintech innovation.

The demo day concluded with remarks from Dr. Laura Alexandrini of CDP Venture Capital, Italy’s largest venture capital fund, which supports startups at all stages of business. “CDP’s mission is to develop the startup ecosystem in Italy,” noted Dr. Alexandrini. She highlighted that the Global Startup Program reflects Italy’s determination to expand its fintech footprint globally, with Singapore playing a vital role as a strategic partner in connecting Italian companies with Asian fintech markets.

As the Global Startup Program continues until November 8, 2024, participating startups will engage with key influencers and businesses in Singapore, attend the Singapore FinTech Festival, and benefit from extensive mentorship and exposure opportunities. The program’s collaborative approach, combining Italian innovation with Singapore’s supportive business environment, points to a bright future for Italy and Singapore as they work together to shape the next era of fintech innovation.