Toduba Secures €3.5 Million Investment to Enhance Employee Well-being Solutions

Toduba, an innovative company based in Turin, is transforming the employee well-being landscape with its proprietary cloud technology. The startup has successfully raised €3.5 million in funding to expand its product offerings, strengthen its merchant network, and roll out additional services aimed at improving workplace benefits.

Investment Details and Strategic Partnership

The investment round was led by P101 SGR, marking their thirteenth investment via Programma 103 and Azimut Eltif Capital P103. This funding adds to the support previously received from other investors, including CDP Venture Capital SGR through its Startup Fondo Rilancio. This strategic partnership with P101 positions Toduba for significant growth in the competitive employee well-being sector.

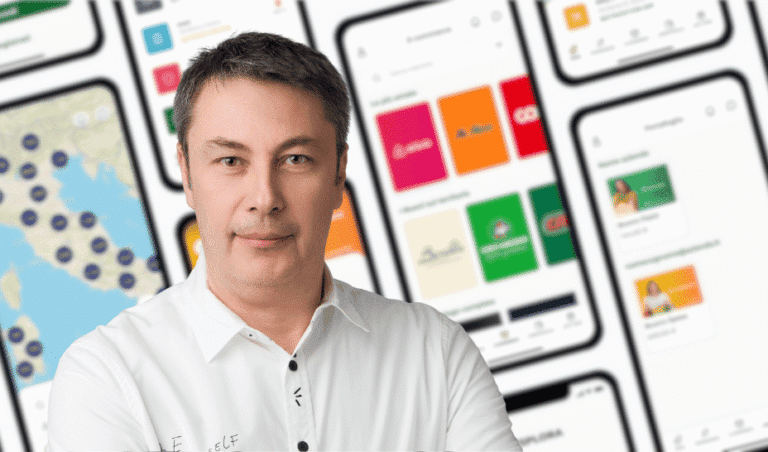

CEO’s Vision for Growth

Gianluca Enrietti, CEO and co-founder of Toduba, expressed his enthusiasm for this new phase, stating, “We are excited to welcome P101 on board as we embark on this growth journey. Their support validates our vision of creating a flexible and transparent model that caters to the evolving landscape of social protection. With our proprietary technology, we have built a people-centric social protection platform, and this new funding will enable us to expand our unique model across Europe.“

About Toduba

Founded in 2017 by Enrietti and co-founder Bruno Cavigioli, Toduba’s mission is to democratize access to employee benefits. The company commenced operations in 2020, playing a pivotal role in digitizing the solidarity vouchers issued by Italian municipalities during the pandemic. Since then, Toduba has established itself as a leader in the digital management of employee well-being.

Cutting-Edge Technology

At the core of Toduba’s platform is a proprietary transactional engine built on private blockchain technology, ensuring safety, traceability, and flexibility for users. The all-in-one application allows companies to transparently manage and customize benefits according to employee needs, while ensuring compliance with regulations. Users can access their preferred stores and restaurants directly through the app, enhancing the overall employee experience.

Growth Trajectory and Market Presence

In just three years, Toduba has experienced remarkable growth, with revenues soaring from €1.6 million in 2022 to a projected €41.7 million in 2024. The company boasts a growing user base of over 150,000 active users, an extensive network of 30,000 merchants, and partnerships with major players in Italian retail. Servicing around 2,000 primarily SME clients, Toduba collaborates with firms such as WTW and Randstad to enhance employee well-being.

Looking Ahead: Expansion Plans

The newly acquired financing will facilitate the expansion of Toduba’s product portfolio, strengthen its merchant network, and accelerate both organic growth and potential mergers and acquisitions. Additionally, the company plans to introduce new services in the flexible benefits space and initiate international expansion efforts.

The Future of Employee Well-being

The recent investment by P101 signifies a pivotal moment for the employee well-being sector, increasingly recognized as a strategic asset for enhancing worker satisfaction and bolstering company competitiveness. With only 18% of Italian companies currently offering structured social protection programs—compared to 48% in France—there’s significant room for growth in Italy.

Market Potential

According to P101, the Italian meal vouchers market alone exceeds €4 billion, with untapped potential estimated at over €33 billion. The corporate well-being segment is anticipated to grow from €5 billion to an additional €27 billion. Furthermore, the gift card sector is projected to expand by 14% annually, reaching €16 billion by 2028, highlighting the opportunities in the evolving landscape of employee benefits.