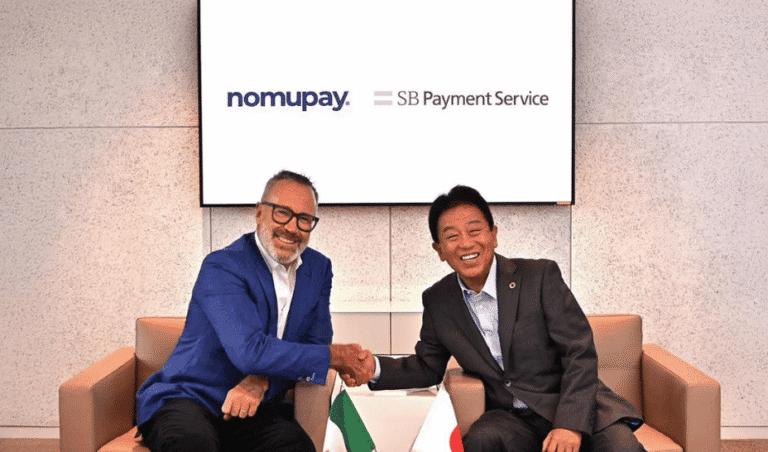

Nomupay Partners with SBPS for Enhanced Payment Solutions in Asia

Based in Dublin, Nomupay has recently entered into a significant partnership with SB Payment Service Corp. (SBPS), a leading Japanese solutions provider. This strategic alliance involves an investment of 35 million euros, setting Nomupay’s valuation at an impressive 254 million euros.

A Milestone Investment to Enhance Market Access

This capital infusion marks a pivotal moment in Nomupay’s commitment to providing unified market access for merchants across Europe, the Middle East, and Asia. The investment allows Nomupay to enhance inter-regional trade, opening up additional countries and payment methods to better serve its growing customer base.

CEO Statement: A Vision for Global Expansion

Peter Burridge, CEO of Nomupay, expressed enthusiasm about the partnership: “We are very pleased to announce the SBPS investment in our company and the formalization of a strategic partnership. This enables us to double our efforts and support inter-regional trade by adding more countries and payment methods to our platform.“

Innovative Payment Management Solutions

Founded in 2021, Nomupay is revolutionizing how businesses manage payments in rapidly evolving and fragmented markets. Their unified payment platform simplifies acquisition, treasury management, and payment processing, allowing companies to expand confidently in Asia, Europe, and the Middle East.

Streamlining Payment Ecosystems

Nomupay tackles the intricate challenges of fragmented payment systems by aggregating local payment options—such as bank transfers, digital wallets, and alternative payment methods—into a single, cohesive API. This centralized control makes it easier for companies to manage global payment flows while maintaining localized customer experiences.

Real-Time Monitoring and Enhanced Efficiency

The Treasury and Reconciliation tools provided by Nomupay offer real-time visibility, automated fund management, and multi-currency support, significantly reducing operational costs and minimizing foreign exchange leaks. This innovative approach enables companies to meet local regulations while delivering tailored payment experiences without the hassle of managing multiple payment service providers (PSPs).

Commitment to a Seamless Payment Ecosystem

“The alignment between Nomupay and SBPS is rooted in a mutual understanding of the complexities involved in cross-border payments. We are committed to providing a comprehensive payment solution that addresses all aspects—from payment acceptance to treasury management,” added Burridge.

Looking Ahead: Future Collaborations

Through this partnership, Nomupay plans to enhance its presence in Japan and throughout Asia, leveraging the strong relationships established with SBPS merchants. Meanwhile, SBPS aims to expand its global reach and improve its payment offerings through this collaboration.

Conclusion: A Stronger Future for Cross-Border Payments

Nomupay and SBPS are well-positioned for future growth and development in the digital payment landscape. With comprehensive support and innovative technology on their side, both companies are focused on realizing a seamless payment experience for businesses operating in the Asian market.