Oze: Revolutionizing Access to Finance for Small Businesses in Ghana

Ghanaian fintech startup Oze claims to deliver a staggering 36x impact on deployed capital, as outlined in their recent impact report. This innovative platform integrates digital file management tools with funding solutions catered specifically to Micro, Small, and Medium Enterprises (MSMEs).

A Monthly Spotlight on Fintech Innovations

In the latest episode of The Month in Fintech, the Disrupt Podcast showcased Oze and discussed its impact on the financial well-being of small businesses across Africa. Co-founder Dave Emnett shared insights on how Oze is addressing the credit gap and empowering entrepreneurs in Ghana.

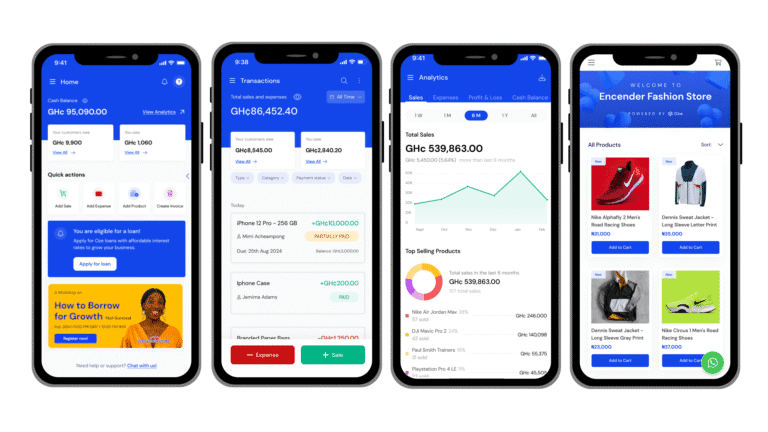

The Oze Mobile Application: Empowering Small Businesses

Launched in beta in 2018, Oze provides a mobile application that assists small businesses in recording their financial transactions. Users can track sales, expenses, debts, and receivables, enabling Oze to generate tailored recommendations and reports. By leveraging data and machine learning, the platform predicts credit risk and connects businesses with affordable capital through partnering banks.

Oze’s Mission to Bridge the Credit Gap

Founded with a clear mission, Oze aims to close the credit gap for small businesses across Africa. “We aim to build 100 million profitable small businesses across the continent,” says Emnett. With 90% of businesses being micro or small enterprises, which contribute over half of GDP and provide more than 60% of jobs, addressing their financing needs is crucial for economic growth.

Insights from Experience: Lessons Learned in Guinea

Emnett and his co-founder Meghan McCormick previously led a Guinea-based business accelerator called Dare to Innovate. Their experiences there informed the foundational strategies for Oze, emphasizing the role that supporting small businesses plays in combating youth unemployment and fostering job creation.

Transforming Challenges into Opportunities

Initially, Oze focused on digital accounting, but after receiving critical feedback during a Y Combinator interview, the team pivoted. Emnett recounts, “The motivation for businesses to adopt digital practices is access to capital.” This realization led Oze to develop a loan management system and a credit risk algorithm, enhancing their platform’s utility.

Supporting Small Businesses with Affordable Financing

To date, more than 275,000 businesses have benefited from Oze’s services. Emnett highlights the significant savings for small business owners, such as a tailor in Lagos who reduced interest payments from 21% per month to just 3% through Oze’s platform. This transformation underscores the importance of providing small enterprises with access to affordable financing solutions.

Looking Ahead: Strategic Partnerships and Future Goals

Originally funded through pitch competitions, Oze has recently secured investments from notable organizations including Visa and DEG. Emnett emphasizes, “Finding strategic partnerships is vital as we scale.” The ultimate aim is to make small businesses more appealing to lenders and to knock down the barriers to obtaining loans.