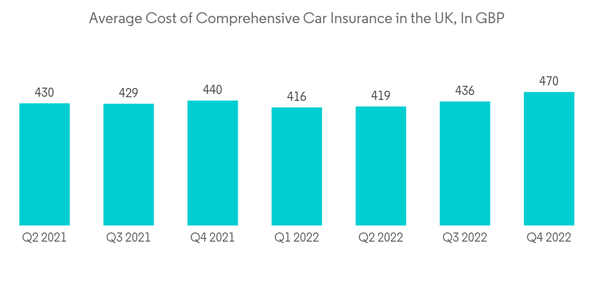

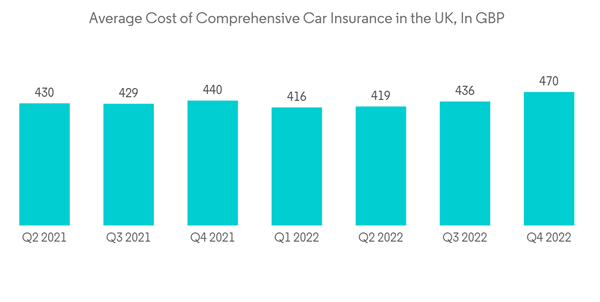

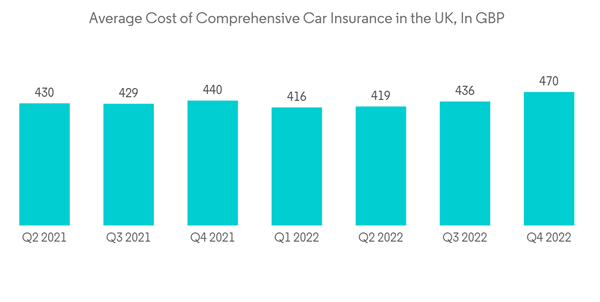

UK Car Insurance Market Average cost of comprehensive car insurance in the UK in GBP

Dublin, March 5, 2024 (GLOBE NEWSWIRE) — The “UK Car Insurance – Market Share Analysis, Industry Trends & Statistics, Growth Forecast 2020-2029” the report has been added to ResearchAndMarkets.com’s offer.

The UK motor insurance market size, in terms of gross written premium value, is expected to grow from USD 23.44 billion in 2024 to USD 28.74 billion in 2029, at a CAGR of 4.16% during the forecast period 2024-2029.

COVID-19 has been an unprecedented event for the insurance industry. Due to the long lockdown, many drivers were no longer able to use their vehicles on the road. The cumulative effect of this situation has been a significant decrease in motor insurance claims.

Car insurance covers cars, trucks, motorcycles or other road vehicles. Its main objective is to provide financial protection against property damage or bodily injury resulting from traffic accidents and against liability that may also arise from incidents in a vehicle. Car insurance in the UK also provides financial protection against theft of the vehicle and against damage to the vehicle caused by events other than traffic accidents, such as key breakage, bad weather or natural disasters, and damage caused by collision with stationary objects. The increase in accidents, the implementation of strict government regulations for the adoption of car insurance and the increase in car sales worldwide are driving the growth of the car insurance market in the UK.

Motor insurance is the largest segment of the non-life insurance market. Gross written premiums for non-life insurance are increasing, with the main driver being the increase in gross written premiums for motor insurance. Motor insurance growth is often important in explaining overall trends in the non-life sector, as insurers collect the largest premiums in motor insurance. This business sector has been identified as a driver of non-life segment developments in several countries. Globally, motor insurance contributes approximately 36.3% of non-life insurance premiums.

In London and the North West, the areas with the highest average car insurance premiums, customers had to pay more than £1,000. In contrast, in the South West, average car insurance premiums were £473, more than three times lower than in London.

UK Car Insurance Market Trends

High volatility in car insurance premiums in recent years

The average cost of comprehensive car insurance has been significantly impacted in recent years. For example, according to data published by the Association of British Insurers, the average cost of comprehensive car insurance fell to £436 (US$524) in Q1 2021, compared to £468 (US$563) in Q4 2020. The premium further fell to £416 (US$500) in Q1 2022, compared to £440 (US$529) in Q4 2021. This volatility is mainly due to the impact of the COVID-19 pandemic in 2020 and 2021. Local government-imposed lockdowns reduced the overall distance travelled during this period, leading to a decrease in the number of claims. However, premium prices recovered until the last quarter of 2022, due to rising inflation and increased prices for paint, spare parts and other repair costs.

Increased funding for fintech sector expected to boost market

The UK is the second largest FinTech investment destination after the US. The UK remains the most attractive destination for FinTech in Europe, with investment in the sector increasing by €9.1 billion in the first half of this year, a 24% increase on the same period in 2021. The UK FinTech sector comprises over 1,600 companies, a number that is expected to double by 2030. The sector contributes $13.4 billion (£11 billion) and over 76,000 jobs to the UK economy.

Overview of the UK motor insurance sector

The UK motor insurance market is consolidated with the top 10 players holding more than 80% share. Some of the major players operating are currently dominating the market. The market is expected to grow during the forecast period owing to the increasing sales of motor vehicles and many other factors driving the market. Companies such as AVIVA, The Prudential Assurance Company, Zurich Assurance Limited, AXA Insurance UK Plc and others have a strong presence in the UK motor insurance market.

Main topics covered:

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Market Overview

4.2 Market Driving Factors

4.3 Market Restrictions

4.4 Porter’s Force Analysis 5

4.5 Impact of COVID 19 on the market

5 MARKET SEGMENTATION

5.1 By product type

5.1.1 Third parties

5.1.2 Fire and theft caused by third parties

5.1.3 Complete

5.2 By distribution channel

5.2.1 Direct

5.2.2 Agency

5.2.3 Banks

5.2.4 Others

6 COMPETITIVE LANDSCAPE

6.1 Overview of market concentration

6.2 Company Profiles

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

For more information about this report, visit https://www.researchandmarkets.com/r/tukjql

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for market research reports and international market data. We provide you with the latest data on international and regional markets, key industries, top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900