- Jeanne Pastrano quit her $200,000-a-year job in New York after feeling burned out.

- After a six-month break, she said she feels rejuvenated and ready to return to work.

- She disclosed her sabbatical on her LinkedIn profile and found that she always got a new job easily.

This essay as told is based on a conversation with Jeanne Pastrano, a 37-year-old mom based in New Jersey. Pastrano quit his job in April after feeling exhausted. This story has been edited for length and clarity. Business Insider reviewed compensation documents for his previous job and his current job as a strategic account manager at Sardine.

People always told me: “It’s thanks to you that being a working mom It looks so easy.” Maybe I did it – but that doesn’t mean it was easy.

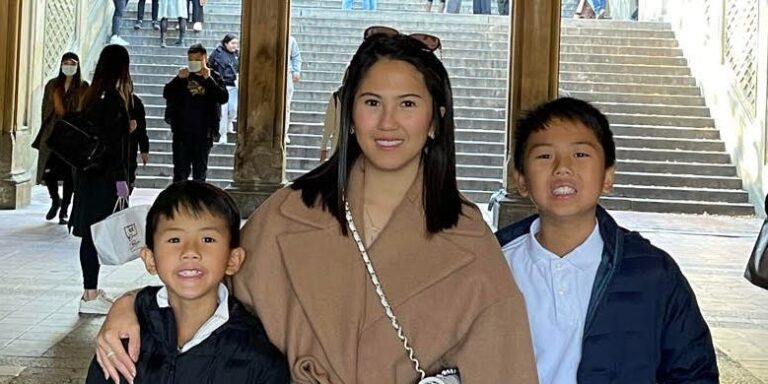

I am 37 years old. I have two boys, aged 10 and 12, and I was an account executive at Adyena financial technology company, until April. I loved my job and made about $200,000. We lived in New Jersey and I worked in New York.

As a working mother, you put on a strong face, because if you don’t, a lot of things will fall apart. The only way to stay together is to be very organized and stay on top of things at all times – and that’s what I did. This doesn’t mean that at the end of the day you aren’t exhausted.

I felt like I was stretching too much. When I was at home, I thought about work. When I was at work, I was also thinking about a million things I needed to do for the kids’ house. Over time it definitely builds up, just this feeling of inadequacy in both abilities.

And for most of my career, until recently, I was the primary breadwinner, so my family depended on my income. There is this weight of “It’s all up to me” and I wanted to free myself from it. Even when my husband’s career took a turn and he started taking over the majority of things financially, I just wanted to enjoy the break. I also wanted to become a full-time mother.

Quit my job was not an easy decision. I was in a good place professionally in a very stable company. This required months and months of planning and financial preparation. But I knew that if I didn’t take a break, I would always feel like I wanted it.

I had a hard time slowing down during my sabbatical

The first day out of work actually slapped me in the face. During my first three months of unemployment, I was still running. I had been on the hamster wheel for too long.

I had household projects and volunteer work. I am very active in church. I had to do more work at home with the kids.

I never really slowed down and always felt overwhelmed. The chores continued to pile up; the to-do lists were still piling up. Three months later, I wondered how I was still so busy after quitting my job. And I realized it was my fault. I didn’t know how not to work.

Eventually I was able to slow down a little more. I was able to spend more time with the kids during the summer and we were able to travel. It was my first time traveling without work – where there’s always that anxiety of checking email and that stress once you get back to the office, there will be a million fires you have to put out. So it was very refreshing.

I was thinking about leaving for good, but over the course of those six months, I really enjoyed the 9 to 5 job. Sometimes we love something, but we just need to breathe.

I never thought I’d be so ready to return to work or able to rekindle the enthusiasm I had at the start of my career, but I feel like I’m already there after six months of sabbatical.

Some people work 20, 30 years without a real break. I can’t imagine. Now I see myself working for another 5 or 10 years, with just a vacation here and there.

Returning to the job market was easier than expected

About five months later, I started interviewing and was looking for the same type of role. I knew I wanted a fully remote job.

I know it seems like it might be difficult to return to work, but I was so pleasantly surprised that that wasn’t the case for me. After six weeks of interviewing, I received an offer from a fintech startup – doing pretty much the same thing as before, with more equity opportunities.

I have been very transparent about my career break on LinkedIn and in interviews. Surprisingly, all the interviews have been so positive about it. They completely understood. I explained exactly why I was taking a break, and it seemed to resonate with them. It’s almost like everyone knows what I’m talking about because, at some point in their career, they’ve felt it.

If anyone is financially able, I would absolutely recommend a sabbatical if you’ve gotten to a point in your career where you just need a break. I have a feeling this is why a formal sabbatical is offered at some companies.

I am so grateful that I was able to take this break and refresh myself and then end up with my dream job that I was looking for.