India’s efforts towards a cashless economy have seen significant developments, including the integration of credit card payments into the Bharat Bill Payment System (BBPS). The Reserve Bank of India (RBI) has mandated that all credit card bill payments be routed through BBPS, putting it at the forefront of India’s digital payments landscape.

The move improves security and transparency, minimizes fraud and provides a unified payment interface. The rise of BBPS, alongside emerging solutions like credit on UPI, which enables on-demand borrowing, highlights the evolution of the digital payments ecosystem. According to a PwC report, The Indian digital payments sector grew at a CAGR of approximately 50% from 2015-2016 to 2019-2020, reflecting the rapid adoption and innovation in this area.

What is BBPS?

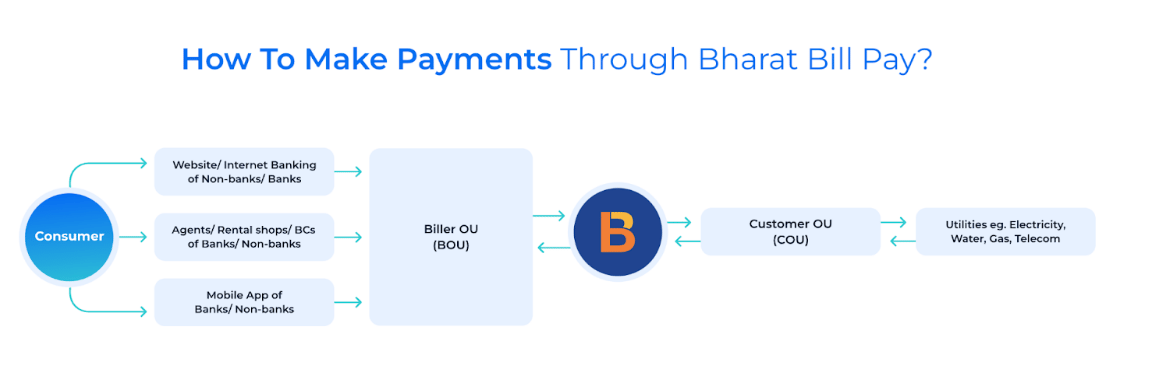

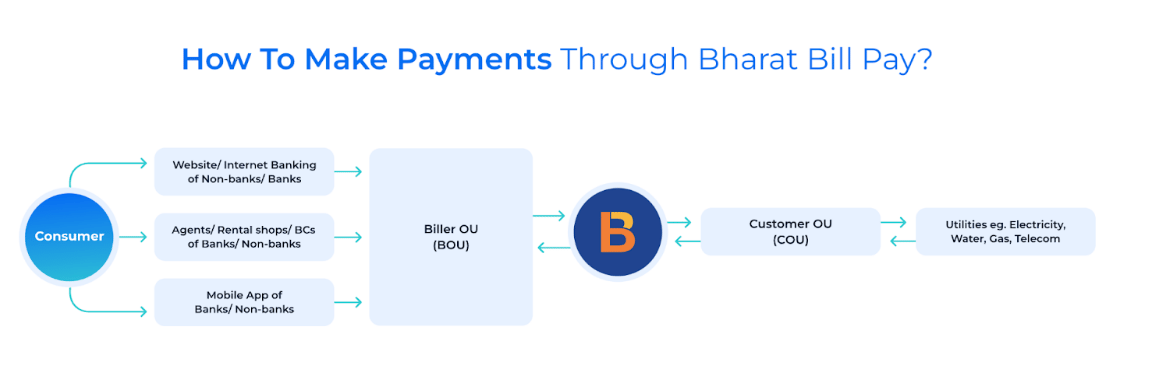

BBPS is a comprehensive platform that centralizes the payment of invoices for various services. Since July 1, the RBI has required all credit card payments through third-party apps to be processed through BBPS, overseen by the National Payments Corporation of India (NPCI). This regulation aims to improve monitoring and regulation of credit card transactions, which previously bypassed centralized systems through direct transfers like NEFT/IMPS.

Beyond credit card payments, BBPS has extended its reach to various other payment methods. Universities are now adopting BBPS for seamless fee collection, allowing students and parents to pay tuition fees through their preferred banks, mobile apps or wallets. Additionally, BBPS simplifies utility bill payments, providing customers with a single interoperable system to manage everything from electricity bills to water bills.

BBPS is also a growing tool in the loan repayment industry, especially for small loans and credit card dues that require manual repayments. While many large loans, such as home and auto loans, are handled through automatic debit mandates, BBPS offers convenience to those who prefer to manage their payments manually. Initially adopted by non-banking financial companies (NBFCs) for EMI collections, major banks are also adopting BBPS to send payment collection requests, strengthening its role in India’s evolving digital payments landscape.

Technological infrastructure: the backbone of Fintech

Union Budget 2024 focuses on improving fintech infrastructure, supporting MSMEs with data-driven solutions and advancing technologies such as AI and blockchain, with key investments in high-speed internet, data centers and cybersecurity. McKinsey research predicts that fintech revenues will grow nearly three times faster than those of traditional banks between 2023 and 2028, highlighting the importance of robust technology infrastructure.

BBPS: a model for an efficient Fintech infrastructure

BBPS illustrates the transformative potential of a well-structured fintech infrastructure. By establishing a unified platform for bill payment, BBPS has significantly streamlined processes for customers and billers, demonstrating the critical role of interoperability, data standardization and robust systems integration . The success of BBPS shows how carefully planned infrastructure can drive efficiency and scalability, serving as a model for other Fintech initiatives.

Customer benefits

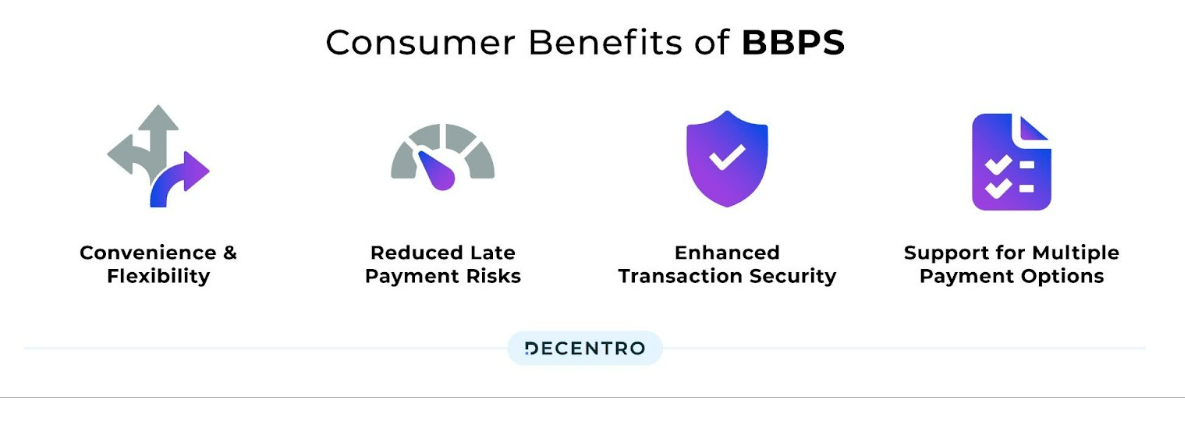

BBPS offers its customers convenient and flexible bill payments through multiple channels, including mobile apps and ATMs. It reduces the risk of late payments with timely notifications and ensures transaction security with enhanced protocols. Supporting various payment options, BBPS aligns with the growing preference for digital payments, as highlighted in PwC’s June 2022 report.

Benefits for billers

For billers, BBPS improves reach, increases revenue, and simplifies onboarding. It provides detailed transaction reporting and a robust claims system, thereby improving operations and building customer trust.

The Bharat Bill Payment System (BBPS) aims to transform India’s bill payment landscape by bringing together various bills on a single platform. This centralization simplifies payments, improves financial monitoring, reduces fraud through standardized security, and improves transparency through detailed reporting. It also provides valuable data on payment behaviors to inform regulatory policies and financial strategies.

The Bharat Bill Payment System (BBPS) is set to revolutionize the bill payment process in India, delivering significant benefits to consumers, businesses and the financial ecosystem. However, like any transformation initiative, BBPS faces challenges that must be addressed to realize its full potential.

Role of Technology Service Providers (TSPs)

Having established the role of BBPS in revolutionizing the way bills are paid across India, it is time to examine what lies at the heart of this robust ecosystem: Technology Service Providers (TSPs)who play an instrumental role in ensuring the smooth operation and success of BBPS. By enabling seamless integration of billers and agents, ensuring efficient payment processing, and integrating the BBPS platform with various stakeholders, TSPs provide the infrastructure and technical expertise needed to facilitate secure and scalable transactions .

As BBPS continues to expand its reach and impact, the role of TSPs will only grow in importance. Their contributions to integration, security, scalability, innovation and support are essential to the continued success of the platform. By facilitating smooth, secure and efficient bill payments, TSPs help drive the digital transformation of the Indian financial ecosystem. As the BBPS evolves, the role of TSPs will also evolve, making them indispensable partners in the journey towards a cashless and inclusive economy.

Short-term disruption for consumers

One of the immediate challenges of BBPS is the potential disruption for consumers accustomed to their favorite fintech platforms. This change requires users to adapt to a different interface and payment process, which may lead to temporary inconvenience and resistance.

BBPS integration requires fintech adjustments, which impact operations and customer interactions. Despite initial challenges, BBPS aims to improve digital payments in India through a unified and secure platform. Benefits such as centralized payments and reduced fraud will become more evident over time.

BBPS and the Fintech industry

BBPS connects traditional bill payment methods with digital platforms such as Paytm and PhonePe. By offering a unified system, BBPS improves transaction efficiency and provides significant benefits to agent institutions, such as seamless integration into the BBPS network and increased revenue potential through additional bill payments. BBPS also offers value-added services such as invoice reminders, automatic payments and consolidated invoice management, improving customer experience.

Budget 2024 and the Fintech ecosystem

Highlights of Union Budget 2024 the government’s commitment to strengthening fintech infrastructure, which is crucial for financial innovation and inclusion. Key initiatives include supporting MSMEs with data-driven financial solutions and focusing on AI and blockchain technologies. This approach promotes collaboration between government and fintech companies, highlighting the need for advanced digital infrastructure and the digitization of financial processes.

Expansion of the Fintech ecosystem

BBPS shows how important robust systems are to improving digital payments. By making payments smoother and more secure, BBPS improves the way we pay today and opens the door to future innovations. As the government invests in better digital systems, such as secure identity checks and open connections between platforms, BBPS will help advance the fintech sector. Thanks to technological advancements such as AI and blockchain, India is poised to become a leader in financial technology.