Other banks and fintech companies will turn to AI to exploit complex algorithms and automatic learning. The finance sector opens the way to the use of AI, with one of the highest adoption rates among industries.

Over the past decade, automatic learning algorithms have improved credit rating models. Chatbots and virtual assistants fed in AI have also made the interactions of customers more fluid. In addition, progress in natural language treatment and predictive analysis have enabled lenders to judge more the risks of the borrower.

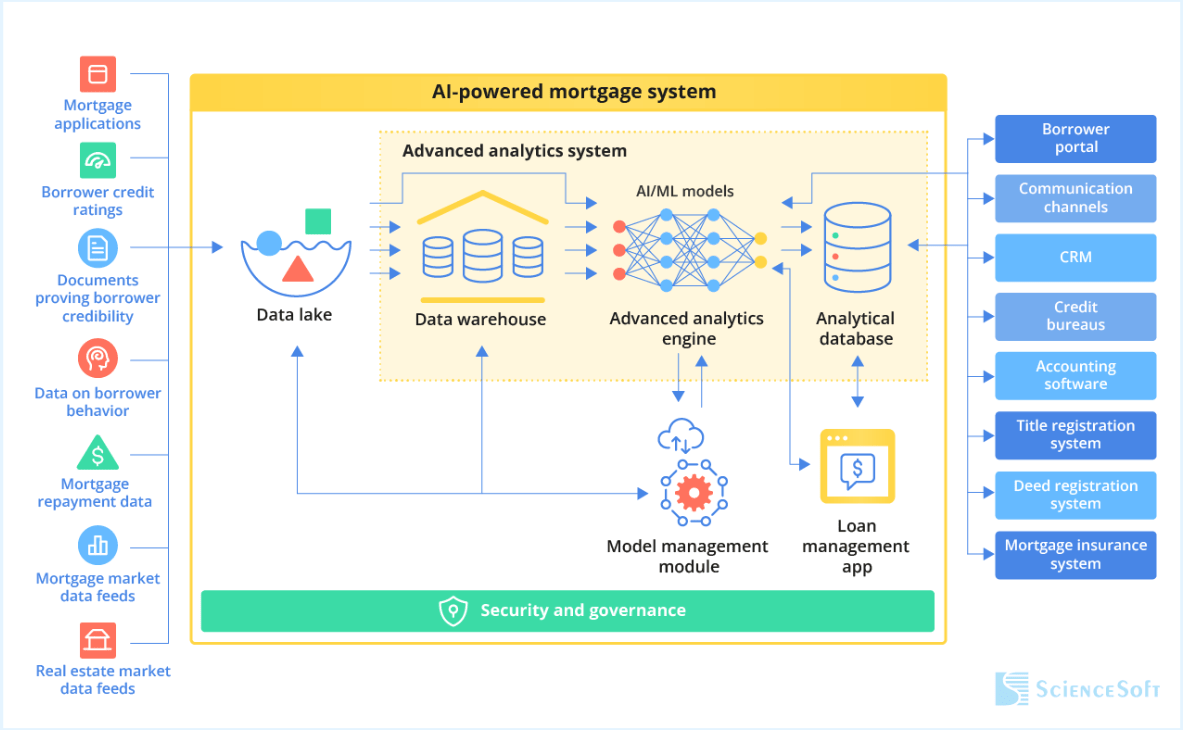

In the mortgage, AI provides automation and better productivity.

(Source: Sciences))

Solutions fueled by AI in the mortgage industry

AI tools help lenders to make choices based on data reduction risks and stimulate customer satisfaction.

Treatment and subscription of loans

- The AI checks and immediately confirms income documents, tax declarations and work files. Automatic verifications compare the data of many sources emphasizing the differences and ensure that the rules are followed.

- The AI assesses the borrower profiles by analyzing previous financial behavior, debt / income ratios and expenditure models to generate instant risks.

- AI has an impact on the automation of routine work such as setting up data and sorting documents. 44% of financial functions Use the automation of intelligent processes to stimulate data management and productivity of workflow (recent survey by Gartner).

Risk assessment and fraud detection

- Generative AI APPLES Analyze monetary habits, credit past and payment trends for loans to group borrowers as at low risk, medium or high.

- Fraud detection tools fed by AI check the authenticity of documents, check personal information with official records and signal suspicious activity in real time.

- AI helps lenders to remain in accordance with anti-white (AML) regulations and to know your customer’s regulations (KYC) by automating identity and risk assessment.

Predictive analysis for mortgage approvals

- The AI identifies money models, such as changes in interest rates and housing market changes. Predictive analyzes help to shape mortgage choices according to the history of the money of a borrower, the stability of employment and the level of risk.

- The AI finds the early signs that someone may not reimburse a loan allowing lenders to take measures, such as redoing the loan or modifying their conditions.

What technologies lead AI to mortgages?

Automatic learning models Examine the borrower’s data to refine credit rating and risk profiling.

Natural language treatment (NLP) rationalizes opinions on mortgage applications and customer interactions. AI chatbots use NLP to manage loan requests with greater precision.

IA IT vision Check the mortgage documents, find mistakes and make sure they are real. The digitization of intelligent image catches fake or modified financial documents, stopping fraud attempts.

Blockchain Keep the history of mortgage transactions in safety, the cessation of data falsification and ensure that the data remains true. The intelligent contracts fueled by AI make loan agreements on their own approvals easier and accelerating how much things are done.

New technological breakthroughs make automation possible, increase risk assessments and improve safety.

Why adopt AI in mortgage loans?

AI reduces the processing time. He means that the subscription, the verification of documents and the risk assessment occurs in itself, accelerating loan approvals for people who wish to borrow. The data search immediately allows the AI to verify borrower information leading to faster loan approvals. In addition, AI systems work well with banks and other places of money making mortgage approvals even more quickly.

AI eliminates inconsistencies in manual assessments. Intelligent algorithms examine the financial stories and the punctual models that people may miss. As the AI models continue to improve and become more intelligent, the LLMS of the leading border have the potential to perform more advanced tasks and lower error rates.

Save money. The reduction of mortgage workflows on the automatic pilot reduces operating costs, allowing banks to offer better interest rates and dropping costs to borrowers. Automation focused on AI means fewer need for many manual work, which reduces administrative expenses. Landers can use their resources more.

Improvement of the customer experience. IA chatbots give quick answers to common questions. Landers use predictive analyzes to suggest mortgage options that correspond to the needs of the borrower and monetary situations. In addition, the self-service portals fed in AI allow borrowers to keep an eye on their applications, download the necessary papers and obtain updates in real time. This makes the whole process clearer and maintains the borrowers happier.

In 2023, the financial services put 35 billion dollars In AI, the bank with around $ 21 billion in this amount.

Challenges in the adoption of AI for mortgages

The laws on data confidentiality, such as the GDPR and the CCPA, ensure that lenders set up solid safety measures for AI solutions. Banks and other financial companies must ensure that AI algorithms manage the data from sensitive customers when stopping violations and to prevent unauthorized users.

AI models can resume the biases of the old loan data, which could cause disloyal loan refusals. Financial institutions must implement strategies to reduce biases and ethical IA executives. AI’s clear decision -making allows borrowers to know how lenders decide if they can obtain a mortgage making the loan process just and open to everyone.

What is the next step?

The explanatory AI will make the loan algorithms more interpretable, allowing borrowers and regulators to understand how decisions are made.

The analysis of the feeling will give lenders a way to verify the borrower’s emotions and monetary plans, which makes risk assessments more precise. Quantum IT could eat huge financial data sets in no time, which makes predictions for mortgage.

By 2030, the AI will have a great impact on mortgage loans. He will create personalized loan options, gentle digital mortgage processes and better ways to stop fraud. Banks will use AI to make packages that meet the needs of each borrower. Online mortgage platforms will provide complete solutions based on AI from start to finish to make loans at home faster and easier. Intelligent fraud detection systems will continue to better make mortgage agreements safer and less risky.

The progress of AI in explanatable AI (XAI), the analysis of feelings and quantum IT will further refine mortgage loan models, improve transparency and decision -making.

Transform mortgage loans with AI

AI has an influence on mortgage loans. This changes the way banks consider risks, manage loans and speak to customers. There are problems, but the breakthroughs of AI change the field. They make things faster, more accurate and safer. People working in Fintech and grant loans must follow the IA changes.

Organic author:

Natallia Babrovich

Analyst of companies and financial and banking IT consultants

For the 10 -year career in Sciencesoft, Natallia has participated in more than 20 large -scale banking and commercial projects. It has helped develop unique financial solutions and new software products for the analysis of banking data, payments management and banking services on the Internet. Natallia specializes in mobile banking application projects, where it helps customers implement advanced technicians such as AI and augmented reality to provide a first -rate user experience and lead a high return on investment. Natallia’s professional skills are confirmed by PMI-PBA and Scrum Alliance certificates.