Navigating Financial Uncertainty: How AI Can Limit Overdraft Costs

By Hebrew University of Jerusalem | May 16, 2025

Credit: Management Science (2025). DOI: 10.1287/mnsc.2022.00304

Introduction to AI in Personal Finance

A recent study highlights how artificial intelligence (AI) can assist consumers in avoiding overdraft fees, potentially saving millions of households from avoidable financial burdens. This research is a collaboration between Professor Orly Sade from the Hebrew University Business School and experts from Intuit, Daniel Ben-David and Ido Mintz.

The Role of AI in Financial Management

AI-driven financial tools are revolutionizing how individuals manage their money. They provide real-time support that transcends conventional budgeting methods. These tools not only issue predictive alerts about potential overdrafts but can also execute automatic fund transfers to avert deficits, offering practical solutions for everyday financial challenges.

Study Overview and Methodology

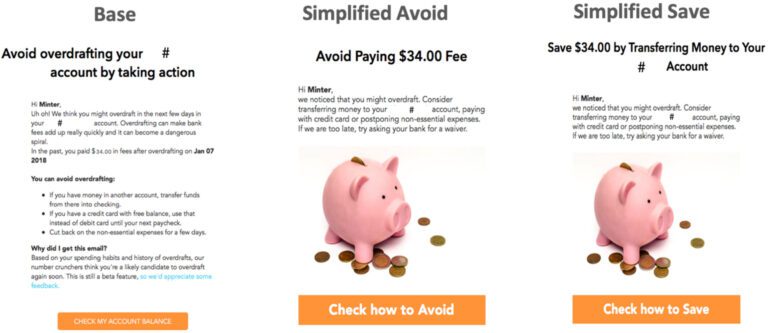

Conducted with a sample size exceeding 39,000 Mint users— a popular personal finance app in the U.S. and Canada— the study examined whether AI-generated reminders could effectively decrease the likelihood of users incurring bank overdraft fees. The AI system assessed when users could likely face overdraft charges and sent tailored email reminders based on their predicted behaviors.

Key Findings from the Research

The study revealed several important insights:

- All reminders had a positive effect: users receiving alerts were less likely to incur overdraft fees.

- Simplicity matters: concise and clear messages proved to be significantly more effective than their complex counterparts.

- Framing the message:

- Negative framing (e.g., “avoid overdraft costs”) resulted in a 9% reduction in overdrafts the following week, saving users approximately $25 over four months.

- Positive framing (“saving money”) was effective but slightly less impactful.

- Who benefited most? Alerts had the highest efficacy for users with average to good credit scores and moderate income, as they were more able to take action based on the information.

- Limitations observed: financially vulnerable users— like those with low liquidity or high debt— were less responsive to the reminders, indicating that behavioral nudges alone might not be sufficient for everyone.

Implications for Financial Behavior

According to Professor Sade, “Our study demonstrates that personalized communication based on AI can positively influence financial behavior. However, it must be accessible and actionable.” Simple and timely messages empower individuals to make informed financial decisions, yet systemic barriers must also be addressed, particularly for those facing significant financial challenges.

Conclusion and Future Directions

This research enriches the existing literature on human-computer interaction, digital nudging, and the application of AI for enhanced financial well-being. It underscores the need for interventions that are both behaviorally informed and responsive to real financial constraints. The study prompts further exploration into how digital tools can be designed to be more inclusive, particularly for those in vulnerable financial situations.