The Expanding Arena of AI in Finance: Market Insights and Forecast

Dublin, December 20, 2024 (Globe Newswire) – The financial industry is witnessing a seismic shift with the integration of artificial intelligence (AI) across various sectors. A report titled "AI in the Finance Market by Product (Algorithmic Trading, Virtual Assistants, Robo-Advisors, Governance, Risk, Compliance (GRC), Intelligent Document Processing (IDP), Underwriting Tools), Technology, Application (Fraud Detection, Risk Management, Trend Analysis, Financial Planning, Forecasting), and Region – Global Forecast to 2030", has been recently published by ResearchAndMarkets.com. It outlines the anticipated growth trajectory of AI technologies within the finance sector, pointing to an immense potential for innovation.

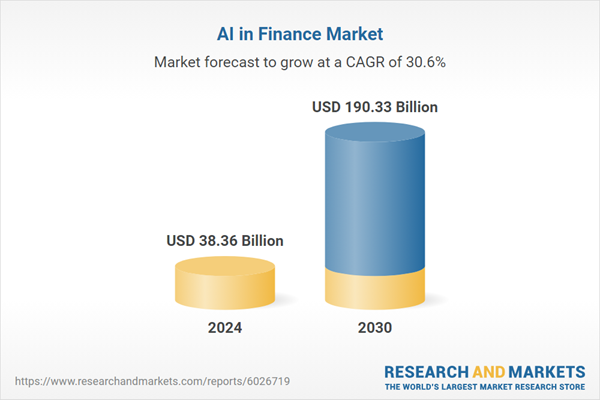

Market Growth Projections

The AI-driven finance market is projected to surge from $38.36 billion in 2024 to $190.33 billion by 2030, translating to an impressive compound annual growth rate (CAGR) of 30.6% during this period. The report highlights the growing reliance on chatbots and virtual assistants, positioned as vital tools for automating customer service, enhancing user experiences, and decreasing operational costs. As AI algorithms become increasingly prevalent, their capability to identify and mitigate risks is also on the rise, promoting safer financial practices.

Key Insights at a Glance:

- Market Size: Expected to grow from $38.36 billion in 2024 to $190.33 billion by 2030.

- CAGR: Projected at 30.6%.

- Main Drivers: Demand for enhanced risk management and automated customer service.

- Predominant Applications: Fraud detection, trend analysis, and personalized financial planning.

The research encompasses an extensive examination of several factors impacting AI growth in finance, including key drivers, constraints, challenges, and opportunities that define the market landscape.

Major Players in the Market

The AI finance market features significant contributors including:

- FIS (US)

- FISERV (US)

- Google (US)

- Microsoft (US)

- Zoho (India)

- IBM (US)

- Socure (US)

- Workiva (US)

- Plaid (US)

- SAS (US)

- C3 AI (US)

This study suggests a thorough competitive analysis of these key players, detailing their business profiles, recent advancements, and pivotal market strategies to sustain a competitive edge.

Fintech Segment: A Leader in AI Adoption

Among the various segments assessed, fintech stands out as expected to exhibit the highest CAGR in the forecasted period. Fintech companies are increasingly harnessing AI technologies to streamline financial services, enhance customer experiences, and boost operational efficiency.

The capability of AI to analyze real-time data is becoming crucial for crafting personalized financial solutions and managing risks effectively. As consumers seek quicker, more efficient services, companies within the fintech space are leveraging AI for a variety of functions, ranging from fraud detection to credit assessments to enhance customer engagement through chatbots. The ongoing evolution and competitive dynamics in fintech are driving the demand for advanced AI solutions, positioning this segment for remarkable growth in the foreseeable future.

Regional Insights: Asia-Pacific Takes the Lead

In terms of regional growth, Asia-Pacific is anticipated to report the highest CAGR during the forecast period. The region is experiencing rapid digital transformation, with numerous fintech startups emerging at a significant pace. Notable countries like China and India are making substantial investments in AI technologies to elevate financial services and refine customer experiences.

The extensive consumer base within Asia-Pacific presents considerable opportunities for highly personalized financial products and services. Regulatory bodies, such as Singapore’s Monetary Authority (MAS) and China’s Cyberspace Administration (CAC), are fostering innovation and propelling market expansion. The increasing focus on data-driven decision-making and the critical need for efficient risk management solutions are further accelerating AI adoption in finance, thereby positioning Asia-Pacific as a frontrunner in this burgeoning sector.

Detailed Market Dynamics

Drivers:

- Rising demand for accurate forecasts for strategic planning and investment decisions.

- Increased adoption of AI algorithms aimed at enhancing risk detection and mitigation.

- Growing interest in personalized financial services tailored to individual consumer needs.

Constraints:

- Ongoing concerns regarding biases within AI systems and the ethical usage of data.

Opportunities:

- An escalating requirement for hyper-personalized financial products that ensure long-term customer engagement and bespoke services.

- The rising demand for precise credit assessments and improved risk management protocols.

Challenges:

- Guaranteeing data security to avert breaches or violations.

- Navigating the complexities involved with AI models in the finance domain.

Case Studies of AI Implementation

The report features numerous case studies that illustrate the successful application of AI in financial settings:

- PayPal enhances its fraud detection capabilities using the H2O.ai platform.

- Vein Solutions revolutionizes financial reporting processes alongside Shift4 Payments.

- Investa optimizes fund reporting effectiveness through the streamlined solutions by Workiva.

- Collaborative efforts between Datavisor and Microsoft Azure aim to elevate real-time fraud detection methods.

- Zoho empowers a unified CRM solution to bolster customer engagement and operational efficiency.

Additional Topics Covered

The report encompasses a wide range of analytical themes, providing insights into:

- The trajectory of AI development in finance.

- Detailed supply chain analysis.

- Environmental ecosystem assessments.

- An extensive technological analysis.

- Key events and conferences slated for 2024-2025.

- An examination of the investment and financing landscape.

- The regulatory framework influencing market operations.

- Insights regarding patent trends and pricing analysis.

- Trends and disruptions impacting customer behavior.

Prominent Companies Analyzed

The report profiles a number of influential companies revolutionizing AI in finance, which include:

- Fis

- Finerv

- Microsoft

- Zoho

- IBM

- Workiva

- Plaid

- C3 AI

- Highradius, among others.

For those seeking extensive insights on this powerful report, further information can be found at ResearchAndMarkets.com.

About ResearchAndMarkets.com

ResearchAndMarkets.com is globally recognized as a premier source for international market research reports and data. Their offerings ensure access to the latest information regarding global and regional markets, key industries, leading companies, emerging products, and the newest trends shaping the market landscape.