In-Depth Analysis of the German Fintech Market: Trends and Future Growth

Overview of the Current German Fintech Landscape

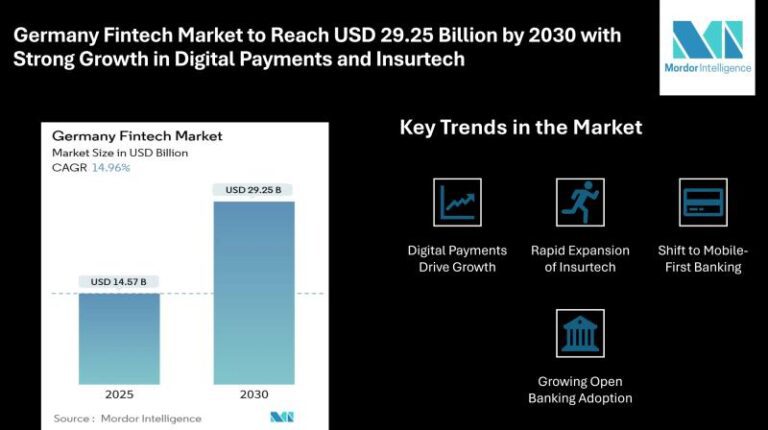

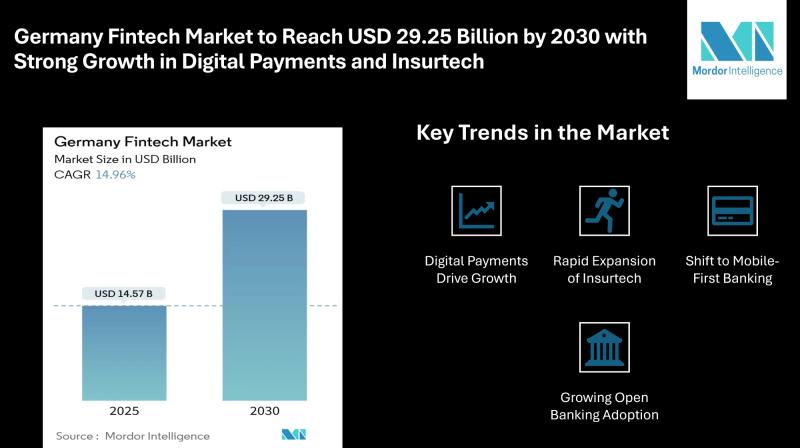

The German fintech market is projected to dominate the European digital financial ecosystem, estimated to reach USD 14.57 billion by 2025 and expand to USD 29.25 billion by 2030. This translates to a compound annual growth rate (CAGR) of 14.96% between 2025 and 2030. Factors driving this robust growth include the rise in smartphone adoption, corporate digitization, and increasing investments in open banking initiatives.

Key Trends Shaping the Industry

Emerging trends within the market prominently feature digital payments, the rise of mobile-first banking solutions, and innovative insurance offerings. These elements are pivotal in fostering a healthy growth environment for the German fintech sector.

1. Surge in Digital Payments

Digital payments are the cornerstone of the fintech industry in Germany. Innovative payment solutions such as contactless transactions, one-click purchasing, and various integrated platforms are fueling expansion in this domain. Consumers increasingly prefer seamless digital payment options, making this segment the largest in the market.

2. Insurtech Evolution

The rise of insurtech is another significant trend, driven by parametric insurance products that streamline claims processes and minimize administrative costs. Both startups and established insurance providers are leveraging technology to enhance operational efficiency and improve customer satisfaction.

3. Growth of Mobile-First Banking

Young urban consumers are leading the shift towards mobile-first banking. Today’s consumers expect instantaneous account setups and real-time information accessible through user-friendly mobile applications. This trend positions mobile apps as the primary interface for retail banking.

4. Increasing Open Banking Adoption

The introduction of PSD2 regulations has accelerated the adoption of open banking in Germany. This allows banks to integrate API-based services, thus fostering partnerships with third-party fintech providers. As a result, users are benefiting from enhanced account aggregation, instant payments, and innovative digital cash solutions.

Market Segmentation Insights

The German fintech market can be segmented by service offerings, including digital payments, loans, investments, insurance, and neo-banks. Additionally, the end-user market is categorized into retail and business sectors, while the user interfaces range from mobile applications to web browsers and POS/IOT devices.

Leading Players in the German Fintech Market

Key players such as N26 GmbH, Solaris SE, and Trade Republic Bank GmbH are at the forefront of this rapidly evolving industry. N26 GmbH offers fully digital banking solutions, while Solaris SE provides banking as a service. Trade Republic Bank GmbH focuses on cost-effective trading in stocks, ETFs, and cryptocurrencies, solidifying their positions as influential contributors to the fintech landscape.

Conclusion: A Promising Future Ahead

The German fintech market is poised for significant growth, driven by digital payments, mobile-first banking solutions, and insurtech adoption. As individual consumers continue to dominate the market, businesses are increasingly integrating fintech innovations into their operations. The market is expected to double in size by 2030, signifying ongoing demand and technological advancement in the fintech sector.

Stay updated on the latest developments and insights in the German fintech landscape to navigate the evolving financial ecosystem effectively.