Innovative Research on AI Interpretation of Financial Advice from YouTube Influencers

In a groundbreaking study, Georgia technology researchers have developed the first reference framework to test how existing artificial intelligence (AI) tools interpret the insights provided by YouTube financial influencers, commonly referred to as “Finfluers.” This research aims to bridge the gap between human financial advice and machine understanding.

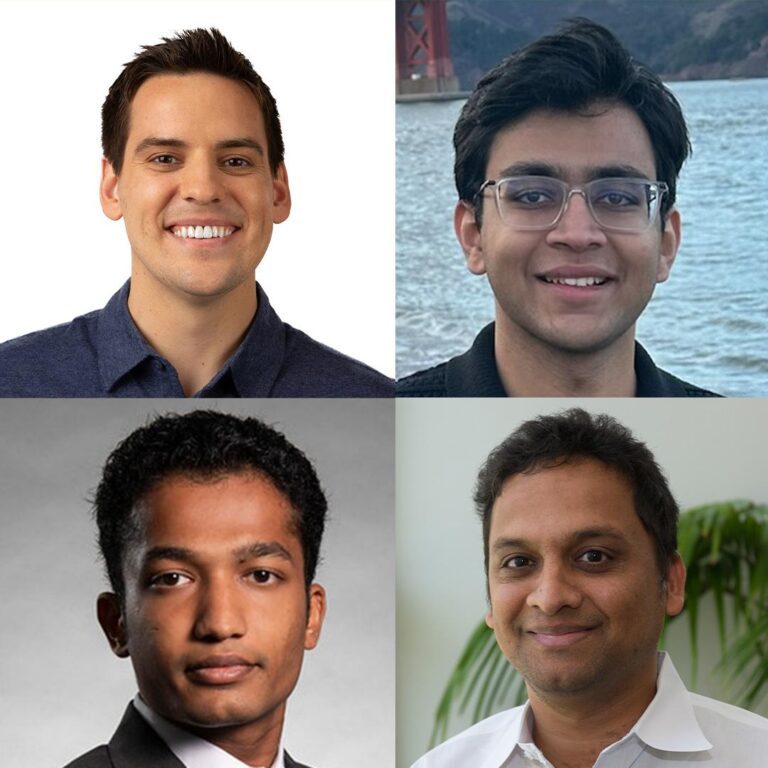

About the Research Team

The study was spearheaded by Michael Galarnyk, Ph.D. in Machine Learning ’28, alongside talented co-authors: Veer Kejriwal, BS in Computer Science ’25; Agam Shah, Ph.D. in Machine Learning ’26; and several others, including notable experts from prestigious institutions like Stanford University and École Polytechnique.

The Multimodal Framework

Dubbed “videoconviction,” the innovative multimodal reference incorporates hundreds of video clips. Each clip has been meticulously labeled by experts based on the influencer’s recommendations—whether to buy, sell, or hold—and the perceived conviction behind their advice. This characterization relies on various elements such as tone, delivery, and facial expressions to assess the level of belief the influencer has in their own financial guidance.

Understanding AI Limitations

Michael Galarnyk highlights a critical finding from their research: “Our work shows that financial reasoning remains a challenge for the most advanced models.” While multimodal inputs have demonstrated improvements, the AI often struggles with complex tasks that require significant analytical distinctions. Recognizing where AI models falter is essential for developing more reliable systems in high-stakes scenarios, especially in finance.

Implications for Financial Decision-Making

This research is particularly relevant in today’s digital age, where financial advice is increasingly disseminated through social media platforms. As Finfluers gather substantial followings, understanding the nuances of their recommendations becomes crucial for both AI systems and human investors alike. Ultimately, this study aims to improve AI’s ability to interpret financial advice, thereby aiding individuals in making more informed decisions.

The Future of AI in Finance

The implications of this research extend beyond just understanding influencer insights. By enhancing AI models to better grasp financial reasoning, researchers hope to foster more sophisticated decision-making tools that can support users in navigating the complexities of the financial markets.

Further Reading and Resources

For those interested in exploring this fascinating intersection of AI and financial advice, additional details can be found in the study published by the Georgia Tech research team. Learn more here.