Overview of the GCC Fintech Market

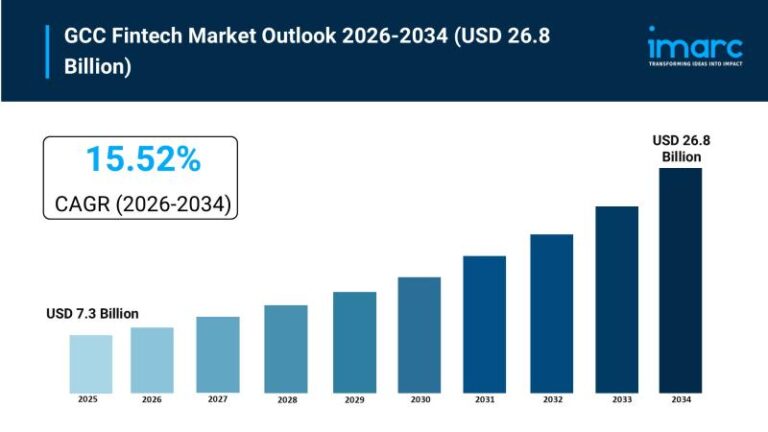

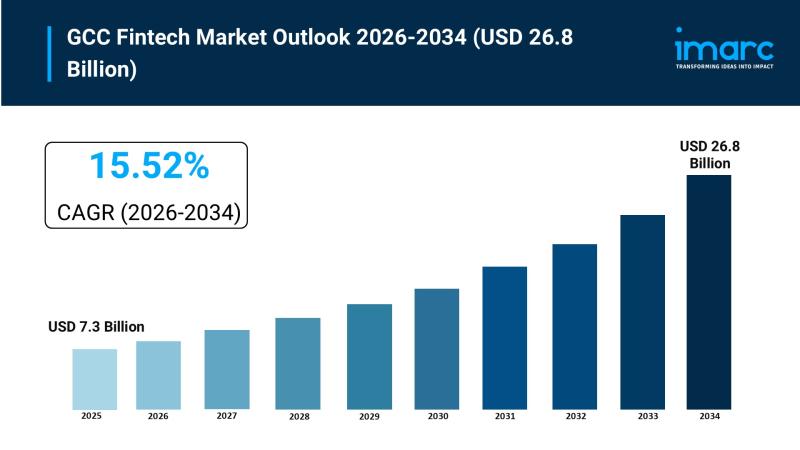

The GCC fintech market is projected to experience significant growth, reaching a market size of $7.3 billion in 2025 and expanding to $26.8 billion by 2034. According to the latest research by the IMARC Group, this represents a compound annual growth rate (CAGR) of 15.52% from 2026 to 2034. This impressive trajectory is driven by advancements in technology, regulatory support, and increasing consumer preferences for digital financial solutions.

The Role of AI in Shaping GCC Fintech

Artificial Intelligence (AI) is revolutionizing the GCC fintech sector through various innovative applications. AI enhances fraud detection and risk management by analyzing transaction patterns in real-time, thereby reducing losses and fostering trust in digital payments, especially in high-volume markets like Saudi Arabia and the UAE.

Furthermore, AI enables personalized financial services, offering tailored investment, lending, and budgeting advice. This capability has proven vital in retaining the region’s young and tech-savvy clientele. AI-driven chatbots and virtual assistants streamline customer support, vastly improving service efficiency by addressing queries in multiple languages for a seamless experience.

Compliance and AI Integration

AI’s role extends into compliance and regulatory frameworks as well. By automating Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, AI expedites the onboarding process while adhering to the rigorous standards set by open banking regulations throughout the GCC. Additionally, AI optimizes lending and credit scoring systems by tapping into alternative data sources, enabling greater access to finance for small and medium-sized enterprises (SMEs).

Vision 2030: A Catalyst for Fintech Growth

Saudi Vision 2030 and similar initiatives across the GCC are transforming the fintech landscape by promoting economic diversification beyond oil. The strategy envisions a significant rise in the number of fintech startups, with Saudi Arabia aiming for over 500 fintech companies by 2030. Regulatory measures, such as open banking policies and digital payment infrastructures, further bolster fintech innovation, paving the way for cashless societies and enhanced integration of technologies like AI and blockchain.

Current Trends and Drivers in the GCC Fintech Market

The GCC fintech market is currently booming, underscored by a high smartphone penetration rate exceeding 95% and widespread adoption of digital payments and mobile wallets. Open banking frameworks, alongside embedded finance and Blockchain technology, are gaining traction. The popularity of Buy Now, Pay Later (BNPL) options and AI-based solutions is particularly pronounced in Saudi Arabia, the UAE, and Qatar, where the young population values convenience and personalization.

Recent Developments in the GCC Fintech Sector

In recent months, GCC fintech investment has surged, with over $6.1 billion raised in the first half of 2025 alone, marking a 37% increase from the previous year. This growth is driven not only by a focus on digital payments and open banking but also by supportive governmental policies and active regulatory environments. The UAE leads the way with more than 5,600 startups registered in just one quarter, benefiting from investor-friendly zones and initiatives.

Conclusion

The GCC fintech market is on the verge of an explosive growth phase, propelled by technological innovations, government initiatives, and shifting consumer preferences. As AI and digital solutions continue to transform financial services, the region is poised to establish itself as a major player in the global fintech landscape. With ongoing support for startups and the integration of advanced technologies, the future of fintech in the GCC looks promising, making it an increasingly vital component of knowledge-based economies.

For further insights, consider exploring our comprehensive report on the GCC fintech market. To stay updated on trends and developments, do not hesitate to reach out for tailored market analysis.