Cici Cao and agencies

Hong Kong yesterday outlined five key initiatives to use artificial intelligence in finance and launched a tax break for virtual assets, as part of efforts to promote itself as an Asian financial hub.

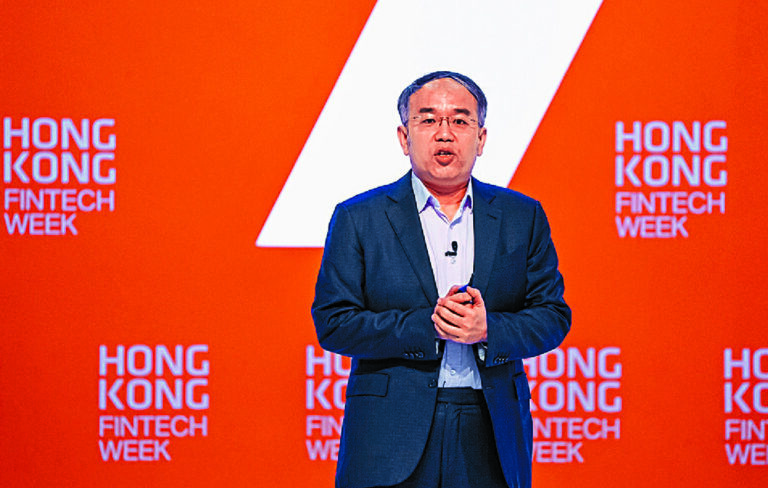

The guidelines were announced during Fintech Week, the city’s annual flagship industry event.

They include a dual-track approach to promoting the use of AI in the financial services sector while addressing challenges such as cybersecurity and data privacy, AI governance strategy for financial institutions , updating regulations of financial regulators and the global exchange of information between international organizations and the police.

In addition, the Hong Kong University of Science and Technology will offer its self-developed AI model and computing resources to the industry.

Speaking at the event, Financial Services and Treasury Secretary Christopher Hui Ching-yu said about 38% of local financial institutions use AI, 12% higher than the global average.

Hui said the government also proposes to expand existing tax breaks for family offices and private funds to include investments in virtual assets.

At the event, the Hong Kong Monetary Authority launched a fintech matchmaking platform called Fintech Connect, aiming to connect financial institutions with fintech service providers and offer one-stop assistance in matching demand and the offer of fintech services.

At the same time, authorities plan to allow more digital asset exchanges by the end of 2024, after a five-month inspection period.

A finalized list of platforms moving from provisional to full license will be released by the end of the year, said Eric Yip Chee-hang, executive director for intermediaries at the Securities and Futures Commission.

“The applicants and their controllers have by and large taken our feedback into account and are prepared to commit resources to correct the issues and take a long-term view of developing their business in a regulated environment,” Yip said.

The regulator will form an advisory group with authorized exchanges to foster closer cooperation by early 2025.

Standard Chartered Bank (Hong Kong) revealed that it has completed trade and supply chain finance testing under the sandbox package launched by the HKMA in August.

BOCHK has also completed sandbox testing, while HSBC and Ant International said they have conducted test interbank blockchain transactions denominated in Hong Kong dollars as part of the sandbox.

Standard Chartered international president Benjamin Hung Pi-cheng said digitalization can make it easier for banks to understand businesses and for businesses to access financing at lower costs.

In market news, Hong Kong Exchanges and Clearing (0388) plans to launch a series of virtual asset indices to provide more benchmarks for Bitcoin and Ether prices in Asia-Pacific time zones. It aims to provide a single reference price for virtual assets among different trading prices on global exchanges.