Zocks Secures $45 Million in Series B Funding to Enhance AI-Driven Financial Advisory Solutions

San Francisco-based Zocks, a pioneering financial technology firm, has successfully raised $45 million in a Series B funding round. This investment underscores the company’s commitment to leveraging artificial intelligence (AI) for personalized financial advisory services, making significant strides in enhancing its platform’s capabilities.

Funding Round Details

The funding round was co-led by esteemed venture capital firms Lightspeed Venture Partners and QED Investors, complemented by contributions from Illuminate Financial, along with existing investors like Motive Partners, Expanse Venture Partners, Ouverture Capital, and 14Peaks Capital. With this latest investment, Zocks has accumulated a total of $65 million in funding, following a previous Series A round of $13.8 million completed in March 2025.

Market Demand for AI in Financial Services

This funding cycle reflects the growing interest among investors in workflow-centric AI platforms specifically designed for the regulated financial services sector. As financial institutions seek to enhance their processes, the application of AI has become integral to providing efficient and effective financial advice.

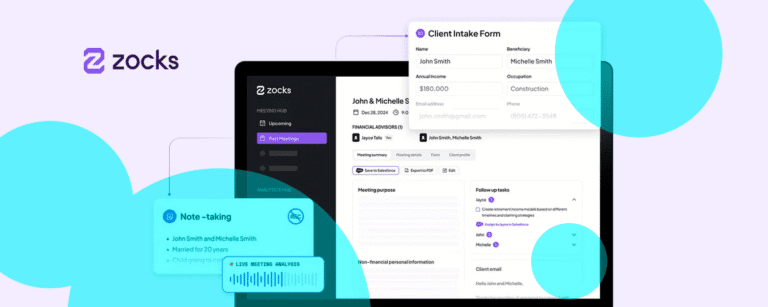

Innovative AI Features of Zocks

Zocks’ platform employs advanced AI algorithms to analyze market trends, user goals, and spending behaviors, which provides users with tailored investment recommendations and automated rebalancing strategies. Additionally, Zocks utilizes natural language processing (NLP) to facilitate easy, conversational interactions, enabling users to inquire about their financial plans in a straightforward manner.

Integration with Existing Advisory Infrastructure

Under the leadership of founder and CEO Mark Gilbert, Zocks positions itself as a privacy-focused AI solution specifically built for financial advisors. The platform began by automating administrative tasks that, while time-consuming, did not significantly affect revenue. Zocks seamlessly integrates with core advisory infrastructures, including customer relationship management (CRM) platforms, financial planning systems, tax software, and portfolio management tools.

Streamlining Workflows for Financial Advisors

This integration allows Zocks to automate various intricate workflows, such as client onboarding, account setup, meeting preparation, and document processing—all without requiring financial advisors to exit their primary systems. Zocks claims that its platform saves advisors more than 10 hours per week by transforming client conversations into organized, actionable data.

Transforming Data into Actionable Insights

By merging conversational inputs with systemic data, Zocks uncovers insights on an advisor’s entire business rather than just at the individual client level. This feature allows advisors to identify clients who lack a college savings plan, possess assets outside of managed portfolios, or are nearing required minimum distribution thresholds. Additionally, actionable suggestions accompany this data, enabling advisors to execute decisions with a single click, thus minimizing friction between analysis and implementation.

Client Adoption and Future Vision

Zocks has reportedly gained traction among over 5,000 financial firms, counting notable corporate clients such as Ameritas, Carson Group, Kestra Financial, and Osaic. Laura Bock, partner at QED Investors, emphasized that Zocks has evolved beyond simply offering meeting transcription tools, positioning itself as a critical operational system for advisors. With the new funding, Zocks aims to elevate its capabilities with enhanced integrations, fortified security measures, and additional compliance functionalities.

Conclusion: The Future of Financial Advisory Services

As financial institutions strive to provide personalized services and enhance customer experience, Zocks’ platform aims to serve as an essential operational layer for consulting firms navigating evolving client expectations. Gilbert noted that the rapid evolution of AI technologies is reshaping service delivery for financial advisors. Zocks is transitioning from a workflow-focused system to a comprehensive information hub, enabling advisors to identify revenue opportunities and foster personalized engagement with their clientele.