Indian fintech startups have seen a staggering 500 per cent growth in the last 10 years, with the local fintech ecosystem attracting investments of over $31 billion, Prime Minister Modi said.

In its efforts to boost the fintech sector, the Centre is making all necessary changes at the policy level, the Prime Minister said, citing examples such as the abolition of the Angel tax and the implementation of the Digital Personal Data Protection Act.

India’s growing fintech market is expected to become a $2.1 trillion opportunity by 2030, according to data from Inc42

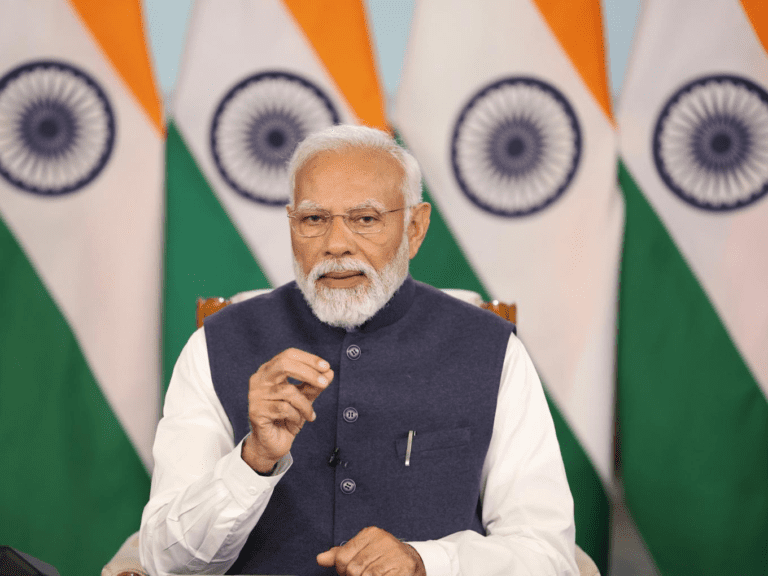

Indian fintech startups have witnessed a staggering 500 per cent growth in the last 10 years, with the local fintech ecosystem attracting investments of over $31 billion, Prime Minister Narendra Modi said today (August 30).

Addressing the Global Fintech Fest 2024, Prime Minister Modi said, “In the last 10 years, the (fintech) industry has received a record investment of over $31 billion, while witnessing a growth in the number of startups of 500 per cent.”

The Prime Minister also hailed India’s Unified Payments Interface (UPI), saying it is a great example of Indian fintech success, with the country now accounting for more than half of global digital transactions.

“Services like remote healthcare, digital education and skill learning would not be possible without fintech. The fintech revolution in India is playing an important role in improving dignity and quality of life,” Prime Minister Modi said.

As the world faces the “dangers of a shadow economy”, the Indian fintech ecosystem has played a crucial role in “putting an end to such a system” and introducing transparency, he added.

In its efforts to boost the fintech sector, the Centre is making all necessary changes at the policy level, the Prime Minister said, citing examples such as the abolition of the Angel Tax, the implementation of the Digital Personal Data Protection Act, as well as $1 billion in funding to encourage research and development in this area.

In addition, the Centre is working on advanced technologies and regulatory frameworks to strengthen financial markets, the prime minister said.

As cyber fraud cases are on the rise in the country, Modi urged regulators to strengthen digital literacy to ensure that cyber fraud does not hamper the growth of the local fintech ecosystem.

“I am confident that the Indian Fintech ecosystem will improve the quality of life of the entire world. The best is yet to come,” Modi said.

The prime minister’s remarks come at a time when the country’s fintech market continues to grow at a rapid pace. Inc42 DataIndia has over 24 fintech unicorns and 36 soonicorns.

These startups are trying to grab a share of the country’s growing fintech market, which is expected to be a $2.1 trillion opportunity by 2030.

The Economic Survey 2023-24 also indicates that India aims to become a “fintech nation” relying on the country’s digital public infrastructure (DPI).