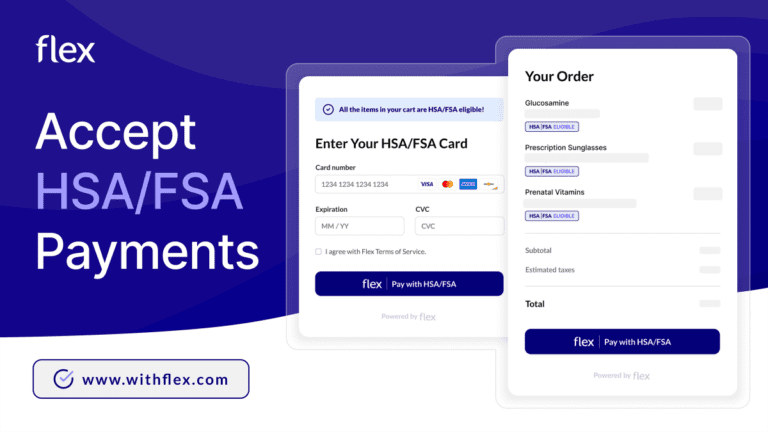

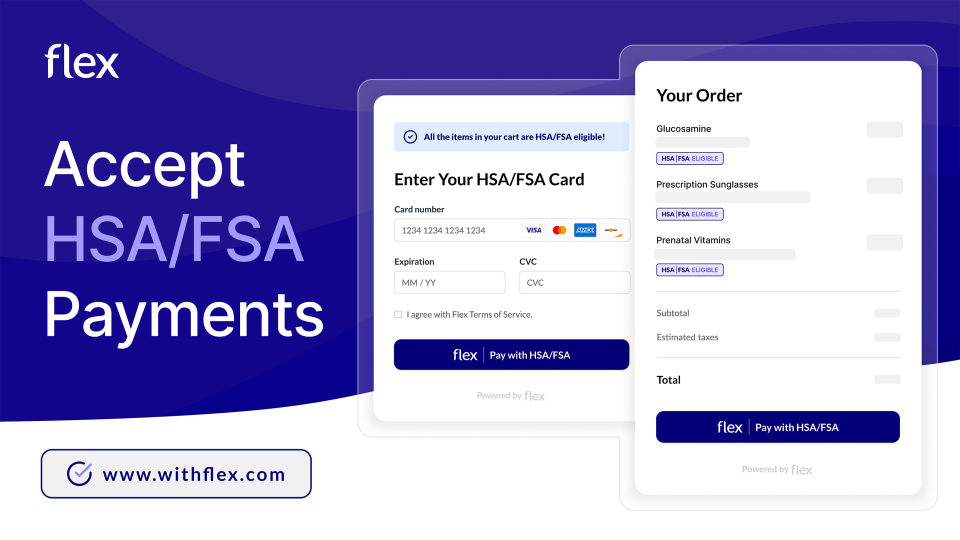

Flex works like Stripe for the HSA/FSA payments ecosystem, enabling brands to tap into $150 billion in potential annual HSA/FSA spend

Flex, a Fintech start-up

SAN FRANCISCO, September 4, 2024 (GLOBE NEWSWIRE) — FlexFlex, which offers direct-to-consumer health and wellness brands the easiest way to accept HSA and FSA payments online, today announced that it has raised $3.2 million from Y Combinator, SV Angel, Precursor, Liquid 2 Ventures and others. Flex will use the funding to accelerate product development, sales and marketing, and capitalize on the strong interest from brands to capture a greater share of the $150 billion in potential annual HSA/FSA spend.

“We were impressed by the strength and experience of the Flex team, whose deep fintech expertise and proven execution capabilities gave us great confidence in their ability to deliver on their ambitious vision to transform the healthcare spending landscape,” said Beth Turner, Managing Partner at SV Angel.

Charles Hudson, Managing Partner and Founder of Precursor Ventures, said, “Flex fills a significant and compelling gap in the payments ecosystem that will help brands and consumers more effectively leverage HSA and FSA funds.”

Flex’s customers include fast-growing brands like KindredBravely, BedJet and Lumen.

Until now, accepting HSA/FSA payments online has been complex, largely due to the need to substantiate the eligibility of each item on the fly. This means that only very large merchants with significant IT resources—companies like Walmart and Amazon—have been able to build their own systems to process HSA/FSA payments online. Smaller merchants have been unable to capitalize on consumers’ desire to spend their HSA/FSA money online. As a result, consumers must pay out of pocket and submit itemized receipts to their FSA provider to get reimbursed. The difficulty of this process means that consumers often buy their products elsewhere, from merchants that facilitate the process.

Flex allows merchants to start accepting HSA/FSA in just 30 minutes and currently works with over 100 brands. The company offers two main solutions.

-

Flex Product Verification provides merchants with a quick and easy way to identify and process payment for items that are eligible for all – such as over-the-counter medications, menstrual products and first aid supplies – at checkout.

-

Flex Health Check is for merchants who sell dual-use items, meaning they may be eligible for HSA/FSA for consumers whose doctors say they are medically necessary to treat a condition. Health Check leverages telehealth to allow a healthcare provider to determine if a customer is eligible to designate a purchase as a medical expense.

Flex works like Stripe for the HSA/FSA ecosystem. At the heart of the Flex platform is a sophisticated API that allows the business to quickly verify the eligibility of items and then process payment for those eligible items. Specifically, Flex interfaces with the SIGIS List of eligible productsSIGIS is a non-profit subsidiary of the IRS responsible for determining which items are eligible for HSA/FSA spending.

Sam O’Keefe and Miguel Toledo founded Flex in June 2023. They had worked together in the anti-fraud group at fintech startup Unit 21 and were interested in the intersection of health and fintech. Specifically, O’Keefe, a fitness enthusiast, wanted to explore ways to incentivize health insurance companies to cover exercise programs. After researching the market and talking to many merchants, the two co-founders decided to focus on helping D2C consumer health and wellness companies take advantage of HSA and FSA spending programs.

“Flex differentiates itself by offering a holistic approach by offering product verification at checkout, the ability to confirm dual-use item eligibility, issuing medical necessity letters and managing split orders, which are orders that include both eligible and ineligible items,” said O’Keefe. “Flex offers the most comprehensive solution available to help brands accept HSA and FSA payments online.”

Flex stands out from its competitors in several other ways:

-

The team’s deep knowledge and experience in the payments ecosystem

-

Ability to meet the customer where they are with multiple implementation options, from a robust API to a Shopify payments app to a no-code solution to get up and running quickly

-

Ability to provide advice on the regulatory landscape, including submission of products to be considered for the SIGIS Eligible Product List.

-

Fast moving and integration, in just 30 minutes, and usually within 48 hours.

About Flex

Flex Flex offers direct-to-consumer health and wellness brands the easiest way to start accepting HSA and FSA payments online. Flex enables merchants to tap into $150 billion in potential annual HSA/FSA spend, generating new revenue, increasing basket sizes and improving customer retention. It also helps consumers expand the reach of their eligible HSA/FSA spend and ensure they don’t lose their FSA funds at the end of the year. Flex is known for its deep understanding of HSA/FSA eligibility and for offering the most comprehensive merchant solutions. Merchants can start www.withflex.com.

Media contact:

Michelle Faulkner

Big swing

617-510-6998

michelle@big-swing.com

A photo accompanying this ad is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3592dd99-933e-44a4-8c26-95b453b913a6