According to multiple sources, Signzy was hit by a cyberattack last week

The Computer Emergency Response Team (CERT-In) is “taking appropriate action with the concerned authority”.

One of Signzy’s clients, PayU, confirmed that they received written confirmation from the company

UPDATE | December 3, 1:15 p.m.

Bangalore-based fintech SaaS startup Signzy

“We have recently been informed of a security incident and are currently investigating. We appreciate the importance of cybersecurity. We take great care,” a Signzy spokesperson told Inc42.

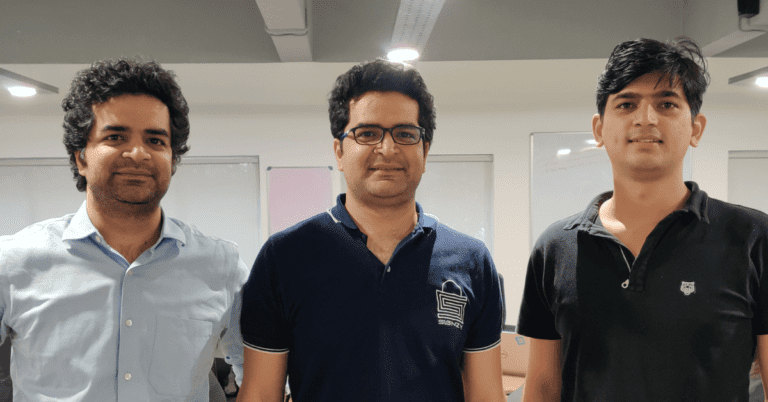

Founded by Ankit Ratan, Ankur Pandey and Arpit Ratan in 2015, Signzy provides digital onboarding solutions to banks and NBFCs through its no-code platform. The startup claims to work with more than 240 financial institutions.

Original | December 3, 11:14 a.m.

Fintech SaaS startup Signzy, which counts Gaja Capital, Vertex Ventures and Arkam Ventures among his supporters, would have confirmed a security incident.

According to TechCrunch, citing multiple sources, the Bengaluru-based startup was hit by a cyberattack last week.

The Computer Emergency Response Team (CERT-In) separately acknowledged to TechCrunch that it was aware of the incident and “in the process of taking appropriate action with the concerned authority.”

Inc42 has contacted Signzy for comment on the development. The story will be updated based on the response.

One of Signzy’s clients, PayU, confirmed that it had received written confirmation from the company, but assured that none of the payment solutions company’s data was compromised in the incident.

On the other hand, ICICI Bank indicated that it had no exposure to the incident, according to the report.

Signzy also hired a professional agency to investigate the security incident, the company spokesperson said.

Founded by Ankit Ratan, Ankur Pandey and Arpit Ratan in 2015, Signzy provides digital onboarding solutions to banks and NBFCs through its no-code platform. The startup claims to work with more than 240 financial institutions.

Signzy was also recently chosen on behalf of the Reserve Bank of India fifth cohort of the regulatory sandbox initiative. Under this initiative, companies test new products or services in a controlled regulatory environment with the opportunity to expand their offerings, bring efficiencies and design solutions to new-age problems.

This security incident comes at a time when cyberattacks are increasing in the country. In September, property and casualty insurance major Star Health & Allied Insurance faces major data breachleading to a leak of the personal data of millions of its online customers.

However, later in October, the alleged hacker claimed that the insurer’s chief information security officer (CISO) had sold him the data.

Similarly, in July, one of WazirX’s multisig wallets was attacked, leading to loss of digital assets worth over $230 million.

Public telecommunications company BSNL also suffered two data breaches in 6 months. The incident involved critical data including International Mobile Subscriber Identity (IMSI) numbers, SIM card information, home location register details, DP card data and even snapshots of SOLARIS servers from BSNL.

According to a recent report from Zscaler, India now tops the global list of mobile malware attacks, surpassing the United States and Canada.

(Note: Story has been updated to include Signzy’s comment)