The Growing Landscape of the Fintech Market

Market Overview

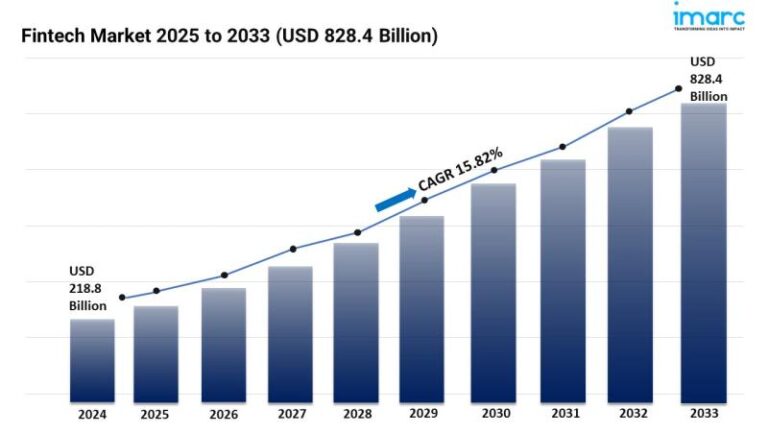

The fintech market is seeing unprecedented growth fueled by the democratization of financial services, the integration of coherent finance solutions, and enhanced personalization driven by AI technologies. According to research from the IMARC Group, the global fintech market was valued at $218.8 billion in 2024, with projections indicating it could reach $828.4 billion between 2025 and 2033.

Key Insights from the Report

This comprehensive report covers vital aspects such as industry size, emerging trends, market share, and growth factors across various regions. It highlights market dynamics, including driving forces and challenges, while identifying lucrative opportunities. Moreover, the report features a detailed regional analysis alongside a competitive landscape assessment.

Factors Influencing Fintech Industry Growth

The growth of the fintech sector is primarily shaped by several critical factors:

Democratization of Financial Access

The fintech landscape is revolutionizing financial access, essential for SMEs and individuals seeking to democratize financial services. By leveraging innovative digital platforms and alternative credit scoring methods, fintech companies are breaking down traditional barriers like geographic limitations and stringent credit requirements. Technologies such as digital wallets and peer-to-peer lending models significantly enhance capital accessibility, while blockchain integration reduces transaction costs and improves financial literacy globally.

Transparent Integration and Unified Financing

Fintech is witnessing a shift toward improving customer experiences through seamless integration and user-friendly financial journeys. Open banking initiatives and the use of dynamic APIs allow fintech firms to embed services within existing financial ecosystems. Enhanced customer engagement through personalized banking and financial advisory services further strengthens client satisfaction. Additionally, AI-driven chatbots provide instant support and tailored financial advice, streamlining customer interactions.

Data-Driven Personalization and AI Advancements

The fintech sector is increasingly focusing on data-driven customization of services, powered by advancements in artificial intelligence. With the ability to analyze vast datasets, fintech companies can deliver personalized financial products and investment strategies, improving user engagement and service quality. Implementing machine learning also enhances fraud detection and credit evaluation, while ensuring robust cybersecurity measures to protect user data.

Market Segmentation and Competitive Landscape

The fintech market is segmented by deployment mode (on-premise and cloud-based solutions), technology (including API, AI, and blockchain), and application (covering payments, loans, and insurance). Traditional banks play a pivotal role, collaborating with fintech firms to expand their digital offerings. Major players in the industry include Adyen NV, PayPal, Robinhood Markets, and Google Payment Corp, among others.

Regional Insights

North America currently leads the global fintech market due to a surge in startups and investment in financial technologies. Other significant regions include Asia-Pacific, Europe, Latin America, and the Middle East, each adapting to unique local challenges and opportunities for growth in the fintech sector.

Conclusion

The fintech market is rapidly evolving, presenting vast opportunities and challenges for businesses and consumers alike. As technology continues to revolutionize financial services, companies must remain agile to thrive in this dynamic environment. For a deeper understanding of the market, access the full report from the IMARC Group to explore comprehensive insights and case studies.

Request a Sample of the Report

Contact Information

For inquiries, reach out to IMARC Group at:

Email: sales@imarcgroup.com

Phone: +1-631-791-1145

Address: 134 N 4th St, Brooklyn, NY 11249, United States