By any stretch of the imagination, the 55.7% rise in the FinTech IPO Index last year was nothing to sneeze at.

And December’s increase, to 16.7%…well, that was impressive too.

Yet: Closer analysis shows that of the names we track, the vast majority are still underwater, trading as “halted IPOs”, where shares trade below the price recorded on the first day of negotiation.

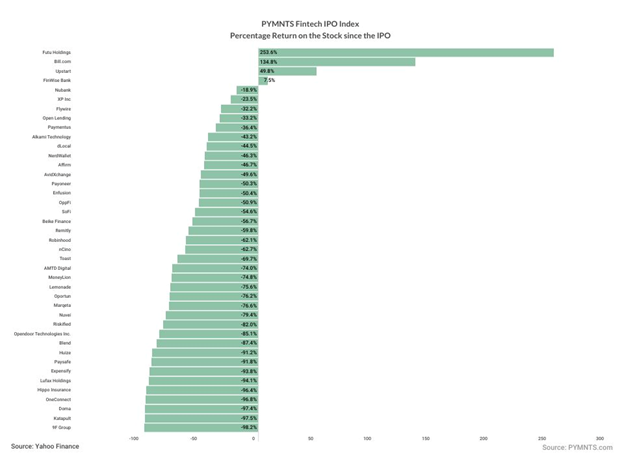

And in fact, as the chart below shows, only four of the more than 40 names making up the index are trading above their offering price.

Digging a little deeper, only Futu Holdings and BILL Holdings crossed the triple-digit mark, measured from the offer price. A staggering nine names are trading more than 90% below their respective debuts.

All of this means that 2023, for all its rebound, represents only a partial retracement of a heavy dose of downtrend in previous months and years.

BNPL stands out

Last year’s highlights include Affirm, which grew more than 400% over the year, followed by Opendoor Tech, which rallied around 300%. MoneyLion has surged about 250% over the year.

We could therefore call 2023 the year of the platform. Affirm’s rally comes alongside a holiday season spending surge and demand for buy-now, pay-later options. During the last weeks of the year, the company concluded several agreements with renowned names in retail, among them Walmart And Amazon.

Opendoor’s boost and the fortunes of other lenders could be linked, at least in part, to the fact that interest rates, according to conventional wisdom, have peaked. If rate cuts are coming, demand for loans should increase, and demand for real estate, in particular, should also increase.

In recent news…

nCino stock, which gained 8% in the final days of the year and is up more than 33% in 2023, said this week the The company had seen its mortgage origination and closing solutions in its mortgage suite implemented by Camden National Bank. The bank operates primarily in Maine and Massachusetts.

The latest news follows the late December announcement that Salesforce and nCino have expanded their 12-year-old collaboration. The expanded agreement will allow nCino to deepen its connectivity to Salesforce platform tools, including its financial services cloud, to help financial institutions modernize customer experiences such as onboarding, loan origination, opening of deposit accounts and portfolio management.

At the start of the new year, and as reported by Yahoo Finance, SoFi shares were downgraded on the Street via Keefe, Bruyette & Woods. Analyst Mike Perito lowered SoFi’s rating from “market perform” to “underperform” and lowered the stock’s price target to $6.50 per share, citing downside risks to EBITDA (a rough indicator of cash flow). The stock’s roughly 17% decline since the final days of December has offset the more than 120% gain seen in 2023.

Robinhood, which has gained 60% over the past year, had a stellar December, rallying more than 50%.

As shown here, Robinhood would have gathered clients of more established brokerages like Fidelity and Charles Schwab, with about $1.1 billion in account transfers since Oct. 23, when it began offering a 1% match on transferred brokerage accounts.