Global FinTech Blockchain Market

Dublin, August 8, 2024 (GLOBE NEWSWIRE) — The “FinTech Blockchain – Global Strategic Business Report” the report has been added to ResearchAndMarkets.com’s offer.

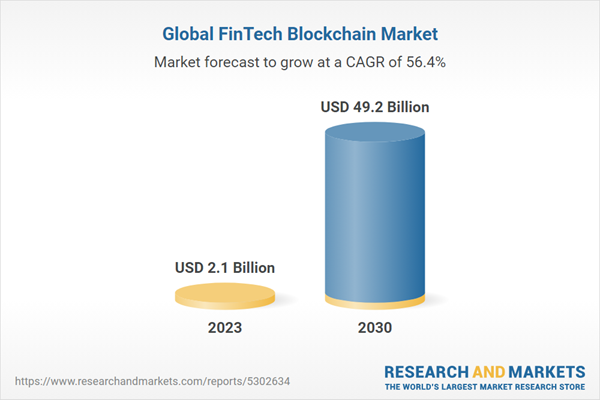

The global FinTech Blockchain market is estimated to reach US$2.1 billion in 2023 and is expected to reach US$49.2 billion by 2030, growing at 56.4% from 2023 to 2030. This full report provides in-depth analysis of market trends, drivers and forecasts, helping you make informed business decisions.

The growth of the blockchain FinTech market is driven by several factors, including the growing demand for faster and cheaper financial services solutions that can operate on a global scale. Technological advancements that improve the scalability and interoperability of blockchain are also important growth drivers. As blockchain technology evolves, its applications in FinTech become more feasible and efficient, encouraging more investment and experimentation.

Consumer behavior is also a crucial factor; As digitally native consumers seek more transparent, secure and efficient ways to manage their money, save, invest and transact, the demand for blockchain-based solutions is increasing. Additionally, the shift towards digital currencies and the increased interest of traditional financial institutions in blockchain solutions are powerful catalysts for market expansion. These trends, combined with continued technological innovation and regulatory developments, ensure robust growth and dynamic evolution of the FinTech blockchain sector.

Key information:

-

Market Growth: Understand the significant growth trajectory of the FinTech Blockchain segment for large enterprises, which is expected to reach US$ 29.3 billion by 2030 with a CAGR of 52.0%. The FinTech Blockchain for SME segment is also expected to grow at 65.6% CAGR during the analysis period.

-

Regional Analysis: Get an overview of the US market, estimated to reach $626.8 million in 2023, and China, which is expected to grow at an impressive CAGR of 65.2% to reach $5.4 billion by 2030 Learn about growth trends in other key regions, including Japan, Canada and Germany. , and the Asia-Pacific region.

Why should you buy this report:

-

Detailed Market Analysis: Access an in-depth analysis of the global FinTech blockchain market, covering all major geographies and market segments.

-

Competitive Insights: Get an overview of the competitive landscape, including the market presence of key players across different geographies.

-

Future Trends and Drivers: Understand the key trends and drivers shaping the future of the global FinTech blockchain market.

-

Actionable Insights: Gain actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key questions answered:

-

How is the global FinTech blockchain market expected to evolve by 2030?

-

What are the key drivers and restraints affecting the market?

-

Which market segments will witness the highest growth during the forecast period?

-

How will the market shares of different regions and segments evolve by 2030?

-

Who are the main market players and what are their prospects?

Report Features:

-

Comprehensive Market Data: Independent analysis of annual sales and market forecasts in millions of US dollars from 2023 to 2030.

-

In-Depth Regional Analysis: Detailed insights into key markets including the United States, China, Japan, Canada, Europe, Asia Pacific, Latin America, Middle East and Africa.

-

Company Profiles: Coverage of major players such as Huawei Technologies Co., Ltd., Accenture PLC, Amazon Web Services, Inc., etc.

-

Free Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Key attributes:

|

Report attribute |

Details |

|

Number of pages |

354 |

|

Forecast period |

2023 – 2030 |

|

Estimated market value (USD) in 2023 |

$2.1 billion |

|

Projected market value (USD) by 2030 |

$49.2 billion |

|

Compound annual growth rate |

56.4% |

|

Regions covered |

Global |

MARKET OVERVIEW

-

In a hyperconnected economy, Blockchain technology paves the way for transformation

-

Blockchain technology: statistics in a few words

-

Main Benefits of Blockchain Technology

-

FinTech Blockchain – Percentage Market Share of Top Global Competitors in 2024 (E)

-

An Introduction to Blockchain FinTech

-

Global Market Outlook and Outlook

-

Main use cases of blockchain in Fintech

-

Venture investments in blockchain applications for financial services continue to accelerate

-

Recent market activity

-

Competitive Market Presence – Strong/Active/Niche/Trivial for Global Players in 2024 (E)

MARKET TRENDS AND FACTORS

-

Digital transformation of financial services sector drives market growth

-

Rapidly evolving FinTech landscape supports blockchain adoption

-

Blockchain promises to improve the transparency, security, immutability and accessibility of systems and processes for financial services

-

Emerging Trends in Fintech Blockchain Market

-

Transformative Impact of Blockchain Technology in Banking

-

Blockchain will play a vital role in facilitating financial inclusion for the unbanked

-

Online banking fraud could become a thing of the past thanks to blockchain

-

With losses from online banking fraud increasing, blockchain has the potential to provide superior security benefits

-

Blockchain-based payment processing: an area of active interest for banks

-

Blockchain adoption to benefit from the growing importance of decentralized finance (DeFi) in developing economies

-

Decentralized Finance (DeFi) to fill the huge SME financing gap and drive blockchain adoption

-

As FinTech Disrupts the Insurance Industry, Blockchain Technology Is Poised for Growth

-

Blockchain applications in the insurance sector

-

Select startups that are transforming the insurance industry

-

As the underlying technology of digital currencies, the expansion of the cryptocurrency market presents opportunities for blockchain FinTech.

-

What are the main cryptocurrencies in the world?

-

Crypto Prices Continue to Ride a Roller Coaster

-

Central Banks Enter Digital Currency Space

-

As a new breed of blockchain-based crypto coins, Stablecoins continue to go from strength to strength

-

Institutional investors continue to pour funds into the cryptocurrency market

-

Smart Contracts: Most Promising Use Case for Distributed Ledger Technology

-

Growing role of blockchain in cross-border payments and money transfers

-

Blockchain for fraud prevention: a powerful new weapon in the making

-

Capital Markets: Blockchain to solve for data duplication, reconciliation errors and settlement delays

-

Key Challenges and Concerns Surrounding Blockchain Adoption

FOCUS ON A SELECTION OF PLAYERS(Total 80 featured)

-

Huawei Technologies Co., Ltd.

-

Accenture PLC

-

Amazon Web Services, Inc.

-

Cognizant Technology Solutions American company

-

Deloitte Touche Tohmatsu Ltd.

-

GardeTime AS

-

Hewlett Packard Enterprise Development LP (HPE)

-

Blockstream Corp.

-

Crypto Finance SA

-

Crypto4all

-

Huobi

-

AlphaPoint

-

Cointelegraph

-

Appinventiv

-

Chain, Inc.

For more information on this report, visit https://www.researchandmarkets.com/r/4vydd1

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of market research reports and international market data. We provide you with the latest data on international and regional markets, key industries, largest companies, new products and latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900