The Growing Divide: Silicon Valley vs. Wall Street on AI

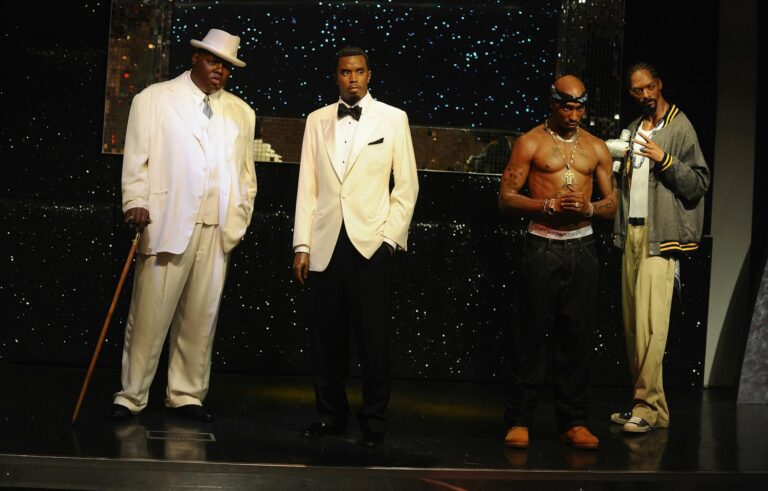

In recent months, a significant schism has emerged, reminiscent of past conflicts such as the East Coast-West Coast rap rivalry. This time, the rift lies in the differing perceptions of artificial intelligence (AI) between Silicon Valley and Wall Street.

Wall Street’s Cautious Approach to AI Investments

Currently, Wall Street’s interest in AI seems primarily focused on companies benefiting from resource shortages, such as memory chips and semi-capsulated equipment. This cautious stance has translated into a net negative sentiment in the market, particularly affecting software stocks vulnerable to potential obsolescence due to AI innovations.

Silicon Valley’s Confidence in AI’s Transformative Power

Contrastingly, in Silicon Valley, tech enthusiasts and venture capitalists are celebrating the advancements in AI, emphasizing its ability to revolutionize desktop work. A notable mention is the progress at Anthropic, which is believed to have enhanced AI’s efficiency and time-saving capabilities, increasing its business utility.

The Perception Gap: Tech vs. Finance

This growing disparity in mood between the finance and tech communities is prevalent, with tech insiders expressing frustration at Wall Street’s perceived short-sightedness. As one observer pointed out, the divergence in sentiment between these two sectors has never been more pronounced.

Investment Challenges in the AI Sector

Despite the recent advancements in AI, investors are facing challenges. The technology requires substantial capital investments, often diverting resources from buybacks to substantial capital expenditures. Additionally, the valuations of leading AI firms have surged by approximately $550 billion since September, rivaling the market cap of major companies like Berkshire Hathaway.

Impacts of New Technology on Existing Systems

The emergence of AI technologies poses a threat to existing systems, reminiscent of historical technological shifts. As Nvidia’s CEO, Jensen Huang, noted, it is illogical to think AI will entirely replace the software industry. Instead, AI tools are likely to optimize and enhance current software, raising questions about fair compensation for traditional software companies in this new landscape.

Looking Ahead: Bridging the Divide

The divide between technology and finance may not simply stem from differing perceptions of AI’s potential but from a more fundamental misunderstanding of market dynamics. As companies rapidly invest in AI, the market’s response has often not reflected these expenditures favorably. Investors are left to navigate a landscape where initial conditions and current positioning seem to dictate price movements more than long-term fundamentals.

As the AI narrative continues to unfold, it’s evident that both tech and finance sectors must learn to communicate and collaborate effectively. Understanding this divide will be crucial as the world moves further into an era shaped by artificial intelligence.