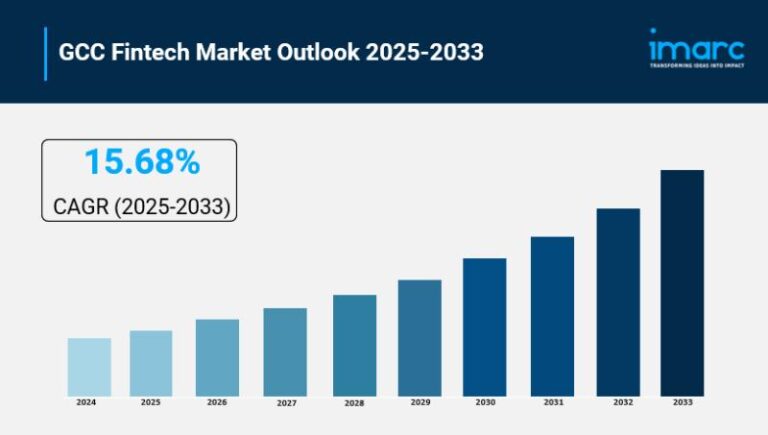

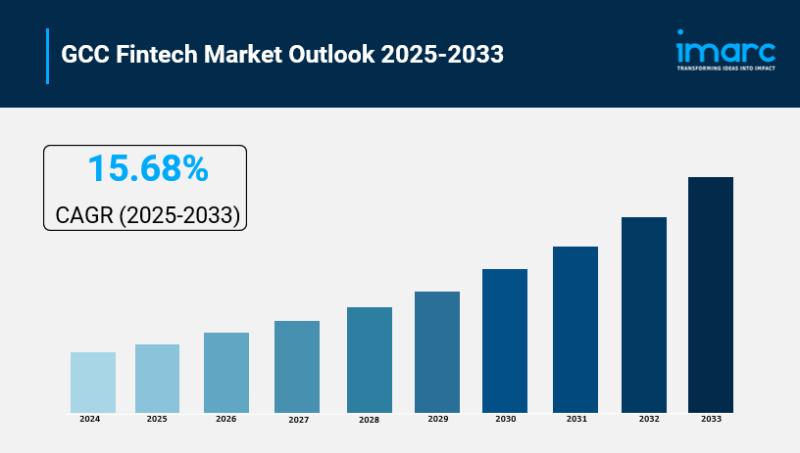

GCC Fintech Market Overview

The GCC Fintech Market is poised for significant growth, with expectations for a compound annual growth rate (CAGR) of 15.68% from 2025 to 2033. This growth is driven by various factors, including evolving technologies and supportive government initiatives.

The Impact of AI on GCC Fintech

Artificial Intelligence (AI) is transforming the GCC Fintech landscape by enhancing banking efficiencies, automating customer service processes, and enabling data-driven decision-making, all while considerably reducing costs. Countries like the UAE, Saudi Arabia, and Bahrain are spearheading this innovation through regulatory sandboxes and dedicated fintech hubs.

Advancements in Fraud Detection and Customer Service

AI-driven tools are significantly improving fraud detection and enabling personalized financial services. This technological advancement aids both banks and fintech companies in better understanding customer needs and streamlining transactions, ultimately leading to higher customer satisfaction.

Emergence of AI-Native Fintech Startups

There has been a surge in AI-native fintech startups within the GCC. Supported by investment and innovation centers, such as Dubai’s DIFC, these ventures are challenging traditional banking models and accelerating the digital transformation of financial services.

Trends Driving Fintech Growth in the GCC

Digital payment platforms are catalyzing 40% of fintech growth in the GCC region. Mobile applications, particularly STC Pay, process $20 billion in transactions annually, reflecting the region’s tech-savvy population. E-commerce, valued at $24.67 billion, relies on transparent payment gateways bolstered by open banking APIs, which extend financial inclusion and encourage fintech adoption.

Blockchain and Cryptocurrency Integration

The adoption of blockchain and cryptocurrency solutions is gaining momentum, with 25% of GCC fintech startups integrating decentralized finance for secure transactions. Initiatives such as Dubai’s blockchain strategy aim for 50% of government transactions to occur on blockchain, projecting significant cost savings.

Government Initiatives Boosting Financial Inclusion

Government initiatives are significantly boosting financial inclusion in the GCC, accounting for 35% of fintech market expansion. In Saudi Arabia, the Neom Fund is committed to investing $1 billion in over 150 startups, fostering innovation and enhancing mobile penetration rates to 98%, successfully reaching 80% of the unbanked population.

Conclusion: A Promising Future for GCC Fintech

The GCC Fintech Market is at a crucial juncture, marked by unprecedented investment and innovation. As regulatory frameworks evolve and technological advancements continue, the region is well-positioned to become a global fintech hub, offering transformative services that align with modern financial needs.

For further insights, you may explore additional resources, such as the comprehensive market report available at IMARC Group.

Contact Us

IMARC Group

134 N 4th St., Brooklyn, NY 11249, United States

Email: sales@imarcgroup.com

Phone: (d) +91 120 433 0800 | US: +1-201-971-6302

This information was published by OpenPR.

This structured HTML article is designed to be engaging, informative, and optimized for search engines, ensuring that relevant keywords are naturally incorporated throughout the content.