Indian FinTech Market

Dublin, February 15, 2024 (GLOBE NEWSWIRE) — The “Indian Fintech Market Competition, Forecast and Opportunities, 2028” the report has been added to ResearchAndMarkets.com’s offer.

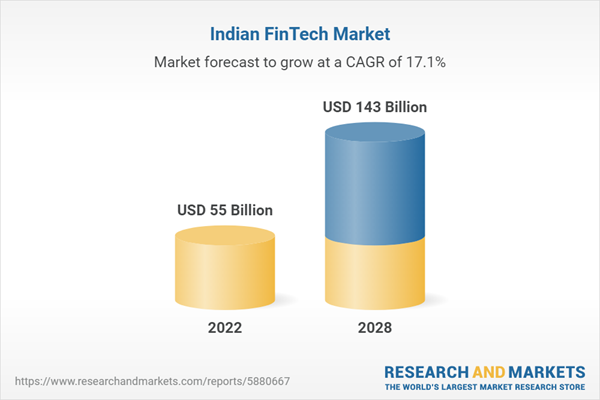

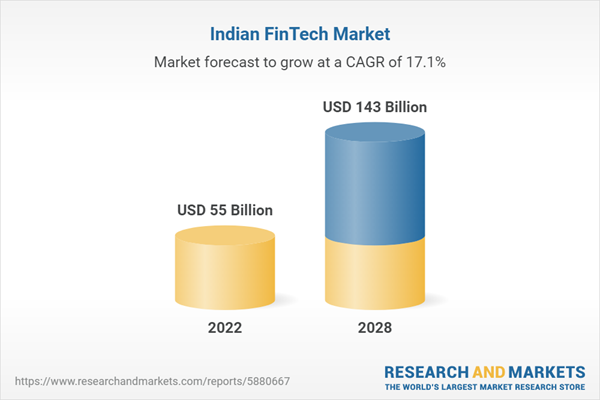

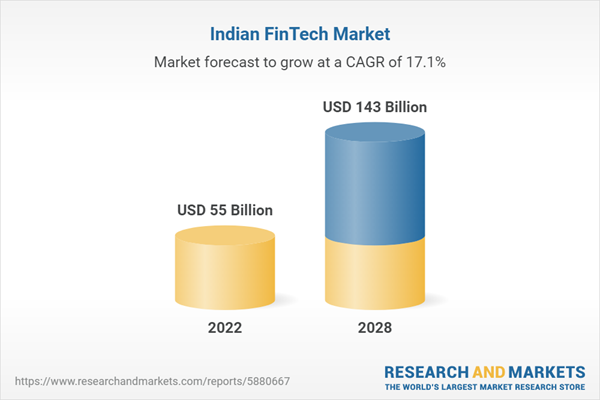

The Indian FinTech market is expected to continue its significant growth trajectory, supported by the widespread trend towards online payment methods and the rise of digital transaction platforms. Government initiatives to foster the FinTech ecosystem, along with the emerging wave of FinTech startups, are the key factors envisioned to propel the expansion of the Indian FinTech sector through 2028, reaching a projected size of USD 143 billion at a CAGR of 17.1%.

The use of technology to enhance and streamline financial service offerings is the foundation of FinTech companies. Specialized software and algorithms across various platforms are contributing to this technological financial revolution. Market segments include PayTech, InsurTech, LendTech, and WealthTech, each addressing a different facet of financial technology, from payments to insurance, lending, and wealth management. Within these segments, PayTech, in particular, is seeing increased demand following the country’s shift towards online payments post-demonetization, highlighting a crucial shift towards digital transactions.

Growth of Indian fintech market is supported by significant smartphone and internet penetration

The rise in smartphone usage and internet penetration is paving the way for accelerated growth in the fintech market. India’s National Investment Promotion and Facilitation Agency has identified that India boasts the second-largest smartphone users in the world and is expected to become the second-largest internet user market by 2026. The sharp increase in the number of households connected to the internet further underlines the huge potential of the market. Innovations like Bharat QR, introduced by the National Payments Corporation of India (NPCI), are helping to move the country towards a cashless economy. The interoperability of Bharat QR is part of the country’s grand vision to adopt innovative and secure financial solutions.

Increase in online payments and government initiatives are boosting the market

The impressive growth of the Indian FinTech market is closely linked to the rise in online payments. NPCI data reveals that an impressive number of transactions were facilitated through UPI in the last one year, reflecting the deep penetration of digital payments in the country following government measures such as demonetisation. Government schemes such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) are helping to expand financial inclusion, fostering an enabling environment for FinTech companies to innovate technologically and cater to India’s vast consumer base.

Market Trends: Startup Ecosystem and Emergence of the “Unicorn” in Indian FinTech

The FinTech startup landscape in India is booming, with a considerable number of companies achieving ‘unicorn status’. Government initiatives such as ‘Startup India’ are incubating entrepreneurial ventures, contributing significantly to the country’s economic dynamism and job market.

-

PayTech

-

AssurTech

-

Technology Loans

-

Technology of wealth

Market Challenges and Opportunities in Indian FinTech Landscape

Despite promising growth, challenges such as data security, user experience, regulatory frameworks, and integration with existing banking systems pose hurdles for the FinTech sector. However, the expanding middle class and untapped markets in Tier II and III cities offer substantial opportunities for market players.

Regional Market Information and Key Market Players

The Indian FinTech market analysis encompasses different regional markets including North, South, East, and West of the country. The report offers an in-depth insight into the key players in the market, setting the benchmark for excellence and innovation in the FinTech space. In conclusion, as the Indian FinTech market strives to reach unprecedented heights by 2028, it is poised to transform the financial services landscape in India, backed by technological advancements, surging investments, and government support, ensuring a more inclusive financial future.

Key Attributes

|

Report attribute |

Details |

|

Number of pages |

72 |

|

Forecast period |

2022-2028 |

|

Estimated Market Value (USD) in 2022 |

$55 billion |

|

Projected Market Value (USD) by 2028 |

$143 billion |

|

Compound annual growth rate |

17.1% |

|

Regions covered |

India |

A selection of companies mentioned in this report includes:

-

One97 Communications Limited (Paytm)

-

Lendingkart Technologies Private Limited

-

PhonePe Private Limited

-

Google India Private Limited (Google Pay)

-

Razorpay Software Private Limited

-

Pine Labs Private Limited

-

Policybazaar Private Insurance Brokers

-

Zerodha Brokerage Ltd

-

InCred Financial Services Limited

-

A MobiKwik Systems Limited (MobiKwik)

For more information about this report, visit https://www.researchandmarkets.com/r/jt7vwr

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for market research reports and international market data. We provide you with the latest data on international and regional markets, key industries, top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900