Balancing Innovation and Regulation in Ghana’s Fintech Sector

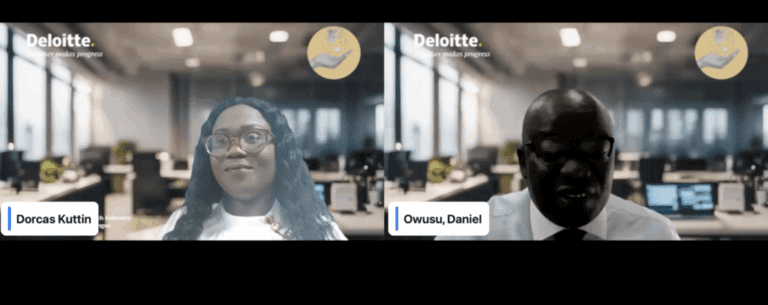

Deloitte Ghana’s Country Managing Partner, Daniel Kwadwo Owusu, emphasizes the necessity for regulators and industry stakeholders in the fintech sector to maintain a delicate equilibrium between fostering innovation and safeguarding the integrity and stability of the financial system.

As the fintech landscape evolves with rapid technological advancements, Owusu acknowledges that this presents both exciting opportunities and complex challenges for financial services in Ghana. The sector’s growth is driven by the continuous development of new technologies and regulatory frameworks.

The Impact of Fintech on Financial Services

During his keynote address at the “Future Trends in Fintech Industry: Regulatory Trends and Challenges” conference, Owusu noted that the fintech industry has been a pivotal force in transforming how individuals and businesses engage with financial products and services. The integration of mobile banking, digital payments, blockchain, and artificial intelligence showcases how fintech is enhancing efficiency and accessibility globally.

However, as these advancements continue to unfold, challenges in regulation, data privacy, cybersecurity, and consumer protection also arise. “Regulators and industry players must strike a delicate balance between fostering innovation while ensuring financial system integrity,” stated Owusu.

Lessons from Nigeria’s Fintech Growth

Oluwole Oyeniran, West African Head of Technology and Telecommunications at Deloitte, shared valuable insights from Nigeria’s fintech sector. He highlighted Nigeria’s emergence as Africa’s leading fintech hub, characterized by rapid growth in startups and increased investments.

With over 400 fintech startups, Nigeria accounts for nearly a third of Africa’s total fintech companies, attracting the highest level of funding on the continent. Oyeniran indicated that in 2021 alone, Nigerian tech startups raised approximately $1.3 billion in fintech investments—making it the largest funding ecosystem in Africa.

Fintech’s Role in Venture Capital

By 2023, fintech was responsible for over 60% of all venture capital funds directed towards Nigerian startups. Oyeniran’s analysis underscores the critical role of fintech in driving innovation and investment within the African startup ecosystem.

Collaborative Efforts for a Sustainable Future

Other notable speakers at the conference included Hayford Kumar, Head of the FinTech Monitoring and Supervision Unit at the Bank of Ghana, and Charlotte Forson-Abbey, Audit Partner and Financial Sector Leader at Deloitte Ghana. Their contributions further reinforced the importance of collaboration among regulators, industry leaders, and stakeholders to nurture a sustainable fintech ecosystem in Ghana.

The future of fintech in Ghana hinges on this collective effort to balance innovation with regulatory compliance, ensuring that the financial sector remains robust and inclusive for all.

DISCLAIMER: The views, comments, opinions, contributions, and statements made by readers and contributors on this platform do not necessarily represent the views or policies of Multimedia Group Limited.