Overcoming Compliance Challenges: The ComplyControl SAFFETART Program for Startups

Compliance poses significant challenges for startups, often becoming a costly hurdle. Data indicates that small businesses invest an average of $7,000 per employee annually in compliance costs—nearly 60% more than large corporations. For startups operating on tight budgets, this can be a daunting pressure point.

The Risks of Non-Compliance

Reducing compliance efforts can lead to severe consequences, including regulatory fines, loss of investor trust, failed partnerships, and even business closures. Ultimately, the costs associated with non-compliance can far exceed initial savings from budget cuts.

Introducing the ComplyControl SAFFETART Program

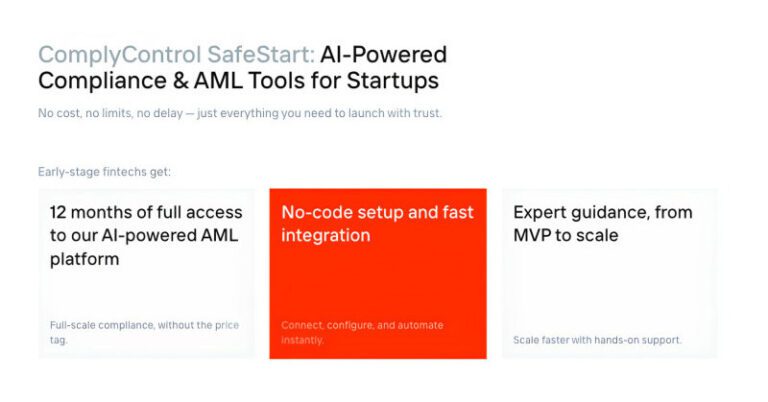

The ComplyControl SAFFETART program is specifically designed to ease the compliance burden for startups. By integrating robust compliance solutions from day one, startups can avoid the complexities and high costs typically associated with compliance. Startups that join the program will benefit from:

- Free access to a comprehensive suite of compliance tools, including real-time transaction monitoring, AI-driven AML and CTF detection, sanctions screening, and policy compliance—all for up to 50,000 transactions per month.

- 12 months of free use with no hidden fees or limitations—ample time for startups to integrate tools and evaluate their effectiveness.

- A code-free rule creation process, enabling system configuration in days instead of months.

- Early access to new features, expert guidance from the ComplyControl team, and flexible transition to commercial terms after the first year.

Advanced AI Technology for Streamlined Compliance

The SAFFETART program equips startups with the same powerful compliance tools utilized by established financial institutions. Its platform leverages advanced AI technology to process transactions in under five seconds, reduce false positives by up to 80%, and simplify daily compliance tasks through an intuitive interface and clear screening results.

Mentorship and Ongoing Support

What sets ComplyControl apart is its commitment to providing continuous support. The expert team does not merely hand over software; they actively mentor startups, sharing insights and expertise to help them navigate the complexities of compliance with confidence.

Testimonials from Industry Leaders

“The compliance landscape grows increasingly complex every day, becoming a significant barrier for many fintech startups. With ComplyControl SAFFETART, we aim to alleviate that burden, allowing startups to concentrate on innovation while we handle compliance,” says Eloshvili Romain, Founder of ComplyControl.

How to Get Involved

Startups interested in the program can apply through the company website or reach out directly via (protected email).

About ComplyControl

ComplyControl is a UK-based AI-focused service provider dedicated to enhancing risk management and ensuring regulatory compliance for financial organizations of all sizes. Specializing in AI-powered solutions, ComplyControl makes compliance processes quicker, smarter, and more cost-effective. As a recognized frontrunner in the industry, included in TechRound’s Top 50 Fintech Startups list for 2025, the company is committed to simplifying regulatory compliance and helping financial organizations proactively manage evolving risks.

Contact Information

ComplyControl

(protected email)

Photo – ComplyControl Image 1

Photo – ComplyControl Image 2

Source

ComplyControl