Understanding the Gig Economy

The gig economy has transformed the way people work, providing flexibility and additional income to millions.

By 2024, nearly 80 million Americans identified as gig workers, a number expected to exceed 86 million by 2027, representing more than half of the U.S. workforce.

While the gig economy provides independence and autonomy, it also brings financial challenges that traditional institutions struggle to address.

The financial obstacles facing gig workers

Irregular income and instability

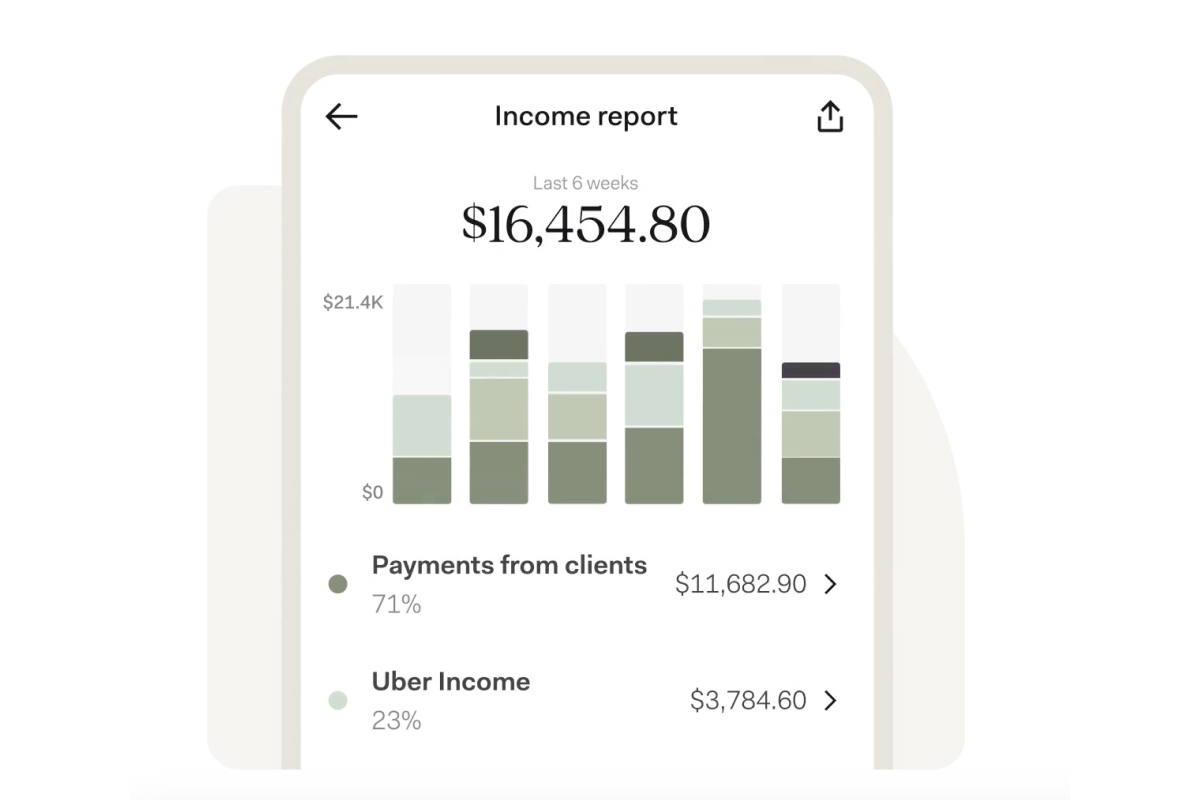

Gig workers often face fluctuating income, making budgeting and financial planning difficult. This inconsistency limits their access to traditional loans or credit, forcing many to live paycheck to paycheck.

Barriers to financial services

Without a stable work history, gig workers are often considered high-risk by traditional institutions, leaving them without access to basic financial products like loans or credit cards.

Complex tax management

Tracking income from multiple sources and navigating self-employment tax laws add layers of complexity for gig workers, often leading to errors or costly professional help.

Lack of benefits

Gig workers typically have to cover healthcare costs, retirement savings and paid time off on their own, adding to their financial strain.

How Fintech meets the needs of gig workers

1. Alternative credit scoring

Fintechs leverage non-traditional data such as payment history from gig platforms, utility bills and even social media activity to assess creditworthiness, giving gig workers access to loans and credit.

2. Income Smoothing and Cash Flow Tools

Earned Wage Access (EWA) platforms allow workers to access their wages before payday, alleviating cash flow concerns. Budgeting tools tailored to gig workers help manage irregular income more effectively.

3. Digital banking solutions

Freelancer-specific accounts offer features like automated tax reporting, expense categorization, and invoicing. These tools simplify financial management and provide access to underbanked workers.

4. Affordable insurance and benefits

Fintech companies offer microinsurance and retirement plans tailored to freelancers, offering affordable coverage and flexible savings options.

5. Simplified tax solutions

Platforms like Keeper Tax and QuickBooks Self-Employed streamline tax tracking and identifying deductions, easing the tax burden on self-employment.

6. Open banking for financial aggregation

Open Banking allows gig workers to consolidate income from multiple platforms into a single view, improving budgeting and financial planning capabilities.

Cutting-Edge Fintech Innovations for Gig Workers

- Stride health And Catch: Affordable health and retirement solutions.

- KarmaLife: Instant credit lines using gig platform data.

- Turaco: Low-cost micro-insurance for health and life coverage.

- Find: Business banking services adapted to self-employed people with tax tools.

- Even And Constant: Income smoothing applications to manage fluctuating income.

Conclusion

As the gig economy grows, so does the demand for tailored financial solutions. Fintech fills the gaps left by traditional institutions, equipping gig workers with tools for stability and growth.

By tackling issues like irregular income and limited access to credit, fintech companies are building a more inclusive financial system for tomorrow’s workforce.