Insights into China’s Growing Fintech Market

Source: Mordor Intelligence

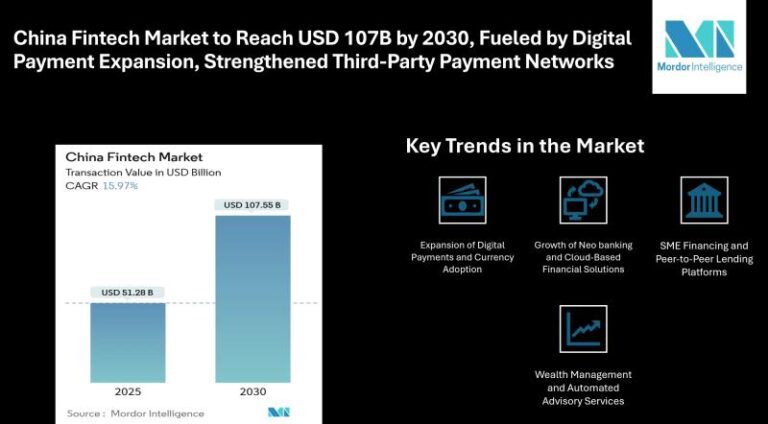

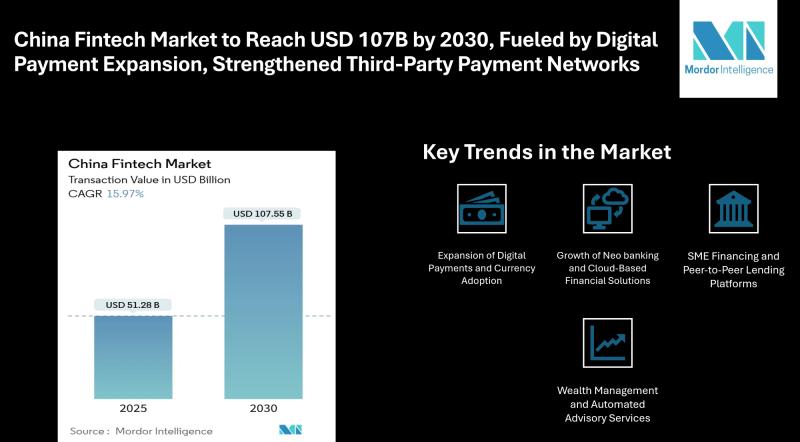

The fintech market in China is on a rapid growth trajectory, expected to be valued at $51.28 billion by 2025 and further rise to $107.55 billion by 2030, showcasing a remarkable compound annual growth rate (CAGR) of 15.97%.

Market Overview

The surge in China’s fintech market is attributed to the widespread adoption of mobile applications, cloud services, and API-based financial platforms. These innovations are enhancing operational efficiency and expanding financial access for various user demographics, including small businesses and retail consumers.

Key Trends Shaping the Fintech Landscape

Numerous trends are fundamentally transforming the fintech ecosystem in China:

- Expansion of Digital Payments: The introduction of the digital yuan and enhanced third-party payment platforms are fostering digital transactions, particularly in Tier 2 and Tier 3 cities.

- Rise of Neobanks: Digital-first banks and cloud-powered platforms are making banking more accessible and efficient for users, promoting innovative financial solutions.

- SME Financing Solutions: Fintech companies are bridging financing gaps for small and medium enterprises (SMEs), utilizing unique models like supply chain financing.

- Automated Wealth Management: Robo-advisors and automated tools are reshaping investment strategies, enhancing personalized financial planning.

Market Segmentation

The fintech market in China can be segmented by various factors:

By Service Proposal:

- Digital Payments

- Loans and Financing

- Digital Investments

- Insurance Technology

- Neobanks

By End User:

- Retail Consumers

- Businesses

By User Interface:

- Mobile Apps

- Web Platforms

- POS/IoT Devices

Key Players in China’s Fintech Market

Several prominent companies are leading the charge in China’s fintech landscape:

- Ant Group: Renowned for Alipay, the leading digital payments platform in the country.

- Tencent Holdings: Operates Tenpay, integrated with WeChat for seamless transactions.

- WeBank: China’s first digital-only bank, focusing on innovative financial solutions.

- Lufax: Specializes in wealth management and lending services through online platforms.

- JD Technology: Offers advanced digital payment solutions powered by AI.

Conclusion: The Future of Fintech in China

With burgeoning adoption of digital payments and advancements in neobanking and AI-enabled solutions, China’s fintech market is set for continued growth. The changing landscape promises more efficient and personalized financial services for both individual consumers and businesses.

Stay updated with the latest insights on China’s fintech market and explore further trends by visiting Mordor Intelligence.