Fnality Raises €115 Million to Advance Wholesale Payment Systems

Fnality International, the London-based operator of next-generation wholesale payment systems regulated by central banks, announced the successful closure of a €115 million financing round in Series C.

Key Investors Fueling Growth

The funding round was spearheaded by notable institutions including Wisdomtree, Bank of America, Citi, KBC Group, Temasek, and Tradeweb. These major investors were joined by existing stakeholders such as Banco Santander, Barclays, BNP Paribas, DTCC, Euroclear, Goldman Sachs, ING, Nasdaq, State Street, and UBS.

Vision for the Future of Finance

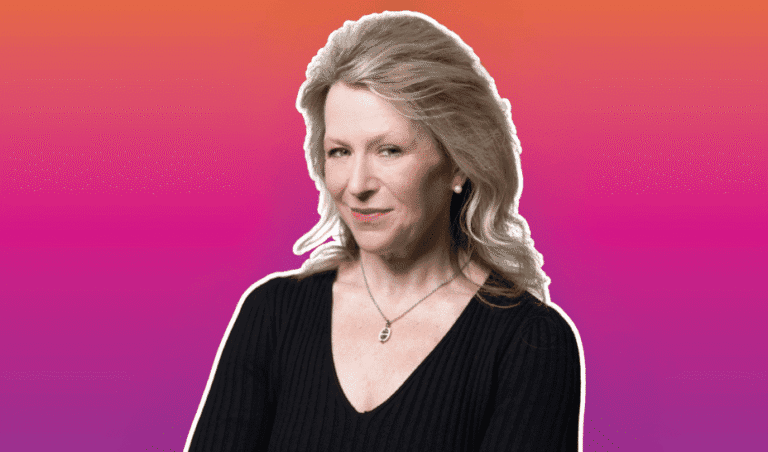

Michelle Neal, CEO of Fnality International, remarked, “The completion of our Series C funding underscores a unified belief that the future of money requires a robust foundation, with Fnality at its core. Our blockchain-based settlement systems, secured by central bank monetary credit, bridge traditional finance with the accelerating world of tokenized and decentralized markets.“

Neal emphasized that this investment will not only modernize wholesale payments but also create a more resilient and inclusive financial market infrastructure designed for the hybrid future of global finance.

Innovations in Wholesale Payment Systems

Founded in 2019, Fnality is dedicated to building a global network of wholesale payment systems utilizing Distributed Ledger Technology (DLT). Each system, known as the Payment System F NEW (FNP), is overseen by its respective central bank. Participants in FNPS utilize representations of central bank funds for instant wholesale payments.

The introduction of FNPS in critical jurisdictions allows for real-time cross-border payments and secure atomic settlements, enhancing the overall efficiency of transactions.

Milestones and Recognitions

In December 2023, the FNP Sterling received recognition from HM Treasury as a systemic payment system, marking a significant milestone as the world’s first wholesale payment system based on regulated DLT. This innovative setup converts traditional currency into a digital representation, revolutionizing the payments landscape.

Expert Insights on Digital Payments

Jim Demare, Co-President of Bank of America, stated, “This partnership is a pivotal step in digitizing institutional markets. By embracing new technological solutions, we are enhancing market structure for faster, more efficient operations.“

Jonathan Steinberg, CEO and founder of Wisdomtree, added, “Our investment reflects our ambition to directly connect with the rapidly expanding tokenized markets, establishing a supportive infrastructure for digital finance.“

Future Directions and Strategic Initiatives

Following the launch of the FNP Sterling, Fnality plans to extend its network footprint to other major currencies. The company is committed to optimizing liquidity management and fostering an emerging payment ecosystem that includes interoperability for stablecoins and token deposits.

Deepak Mehra, Digital Strategy Manager at Citi Markets, noted, “Fnality’s efforts in wholesale payments align with Citi’s dedication to providing innovative solutions within the evolving digital assets landscape.“