Tide Joins Unicorn Club with $120 Million Funding Round

Tide, a UK-based fintech company, has successfully entered the Unicorn Club with a $120 million funding round led by TPG. The startup now supports over 1.6 million micro and small businesses globally, with a significant portion based in India—the fastest-growing market for Tide.

Funding Details and Valuation

The recent funding round, comprising both primary and secondary investments, values Tide at approximately $1.5 billion. While the exact split between primary and secondary investments hasn’t been disclosed, it includes stock sales by employees, early investors, and minority stakeholders. TPG’s Rise Fund, focused on impact investments, and existing investor Apax Digital Funds participated in this funding round.

Addressing the Needs of Small Businesses

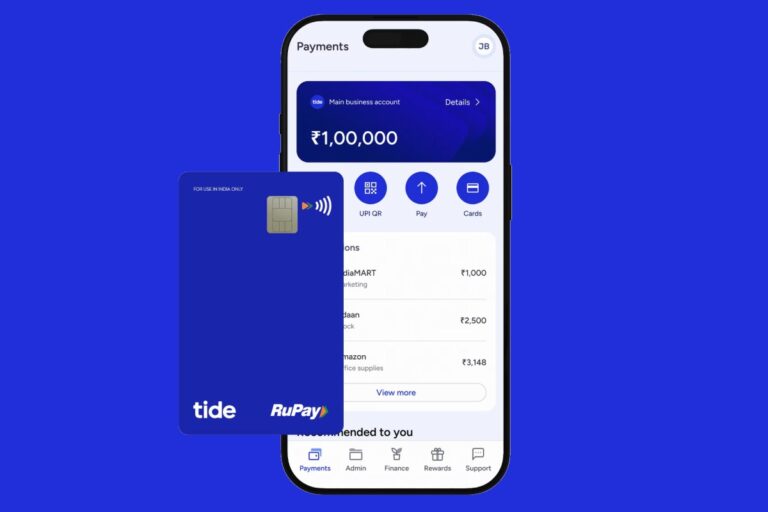

Micro-enterprises and small businesses, including freelancers and solopreneurs, often spend considerable time on administrative tasks like accounting, invoicing, and expense management. Traditional banks and fintech solutions frequently fall short in meeting their specific needs. Tide aims to rectify this by offering a unified platform that provides tailored tools, including accounting integrations, commercial loans, payroll services, and business registration.

Expansion into India

Founded in 2015, Tide initially launched in the UK but expanded its services to India in December 2022, recognizing the country’s vast small business ecosystem—over 60 million micro and small enterprises employing more than 250 million people. Since entering India, Tide has registered over 800,000 Indian businesses, now exceeding its UK member base of nearly 800,000. The company now serves around 14% of the UK’s small and medium-sized enterprises (SMEs) and has achieved profitability in this market.

Tide’s CEO Insights on Market Opportunities

“There is a significant trend towards formalization in the market,” said Oliver Prill, CEO of Tide. “Our largest competitor is cash, not other fintech solutions.” He acknowledged that while growth rates in India have moderated slightly, they remain impressive compared to other regions, such as continental Europe and the UK.

Supporting India’s Small Business Landscape

Every year, approximately four million micro and small businesses are launched in India, many seeking assistance in formal credit access and navigating the complex indirect tax system. Tide caters to these needs through its digital platform, available on both iOS and Android, while actively collaborating with around 25 lenders to facilitate credit solutions aligned with the specific requirements of each business.

Global Expansion Plans and Innovations

Beyond the UK and India, Tide plans to expand further into Germany and France, tailored to each market’s unique needs. The new funding will support geographical growth, product enhancements, and investment in AI technologies to further elevate the user experience. Prill promises significant product developments in the coming months, ensuring Tide remains a frontrunner in fintech innovation.

Tide’s Workforce and Future Vision

Currently, Tide employs over 2,500 people across its global operations. With plans for widening its service offerings and integrating new technologies, Tide is well-positioned to support millions of small businesses in unlocking their potential and driving economic growth globally.