Sure! Here’s a paraphrase of the content:

This report speaks of a different individual. It’s not uncommon to witness lawbreaking or violent actions and property damage. Such incidents are not new and have been highlighted multiple times before.

When the National Crime Records Bureau (NCRB) compiles statistics on violent crimes, it raises concerns about law violations. Instances of justification groups attacking individuals or couples are part of this trend of violence. Moreover, when government officials use bulldozers to demolish alleged encroachments, it relates to property destruction. The Prime Minister’s derogatory remarks about the opposition, particularly referring to the Congress, as the ‘tukde tukde gang’ or ‘urban naxals’ highlights a recurring theme of conflict.

Shattering Hopes and Hearts

Today, I want to share some crucial information that could shatter your hopes and hearts. Mr. KV Kamath is a renowned banker who played a key role in transforming ICICI into a leading private bank in India. He was the first president of the New Development Bank (BRICS Bank) and is currently the president of the National Bank for Financing Infrastructure and Development (NABFID). In a recent book review, he outlined the steps India needs to take to achieve the status of ‘Viksit Bharat’ (Developed India) by 2047.

In the review published in a prominent newspaper, Mr. Kamath praised the author, Mr. Krishnamurthy Subramanian, for presenting his core theme compellingly, emphasizing that India must break free from pessimistic views of the past and set ambitious goals guided by constructive thinking. He agreed with the author that only a consistent nominal GDP growth of 12.5% annually would allow the GDP to rise from approximately $16.28 trillion in 2023 to $55 trillion by 2047, which he considers achievable and encourages aiming for such sustained growth.

Significant Implications

The crucial insights in Mr. Kamath’s review are found within the last six paragraphs. He outlines the “four pillars” that will shape India over the next century: a focus on macroeconomic growth, social and economic inclusion, ethical wealth generation by the private sector, and a virtuous cycle driven by private investment. Let’s examine these pillars in light of the current government’s performance.

Regarding macroeconomic growth: the undeniable indicators are budget deficit, inflation rates, interest rates, the current account deficit, and debt-to-GDP ratio. The government still has a significant distance to cover to achieve the fiscal deficit target of 3% of GDP (currently at 5.6%). Inflation remains above 4%, and the RBI‘s repo rate has been steady at 6.5% since May 2022. The current account deficit stood at $23.2 billion at the end of 2023-24, though foreign funding provided some relief. The debt-to-GDP ratio is at a manageable 18.7%. Overall, the record is mixed.

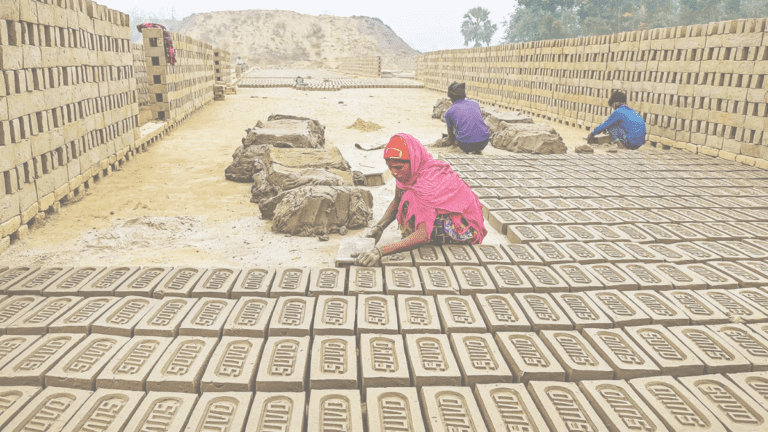

As for social and economic inclusion: the Modi government has notably struggled to reduce inequalities. Crony capitalism, high public investment in capital-intensive industries, corporate tax reductions, sales taxes on mass consumer goods, elevated fuel prices, insufficient minimum wages, neglect of farmers, and biases against services for poorer populations (e.g., the Vande Bharat trains) have further widened economic disparities between the wealthiest 1% and the bottom 20%. Moreover, social inclusion has suffered setbacks due to hate campaigns and urban conflicts. The second pillar identified by Mr. Kamath appears unstable and weak.

On the topic of ethical wealth creation by the private sector: incidents of bank fraud and corporate malfeasance have surged in the past decade. The Insolvency and Bankruptcy Code has often been misused to legitimize banking practices and facilitate control over troubled companies, with a recovery rate of only 32% under this code. The regulatory environment, including intrusive regulations and oppressive taxation, has discouraged ethical business practices, prompting many young entrepreneurs to seek opportunities abroad or migrate. Since 2000, over 4,300 Indian millionaires have relocated to Singapore (HCI, Singapore). The constant pressure from investigative agencies has fostered an atmosphere of fear among business owners. In September 2022, the Finance Minister questioned Indian companies about their hesitance to invest domestically.

Mr. Kamath’s insights raise important questions for us to consider.