In a significant move highlighting the value of cross-border collaboration, Brazilian digital banking group Nubank, a NYSE-listed company, today announced its investment in South Africa-born fintech Tyme Group.

The agreementfacilitated by Endeavor’s global entrepreneurial network, shows how curated connections can drive transformative business results.

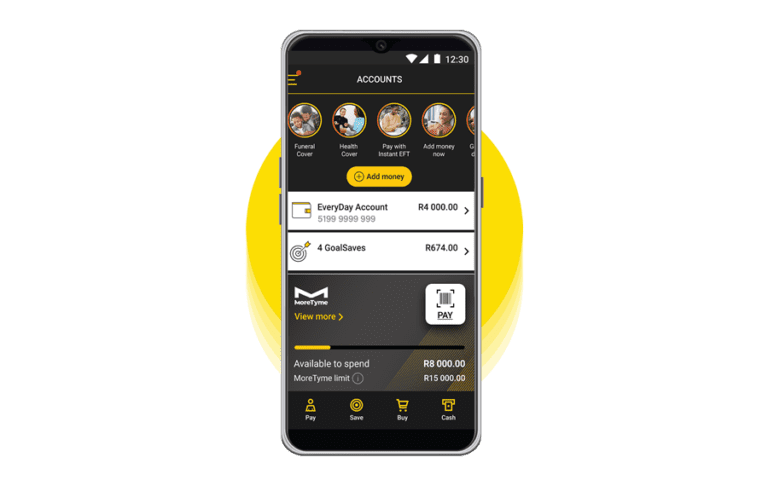

Tyme, a global digital banking group headquartered in Singapore and backed by Africa Rainbow Capital (ARC) of SA, operates two high-growth digital banks: TymeBank in South Africa and GoTyme Bank in the Philippines. TymeBank, launched in 2019, surpassed 10 million customers with a year-on-year growth rate of 29%, while GoTyme, in partnership with Gokongwei Group, achieved an extraordinary 317% year-on-year growth, accumulating more 4 million customers since its launch in October 2022.

“This partnership between Nubank and Tyme highlights the essence of Endeavor’s mission, which is to connect high-impact entrepreneurs in emerging markets with opportunities that allow them to grow across borders,” said Alison Collier, Managing Director of Endeavor South Africa. “This is an example of how aligning the right partners at the right time can create exponential value.”

Tyme’s relationship with Endeavor began in 2021 when the company joined the Endeavor South Africa network. Initially supported by mutual mentoring, the partnership has evolved to include investments through our global co-investment fund and Endeavor’s Harvest Fund, focused on South Africa. Recently, Tjaart van der Walt, Co-Founder and CEO of TymeBank, joined the Endeavor South Africa Board of Directors to continue supporting the work Endeavor is doing to champion the next generation of entrepreneurs. This was nicknamed the Endeavor “multiplier effect” – practice the philosophy of paying it forward.

Endeavor’s global network was instrumental in connecting Tyme with the Gokongwei Group, a crucial strategic partner for its expansion in the Philippines, among others. Likewise, the introduction to Nubank was facilitated by Endeavor after a meeting at one of its events in New York, where Endeavor is headquartered. This led to direct engagements between the two companies, resulting in an agreement that positions Tyme for future growth in emerging markets.

“The Endeavor network doesn’t just open doors; it brings the right, trusted people into the room,” Collier explained. “This was essential in creating the trust and alignment necessary for a deal of this magnitude.”

With operations spanning Latin America and Europe, Nubank brings substantial resources and expertise to its partnership with Tyme’s complementary presence in Africa and Southeast Asia. The Brazilian fintech giant, which has a customer base of more than 100 million and $8 billion in cash reserves, is well-positioned to accelerate the expansion of Tyme’s operations in its current and new markets.

“This investment represents a major milestone for Tyme and validates its innovative approach to digital banking,” Collier said. “Nubank’s market capitalization of $68 billion is just below South Africa’s total banking sector of $85 billion, including Capitec. The market capitalizations of Nubank and Capitec have increased by more than 70% this year.

The Nubank-Tyme partnership is part of a growing trend within the Endeavor ecosystem. Other recent deals between the Endeavor companies include Turkish fintech Papara’s acquisition of Pakistan’s SadaPay in May 2024, and the merger between Egyptian e-commerce platforms MaxAB and Kenyan Wasoko in August this year.

Endeavor’s global venture fund has made more than 325 investments across 30 countries, with almost a quarter of its portfolio in fintech, including investments in Tyme. The fund has backed 49 unicorns to date, highlighting Endeavor’s ability to identify high-growth companies and foster meaningful connections.

Endeavor South Africa’s Harvest Fund has also played a vital role in supporting local entrepreneurs. Following the success of Harvest Fund II, which invested in 17 companies, Harvest Fund III recently completed its first closing, with plans to invest in up to 30 high-growth South African companies. Harvest Fund II and III invested in Tyme.

The broader impact of these investments extends beyond individual businesses. Each agreement amplifies the entrepreneurial ecosystem, creating jobs and stimulating innovation. Globally, Endeavor entrepreneurs have created more than 4.1 million jobs and generate more than $50 billion in annual revenue.

For investors, the dual due diligence process conducted by Endeavor through its rigorous 18-month selection process and its co-investment partners, helps reduce opportunity risk while the absence of active due diligence fees ensures that the focus remains on long-term value creation. .

“The results speak for themselves,” Collier concluded. “Endeavor’s ability to connect the right people across markets and continents generates transformative deals that not only elevate individual businesses, but also contribute to meaningful economic growth and innovation on a global scale.

As Tyme looks to leverage Nubank’s expertise and resources to grow in its existing markets and expand its presence, the deal is a testament to the power of networks in shaping the future of entrepreneurship.

//Editor