The Crypto Market Faces a $1.7 Billion Sell-Off

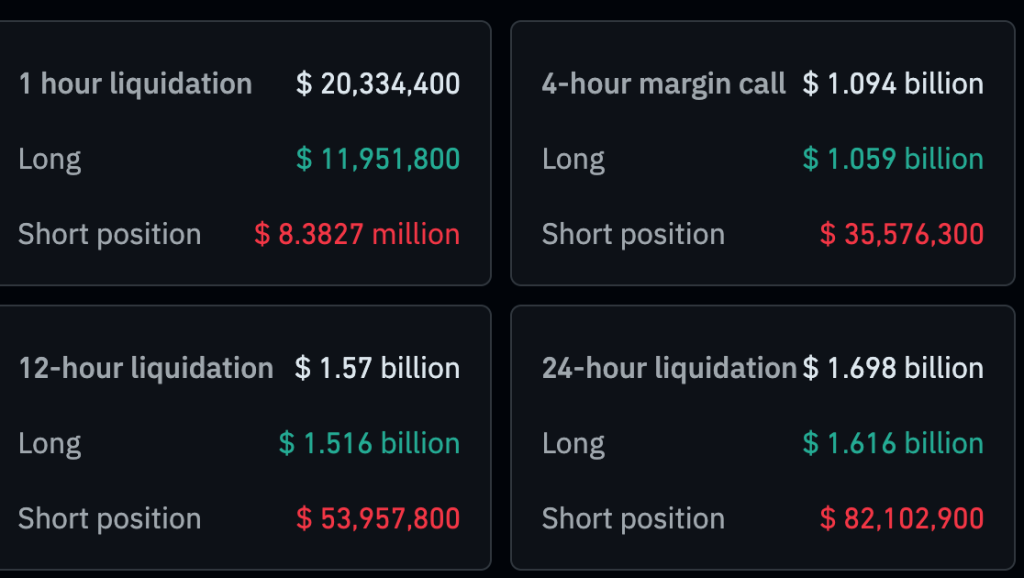

The cryptocurrency market has recently experienced a significant downturn, with liquidations exceeding $1.7 billion in just 24 hours. Major cryptocurrencies such as Bitcoin, Ethereum, Ripple (XRP), and Solana saw substantial losses, with many dropping around 8% in value. This sell-off highlights the volatility that characterizes the crypto landscape, leaving market participants on edge.

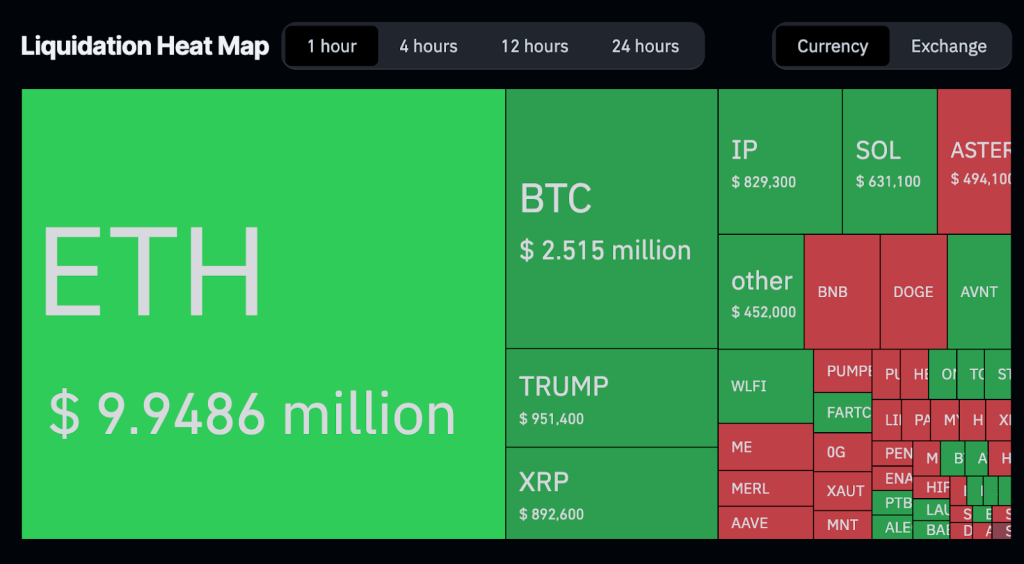

According to data from Coinglass, the rapid fire liquidations saw over $1 billion wiped away from the market in a mere 10 minutes, indicating how quickly sentiment can shift in this high-stakes environment. The breakdown of the liquidations reveals that long positions suffered the most, with $1.615 billion in long positions liquidated compared to $85.88 million in shorts. This unexpected event has stirred significant concern among traders.

Factors Contributing to the Swift Market Decline

Several intertwined factors contributed to this abrupt sell-off:

- Economic Uncertainty: Fears of recession, compounded by weak macroeconomic data, have placed considerable pressure on risk assets globally.

- Low Liquidity: A lack of sufficient liquidity in the market heightened vulnerability to swift price movements.

- Leveraged Positions: The liquidation of large leveraged long positions exacerbated the downward spiral.

- Stock Market Correlation: A simultaneous decline in stock markets has resonated through cryptocurrency ecosystems.

In light of these market conditions, analysts have indicated a downturn in chain activity, suggesting weakening momentum. Recent reports have cautioned that the current leveraged positions may not hold, and liquidity remains fragile. Historically, such consolidation phases tend to occur after brief price rallies.

Potential Implications for Bitcoin, Ethereum, and Altcoins

The ramifications of the recent liquidation wave could be far-reaching:

- Increasing Risk: Investors might shift towards Bitcoin or stablecoins as safer investment options amid market instability.

- Possible Recovery Conditions: If macroeconomic conditions stabilize, a potential recovery could emerge.

- Regulatory Influences: Key political and regulatory decisions from central banks will significantly affect the future of crypto markets.

What Lies Ahead for Cryptocurrency Investors

While the current market shock has been significant, volatility is a characteristic feature of cryptocurrencies. Traders are urged to exercise caution, particularly when engaging in high-leverage trading in low liquidity environments. With seasonal holidays approaching, a period of consolidation lasting 1 to 2 weeks is anticipated before a potential shift in market movements.

Looking forward, the cryptocurrency community remains eager to see if rumored announcements can positively shift market sentiment or if further liquidations are on the horizon.

Stay Updated on Cryptocurrency Trends!

Keep yourself informed with the latest news, expert analyses, and real-time updates regarding Bitcoin, Altcoins, DeFi, NFTs, and more.