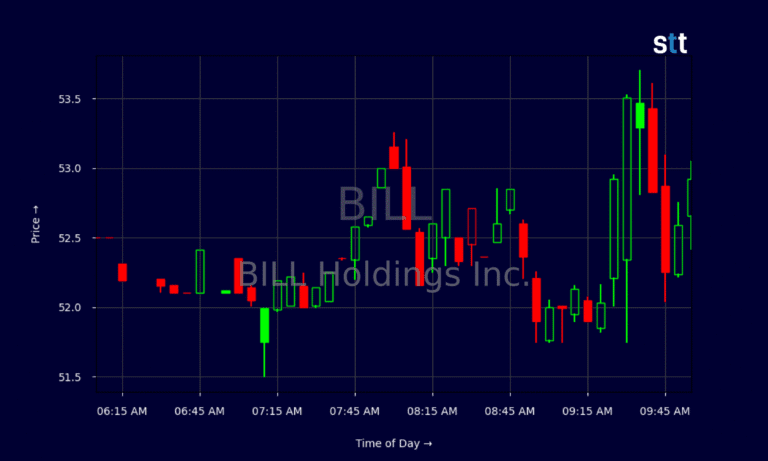

BILL Holdings Inc. Experiences Significant Stock Surge Amidst Fintech Market Uncertainty

Shares of BILL Holdings Inc. surged by 13.65 percent despite facing potential uncertainties in the fintech sector. This remarkable increase in stock value has drawn attention from investors and market analysts alike.

Current Developments: What Drives BILL’s Growth?

BILL Holdings reported a promising first quarter for 2026, showcasing noteworthy increases in both core and total revenues, even while posting a net loss. The company’s successful partnerships with industry leaders such as NetSuite, Paychex, and Acumatica played a crucial role in bolstering its performance.

Moreover, BILL’s performance exceeded market expectations, with a significant rise in its adjusted earnings per share (EPS) and revenue. This success can be largely attributed to the onboarding of AI agents and the strategic expansion of partnerships.

The stock saw an impressive 6.5 percent boost following rumors reported by Bloomberg regarding potential acquisition interests, generating excitement and speculation among investors.

Financial Overview: A Mixed Bag of Results

BILL Holdings Inc. presented a mixed financial report, highlighting both strong revenue growth and ongoing challenges. The company achieved a year-over-year revenue growth of $1.46 billion, supported by its strategic partnerships and the positive dynamics within the industry. However, despite these successes, a net loss was reported, attributed to high operational expenses.

Financial metrics indicate a gross margin of 81%, reflecting efficient production practices. Nonetheless, the Ebit margin stands at 2.4%, with a higher Ebitda margin of 7.6%. These figures suggest potential avenues for cost reduction to offset future losses.

The company’s attractive valuation metrics include a price-to-sales ratio of 3.15 and a price-to-book value of 1.22, making BILL appealing to growth-focused investors. A high price-to-cash flow ratio of 12.2 emphasizes stability even amid market volatility.

Market Speculation: The Implications for BILL

The buzz around potential acquisition interest is affecting BILL’s stock prices and market perceptions. Speculation surrounding the engagement of financial advisors signals a possible strategic shift, as the company seeks to enhance shareholder value amid changing industry dynamics.

Amidst these rumors, BILL’s first-quarter performance, propelled by its partnerships and technological advancements, establishes a compelling narrative. The blend of speculation and financial stability creates an intriguing landscape for investors to consider.

Strategic Partnerships: Expanding the Horizon

BILL Holdings is at a pivotal moment, with its partnerships forming the backbone of its market presence. Collaborations with Paychex and NetSuite position BILL to explore broader opportunities and strengthen its foothold in the fintech arena. These alliances are pivotal in enhancing the value proposition for clients and partners alike.

As investor interest grows, the ongoing speculation about BILL’s potential strategies invites financial analysts to take a closer look at its performance trajectory. The interplay between financial metrics and market rumors adds an intriguing dynamic to its corporate narrative.

Finally, Navigating Financial Strategies

BILL’s approach to market dynamics involves an active engagement with GCC (Global Consultancy Care) for potential sales exploration. This could signify strategic moves to align with larger entities, positioning the company as a formidable contender in the competitive fintech landscape.

The company’s recent successes combined with its proactive market engagement set a stage ripe for analysts and investors alike. As BILL Holdings continues to adapt to the fast-evolving market, its strategic execution will play a key role in shaping future growth trajectories.

Conclusion: BILL’s Future on the Horizon

The journey ahead for BILL Holdings reflects a blend of strategic depth and adaptability, crucial in navigating the current fintech landscape. With a focus on growth and innovation, the company stands at a crossroads, poised to either ascend into new peaks of growth or transform alongside a consolidating market. The unfolding narrative of BILL Holdings beckons investors to monitor its next strategic moves closely.