(Bloomberg) — President Joe Biden’s administration plans a new round of restrictions on the export of artificial intelligence chips from companies like Nvidia Corp.NVDA) just days before leaving office, a last ditch effort in his efforts to keep advanced technologies out of the hands of China and Russia.

Most read on Bloomberg

The United States wants to curb the sale of AI chips used in data centers, both by country and company, with the aim of focusing AI development in friendly countries and bringing companies around the world to align with American standards, according to sources familiar with the matter. matter.

The result would be an expansion of semiconductor caps across most of the world – an attempt to control the spread of AI technology at a time of growing demand. The regulations, which could be released as early as Friday, would create three tiers of restrictions on chip trading, said the sources, who asked not to be identified because the discussions are private.

At the highest level, a small number of U.S. allies would retain essentially unfettered access to U.S. chips. Meanwhile, a group of adversaries would be effectively blocked from importing the semiconductors. And the vast majority of the world would face limits on the total computing power that could be allocated to a country.

Countries in the latter group could circumvent their national limits – and get their own, significantly higher caps – by accepting a set of US government security requirements and human rights standards, one said. sources. This type of designation – called a validated end user, or VEU – aims to create a set of trusted entities that develop and deploy AI in secure environments around the world.

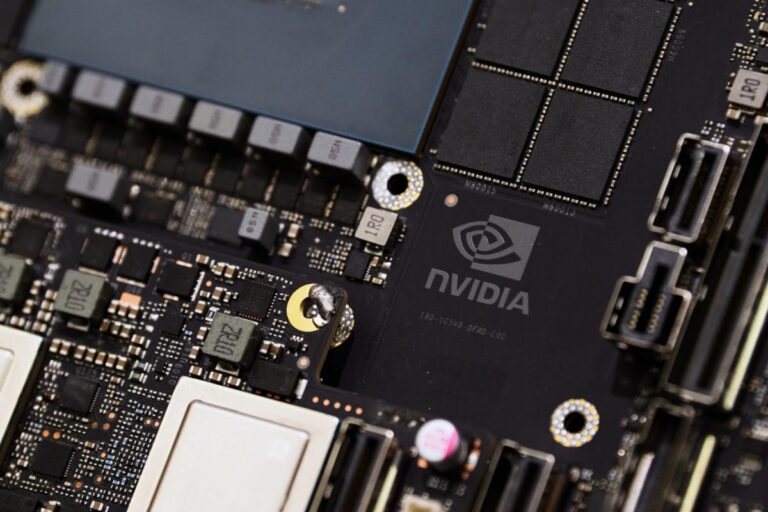

Shares of Nvidia, the leading maker of AI chips, fell more than 1% in late trading after Bloomberg reported on the plan. They were up 4.3% this year through the close, after stratospheric gains in 2023 and 2024 that made the company the world’s most valuable chipmaker.

At 2:36:35 p.m. EST. Open market.

Nvidia opposed the proposal in a statement. “A last-minute rule restricting exports to most countries around the world would constitute a major policy shift that would not reduce the risk of abuse but would threaten U.S. economic growth and leadership,” Nvidia said.

Every data center and enterprise is already integrating AI through what the company calls accelerated computing, Nvidia said. “Global interest in accelerated computing for everyday applications presents a tremendous opportunity for the United States to exploit, boosting the economy and creating U.S. jobs,” the chipmaker said.